In a remarkable economic development, land-related revenue in Ho Chi Minh City surged nearly 50% year-on-year, surpassing VNĐ25.3 trillion (approximately US$1 billion) in 2024. This increase is attributed to various factors, including a significant rise in revenue from land use fees, which reached VNĐ9.654 trillion, marking a 64.7% increase. Additionally, revenue from land rentals and water surface rentals amounted to VNĐ5.957 trillion, up 17% from the previous year. The real estate transaction revenue also saw a substantial increase, totaling VNĐ9.692 trillion, reflecting a 54% growth. Property registration fees contributed VNĐ2.408 trillion, up 50.3%, while personal income tax from real estate transactions exceeded VNĐ7.284 trillion, up 55.4% [6252a102].

The overall state budget revenue for Ho Chi Minh City reached VNĐ508.5 trillion (US$19.96 billion), achieving 105.3% of the set target. For 2025, the city has set a revenue target of VNĐ520 trillion, representing a 7.71% increase. The growth in the real estate market is also noteworthy, with an estimated increase of around 9% in 2024. Current land prices in central districts are valued at over VNĐ687 million (approximately $27,000) per square meter, indicating a robust demand in the property sector [6252a102].

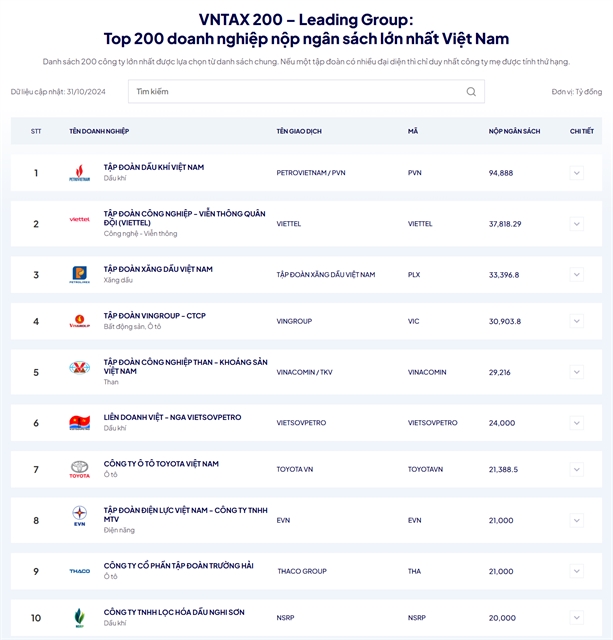

This surge in land-related revenue comes at a time when Vietnam's economy is navigating various challenges. Major corporate taxpayers in the country, including PetroVietnam and Viettel, contributed significantly to the state budget, with total contributions from the top 10 corporate taxpayers reaching VNĐ333.6 trillion (around US$13.1 billion) from June 30, 2023, to March 31, 2024. Despite these contributions, Vietnam's state budget revenue for the first nine months of the year was estimated at over VNĐ1.2 quadrillion (US$50.8 billion), reflecting an 8.3% decrease compared to the previous year [108d9f51].

As businesses in Vietnam express hopes for recovery in 2024, the real estate sector's growth in Ho Chi Minh City may play a crucial role in revitalizing the economy. The easing of visa rules and other supportive policies are expected to bolster the tourism industry, further contributing to economic recovery [12081f07].