FHLBank Indianapolis, a regional bank, is supporting affordable housing in Fort Wayne through grants and low-cost loans. Fort Wayne is considered an affordable place to live, but there are disparities in housing affordability due to low wages. FHLBank Indianapolis offers grants for member financial institutions to partner with housing providers and developers to create affordable housing developments. The funding program, called the Affordable Housing Program (AHP), provides gap funding for these developments. Since 1993, FHLBank Indianapolis has funded over 20 projects in Fort Wayne. The AHP grants are competitive, and the scoring system considers various factors such as nonprofit sponsorship, community stability initiatives, and member financial institution involvement. Keller Development Inc. is one of the recipients of AHP funding and has developed affordable housing projects in Fort Wayne. FHLBank Indianapolis also offers programs to help low-income households become homeowners and assist with home repairs and modifications. The bank aims to address the need for affordable housing in the region, although the demand exceeds the available funding. The total funding allocation for the AHP grants has increased to over $28.5 million for the 2024 grant cycle. [47f5e7f0]

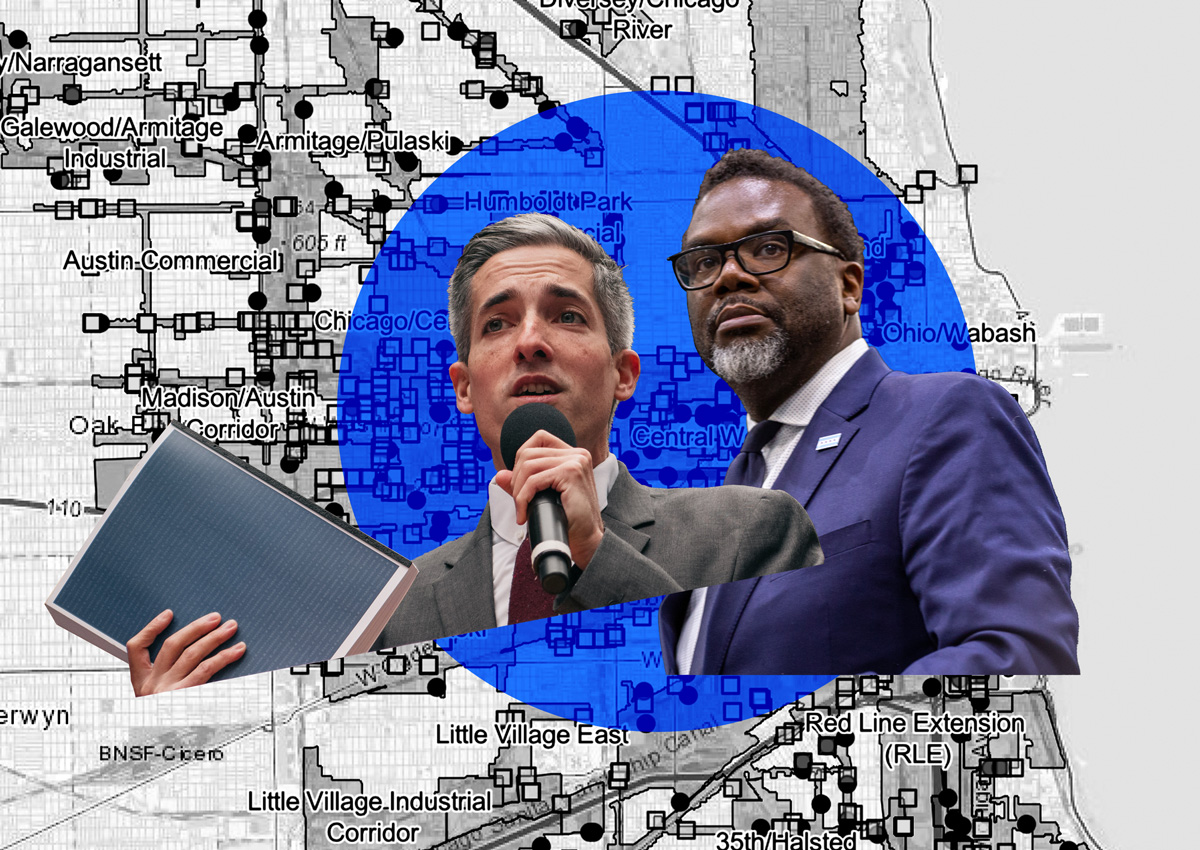

In addition to FHLBank Indianapolis, the City of Chicago is planning to borrow over $1 billion to fund affordable housing and other real estate developments as it withdraws from tax-increment financing districts (TIFs). The city aims to replace the use of TIFs, which provide property tax breaks to developers, with borrowing to subsidize new projects. A proposed $1.25 billion bond would be issued over five years, generating an annual influx of $250 million for city development projects. The funds would be repaid over 30 years. The move comes as more than 50 TIF districts are set to expire within the next five years. However, the borrowing proposal is not without controversy, with some aldermen calling for transparency and a detailed spending outline. [d70ced95]

Meanwhile, the North Platte Planning Commission has unanimously approved a $200 million mixed-use development plan that aims to build over 600 new housing units by 2030. The plan includes recommendations for nearly $37 million in tax increment financing (TIF), changes to the city's land-use map, and rezoning of 222 acres of land. The development, led by KOW Council LLC and Midwest Land Development LLC, will consist of four 54-unit apartment buildings, 61 townhomes, and 330 single-family detached homes. The project also includes 21,000 square feet of commercial retail space, 20 acres for industrial use, and 72 acres of park space. The TIF plan still requires formal recommendation from the city's Community Redevelopment Authority before it can proceed to City Council hearings and votes on March 5. [b8dfe8c2]

Additionally, Kittle Property Group, Inc. is addressing the shortage of affordable workforce housing in Indiana by developing new apartment communities. A new report by the National Low Income Housing Coalition shows that Indiana falls behind other Midwest states in the number of rental homes for renters in the workforce. The shortage of affordable workforce housing costs the American economy an estimated $2 trillion each year. Kittle Property Group operates across 16 states and is focused on providing affordable housing solutions. Meadows on Main in Whitestown, Indiana is an example of their efforts, adding 264 apartment homes to the area. The community offers amenities such as a clubhouse, pool, playground, and is pet-friendly. The development aims to provide affordable workforce housing to support the growing population and economy of Whitestown. [a43e569a]