Canada's big six banks are facing another drop in profits due to an economic slowdown and challenges in the banking sector. Lagging investment banking fees and weakened business in the US have led to job cuts and reduced profits. While high interest rates have boosted lending margins, residential mortgages, auto loans, and commercial real estate loans have slowed. The renewal of residential mortgages and the impact of high borrowing costs on commercial real estate lending and auto loans will further weigh on the banks. Provision for credit losses is expected to grow significantly, and profits are projected to shrink. Refinancing of home loans is expected to be painful for customers who took out cheaper mortgages during the pandemic, while real estate developers face liquidity pressures.

On the other hand, PricewaterhouseCoopers International Ltd. (PwC) is cutting jobs in an effort to reduce costs and improve profitability. The company reported a loss in its third quarter and is taking measures to streamline its workforce. The stock market has pulled back after a four-week rally, and Suncor's plans to operate the Terra Nova field provide hope for the Canadian economy. However, preliminary data suggests that Canada's economy is heading towards a recession, and China's industrial profits have also shown a sharp slowdown.

Despite these challenges, the Canadian government remains committed to responsible fiscal management. The government has introduced the Affordable Housing and Groceries Act and plans to outline further actions to make life and housing more affordable. The government's efforts have resulted in a reduction of Canadians living in poverty since 2015 and maintained a low deficit and net debt-to-GDP ratio.

PricewaterhouseCoopers (PwC) has faced a series of scandals, government probes, and media exposés over the past decade. The International Consortium of Investigative Journalists (ICIJ) has uncovered many of these exposés. PwC has been involved in questionable practices, including helping clients like Caterpillar Inc. reduce their tax bills by shuffling profits to Switzerland. The firm has also been implicated in facilitating transfers of cash for sanctioned parties and securing secret tax deals in Luxembourg. PwC has provided services to individuals with corruption allegations, such as Isabel dos Santos and Russian steel magnate Alexey Mordashov. The European Parliament has raised concerns about PwC's role in assisting Russian oligarchs with their investments in the West. In Australia, senior leaders at PwC stepped down after a tax partner shared confidential information about the government's tax reform plans. Despite these scandals, PwC maintains that its work is legal and compliant with relevant laws and tax rules.

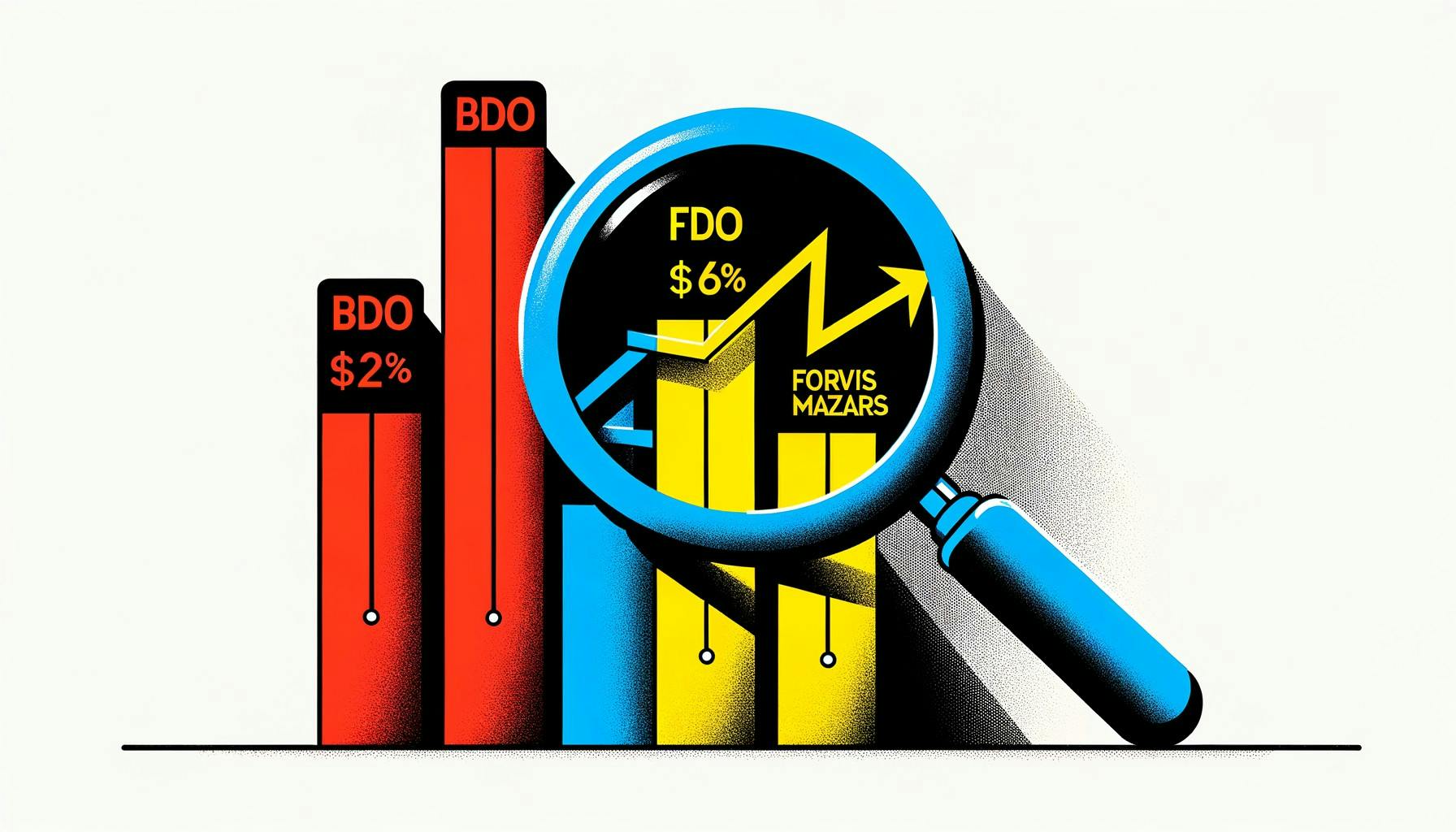

In the UK, the Financial Reporting Council (FRC) has reported a significant decline in audit quality at BDO and Forvis Mazars. BDO's audit quality dropped from 69% to 38% this year, while Forvis Mazars fell from 56% to 44%. The FRC's executive director of supervision expressed disappointment and emphasized the need for improvement. The decline in audit quality has implications for market competition and corporate governance, highlighting the need for continuous improvement and strict supervision. BDO and Forvis Mazars play vital roles in the UK audit sector and economic landscape. The FRC pledges ongoing supervision to help these firms elevate their standards. [0cac5c30]