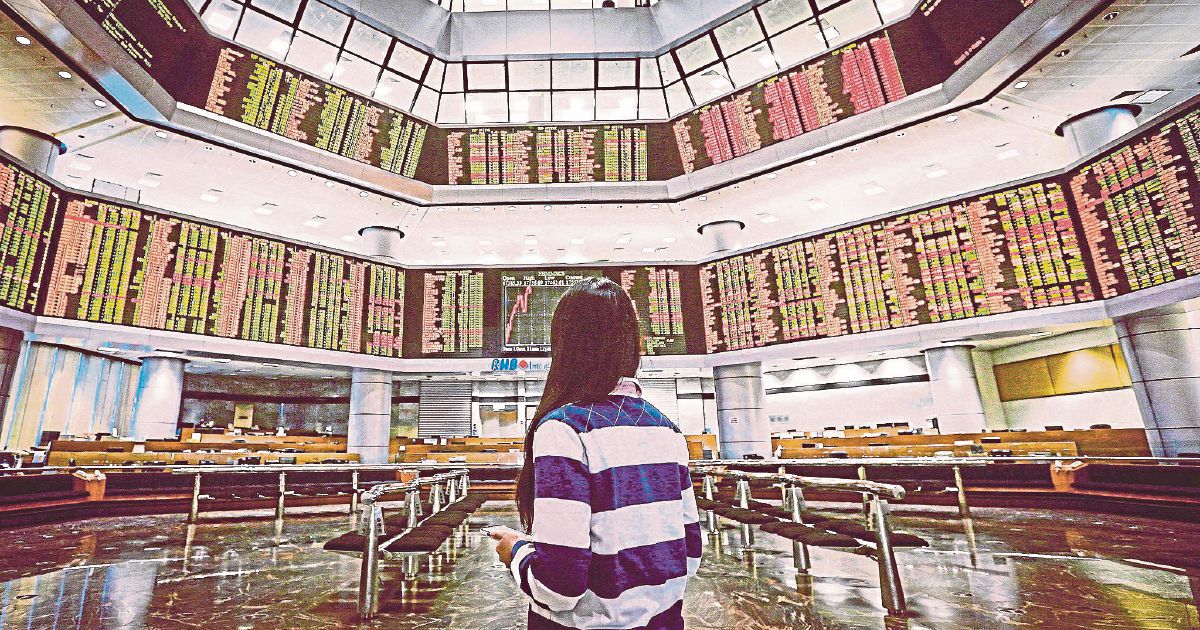

As of January 15, 2025, Bursa Malaysia has experienced a downturn, with the FTSE Bursa Malaysia KLCI dropping 0.91%, or 14.34 points, to close at 1,562.12. This decline was marked by a significant imbalance in market activity, with 960 decliners outnumbering just 193 gainers. Investor sentiment has been heavily influenced by concerns regarding a potential delay in rate cuts by the US Federal Open Market Committee, alongside fears of increased tariffs under a possible second Trump administration. The recent robust US job growth data has contradicted earlier expectations for an economic slowdown, further complicating the outlook for investors in Malaysia. Mohd Sedek Jantan from UOB Kay Hian noted that Malaysian investors are exhibiting a conservative risk appetite amid these global uncertainties, reflecting a cautious approach to market engagement.

Previously, on January 5, 2025, Bursa Malaysia had opened the year with a cautious stance, influenced by the upcoming US Presidential Inauguration Day on January 20. Stephen Innes from SPI Asset Management had warned of potential trade protectionism risks that could adversely affect Asia's exporters, including Malaysia. The FBM KLCI had closed 2024 at 1,642.33 after a six-day winning streak, but the start of 2025 saw a decline due to profit-taking activities, indicating a modest drop in investor confidence.

Market turnover on January 5 rose to RM8.98 billion, signaling active trading despite mixed performances across various indices. Analysts had anticipated January 10 to be a significant date for both Malaysian and US markets, with key economic data releases expected to influence investor sentiment. The FBM Emas Index was reported at 12,533.64, while the Financial Services Index fell to 19,023.06, showcasing the mixed results among key indices.

In the preceding weeks, Bursa Malaysia had shown resilience, with the FBM KLCI rising 7.09 points on December 4, 2024, closing at 1,614.05. This increase suggested a potential end to foreign selling pressure, with expectations for the index to stabilize between 1,605 and 1,615. However, mixed signals from Wall Street, where the DJIA closed lower while the Nasdaq and S&P 500 gained slightly, contributed to the cautious sentiment in the Malaysian market. Investors are closely monitoring these developments as they prepare for the key economic indicators that will shape the outlook for the coming months in both Malaysia and the broader Asian market. [990d05aa][2259f4d6][bb4bb796][b88c9ce5][afbd6292][a603b9b6][46def72d][89434f7c][000ff3a8][bd3b29f3][64caf89a][1eae3f63][5f22de3f][38fb9969][a8ec5896][f17f6d97][68469bfe][ab4a2de0][1f58467b]