Once upon a time in the world of stocks, there were three healthcare companies - MacroGenics Inc (MGNX), Pulmonx Corp (LUNG), and 22nd Century Group Inc (XXII). Each had its own unique story to tell.

MacroGenics Inc (MGNX) was a company in the Healthcare sector. Its stock was currently trading at $7.66, with a slight increase of 0.13% from the previous closing price. The stock had a high overall rating and was performing well. However, investors were advised to consider other factors before making investment decisions. The volume of trades for MacroGenics Inc (MGNX) was lower than average.

On the other hand, Pulmonx Corp (LUNG) was a medical devices company. It had a score of 77, which meant it scored higher than 77% of stocks in the industry. Pulmonx Corp also received an overall rating of 54, putting it above 54% of all stocks. The Medical Devices industry was ranked 82 out of the 148 industries. Pulmonx Corp (LUNG) stock was trading at $11.01, a rise of $0.11 or 1.01% from the previous closing price. The volume of trades for Pulmonx Corp (LUNG) was high, with 460,356 shares traded compared to the average volume of 261,328 shares. The stock had traded between $10.30 and $11.06 so far that day.

Now, let's turn our attention to 22nd Century Group Inc (XXII). This company is ranked in the middle of the Drug Manufacturers - Specialty & Generic industry, with an overall rating of 32. It scores higher than 32 percent of all stocks and above 52 percent of Drug Manufacturers - Specialty & Generic stocks. The industry is ranked 128 out of 148 industries. XXII stock is trading at $0.18, a loss of -$0.01 or -5.29% from the previous closing price. Volume today is low with 604,315 shares traded compared to the average volume of 1,611,020 shares.

These three healthcare stocks were on a journey, navigating the ups and downs of the stock market. Investors were keeping a close eye on their performance, analyzing various factors, and making decisions based on their own strategies and goals.

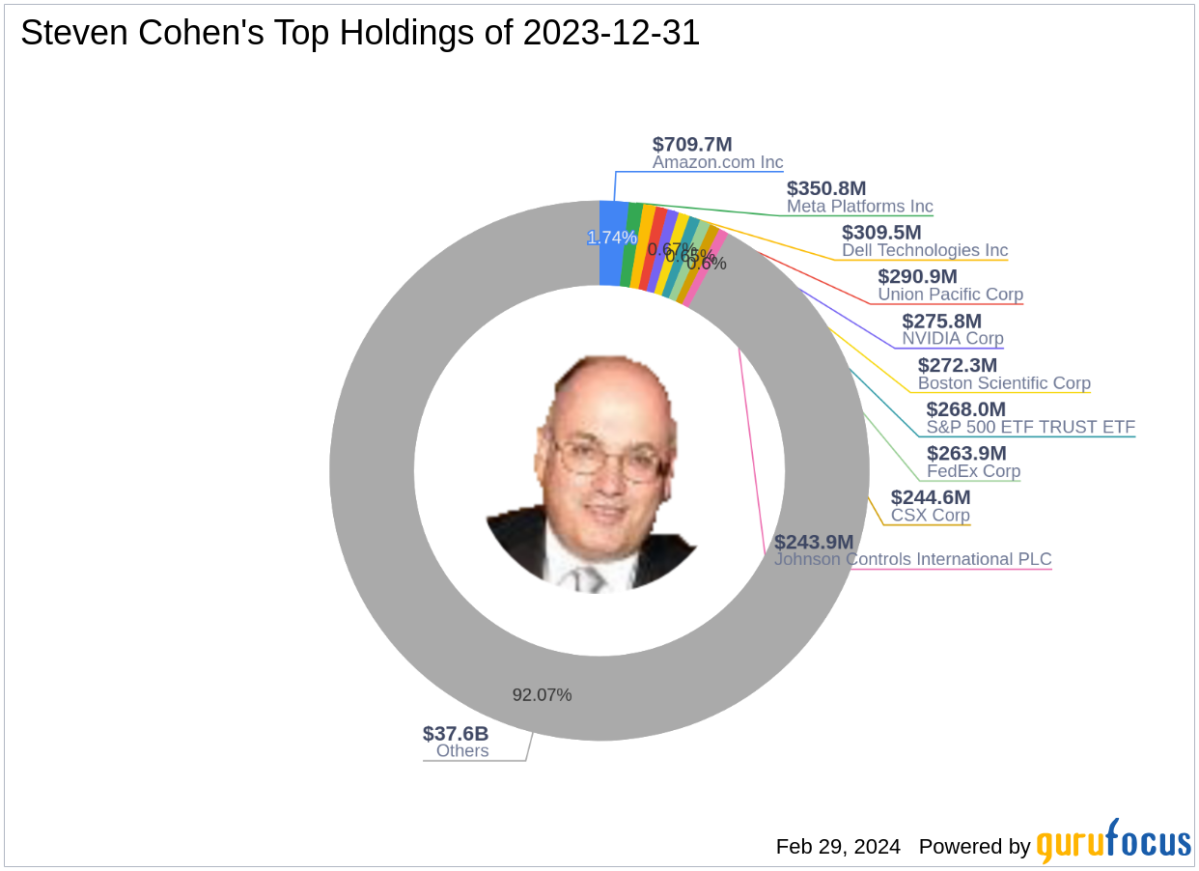

In recent news, Steven Cohen's Point72 Asset Management has increased its stake in Pulmonx Corp. The firm acquired an additional 389,994 shares, bringing the total share count to 1,936,083. This transaction reflects a 0.01% impact on the portfolio, with the shares purchased at a price of $9.36 each. Point72 now holds a 5.00% stake in Pulmonx Corp, representing 0.04% of its investment portfolio. Pulmonx Corp is a commercial-stage medical technology company specializing in minimally invasive treatments for patients with severe emphysema. The recent acquisition by Point72 Asset Management suggests a strategic move based on its investment philosophy and sector focus in healthcare. Despite Pulmonx Corp's current stock performance and valuation, Cohen's firm appears to be taking a long-term view on the investment [27d13640].