/tpg%2F642a63f4-7cbb-4d06-822a-559cf8c72ec5.jpeg)

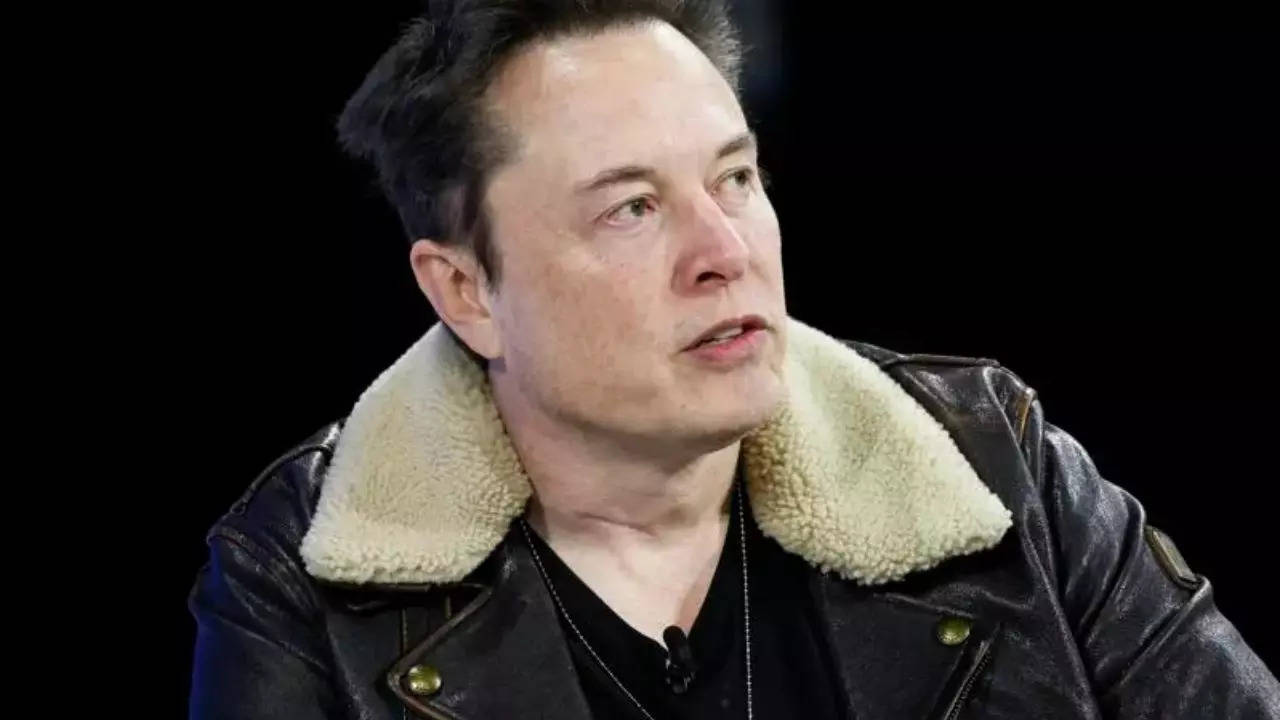

Elon Musk has intensified his warnings regarding the financial state of the United States, declaring that the nation is on the verge of 'de facto bankruptcy' unless significant measures are taken to address its soaring national debt, which has now surpassed $36 trillion. Musk's concerns were prominently featured during his recent appearance on The Joe Rogan Experience podcast, where he highlighted that annual interest payments on this debt exceed $1 trillion, a figure that now surpasses the country's defense spending [d29daf98].

In a recent opinion piece, Qamar Bashir from the Islamabad Post echoed Musk's sentiments, emphasizing the staggering implications of the U.S. defense budget, which stands at $1 trillion. He pointed out that the interest payments on the national debt also exceed $1 trillion, leading to a per capita debt burden of $35,928 for each American. This financial strain has drastically reduced the average per capita income from $80,035 to $44,107, raising concerns about the overall economic stability of the nation [e3703eeb].

Musk's advocacy for fiscal responsibility is underscored by the alarming statistic that interest payments currently account for 23% of the government's income. He emphasized that without immediate action, critical funding for essential programs like Social Security and Medicare could be jeopardized [d29daf98].

In light of these challenges, Musk is set to co-chair the newly formed Department of Government Efficiency (DOGE) under President-elect Donald Trump. This department aims to implement substantial cuts to federal spending, initially proposing a target of $2 trillion. However, during a recent interview with Mark Penn on January 10, 2025, Musk expressed skepticism about achieving this ambitious goal, suggesting a more realistic target of $1 trillion instead [1d0d9e72]. The initial $2 trillion figure was proposed by Musk at a Trump rally before the 2024 election, but experts have raised concerns about its feasibility, as it exceeds annual government agency spending and would likely require cuts to popular programs like Social Security and Medicare [1d0d9e72].

Bashir warns that Musk's proposals to cut defense spending could weaken U.S. military power and global influence, suggesting that a potential loss of the dollar's reserve status could lead to a 53% decline in per capita income. Instead of slashing budgets, he advocates for increasing revenue streams and sharing military costs with allies [e3703eeb].

The urgency of Musk's message is reflected in the recent failure of a lengthy spending bill, which faced backlash from lawmakers, leading to the passage of a more concise 118-page funding solution to prevent a government shutdown [ba535495]. The political landscape remains contentious as Trump, following his election victory on November 19, 2024, seeks to push through ambitious fiscal reforms, including extending tax cuts and reducing government size. However, he has faced significant opposition within his party, with 38 Republicans voting against his proposed budget cuts on December 22 [2ddc0824].

Musk's leadership in DOGE is viewed as a critical opportunity to drive the necessary reforms to stabilize the nation's finances. Nevertheless, critics warn that aggressive cuts to federal spending could adversely affect public services, highlighting the ongoing political divides between Republicans and Democrats [ba535495].

Further complicating the fiscal landscape, the U.S. government is grappling with a significant deficit, with revenues of $5.56 trillion falling short of spending at $7.44 trillion, resulting in a $1.88 trillion deficit. Major spending areas include $1.63 trillion on Social Security, $1.25 trillion on Medicare and Medicaid, $879 billion on national defense, and $308 billion on interest payments. Trump's ability to implement reforms is limited by the need for congressional approval, and political polarization complicates consensus on necessary adjustments [6d9e24b7].

As the new administration prepares to tackle these pressing issues, the debate over fiscal policy is expected to intensify. Market analysts are closely monitoring how Trump's policies will impact inflation and the Federal Reserve's interest rate decisions, particularly as the national debt continues to rise [725fb7a9]. The concept of fiscal dominance, where structural fiscal deficits surpass private sector lending and monetary policy, complicates the landscape. Projections indicate that at a fixed 5% interest rate, the debt-to-GDP ratio will rise significantly, while a 2% rate would lead to a decline [4b333490]. The sustainability of U.S. debt hinges on identifying buyers amid rising rates, and the growth of stablecoins like Tether offers some short-term demand for Treasury bills but does not address long-term needs [4b333490].

In a recent analysis, DoubleLine analyst Ryan Kimmel stated that despite improved budget forecasts from the Congressional Budget Office (CBO), the U.S. fiscal path remains unsustainable. The CBO projects that debt-to-GDP will rise to 118.5% by 2035, a figure lower than previous estimates. However, Kimmel believes these projections are overly optimistic, particularly if President Trump's proposed tax cuts are extended, which could increase deficits by over $4 trillion in the next decade. With current federal funds rates and Treasury yields above 4%, Kimmel expects long-term Treasury yields to rise as the fiscal outlook deteriorates [78c89593]. The upcoming legislative sessions will be pivotal in determining whether the government can effectively manage its fiscal health while fostering economic growth amidst these challenges [be1f24d7].