In the ongoing discourse about the U.S. economy and its relationship with competition, recent analyses highlight the multifaceted impacts of trade policies and tariffs. James Pethokoukis from the American Enterprise Institute argues that imposing significant trade tariffs can lead to reduced jobs and productivity, emphasizing the importance of avoiding protectionism in both trade and technology [0282ddc4]. He draws on insights from economist Glenn Hubbard, who warns against overreacting to the so-called 'China trade shock' and advocates for embracing economic disruption as a catalyst for growth [0282ddc4].

The narrative surrounding the U.S. manufacturing sector has evolved significantly over the years. Initially, there was a perception of a manufacturing crisis, fueled by political rhetoric and the belief that American manufacturing was in decline. However, various analyses, including those by Bruce Yandle, have challenged this notion, arguing that the sector remains robust despite shifts in employment and productivity [c66df397]. Yandle criticizes protectionist policies, asserting that they serve special interest groups rather than the broader economy [c66df397].

Further supporting this perspective, George F. Will highlights that the U.S. still boasts the world's second-largest manufacturing economy, with a significant share of global manufacturing output [ac799170]. He attributes the decline in manufacturing jobs primarily to increased productivity rather than a lack of competitiveness. Will's analysis suggests that the narrative of a manufacturing crisis is more about changing consumer preferences than a fundamental weakness in the sector [ac799170].

The COVID-19 pandemic has underscored the vulnerabilities in the U.S. supply chain, prompting renewed efforts to reshore manufacturing. The Biden administration has introduced legislation aimed at bolstering domestic production, particularly in critical sectors like semiconductors [4d6f1d6b]. However, recent data indicates that while the manufacturing sector has shown resilience, it has not led to significant job growth, raising questions about the effectiveness of current policies [566e2d76].

In a related discussion, Peter Mihalick emphasizes the role of competition in enhancing product quality and consumer choice. He cites the rivalry between tennis players Roger Federer and Rafael Nadal, which improved their games through competition [44b2387f]. Mihalick also points to the American automotive industry, which struggled until competition from Japanese firms like Toyota and Honda forced improvements in quality and efficiency [44b2387f].

Moreover, Mihalick discusses the impact of tariffs on consumer goods, particularly in the fashion industry, where companies like SHEIN have revolutionized fast fashion with efficient supply chains. He warns that proposed tariffs could increase clothing costs for consumers, disproportionately affecting low-income individuals [44b2387f]. This aligns with Pethokoukis's critique of protectionist measures, suggesting that while tariffs may provide short-term relief, they can ultimately hinder long-term economic growth and innovation [0282ddc4].

As the U.S. navigates its trade relationship with China, there is a growing acknowledgment of the need for a nuanced approach. The complexities of state interventions in China's economy necessitate a different strategy compared to traditional trade relationships [0282ddc4]. Pethokoukis calls for the establishment of new trade groups based on shared principles to address these challenges effectively [0282ddc4].

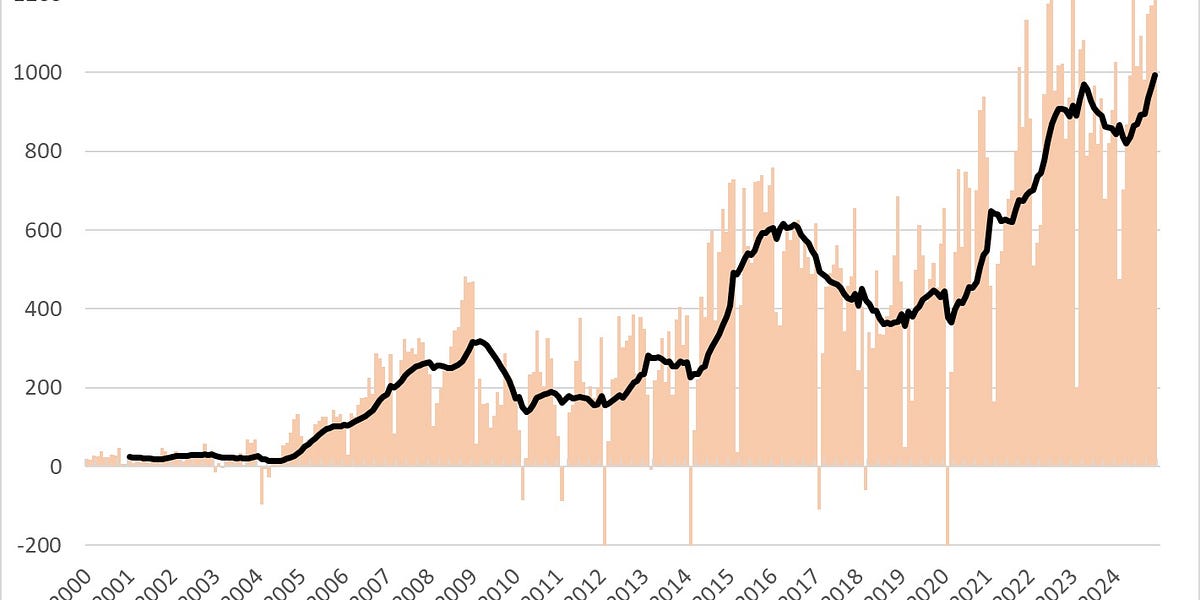

Adding to this discussion, Noah Smith from Noahpinion highlights China's growing trade surplus and its implications for the global economy, characterizing the current situation as the 'Second China Shock.' This shock is marked by China's exports to developing countries, which have raised concerns about global economic distortions stemming from subsidized Chinese exports [759dd0f1].

Smith discusses the advocacy of economist Michael Pettis for increased domestic consumption in China as a means to rebalance trade. Pettis argues that tariffs could potentially boost U.S. GDP and employment, although Tyler Cowen critiques this focus on domestic consumption as insufficient [759dd0f1]. Smith emphasizes the complexities in international economics, noting that China's economic model under Xi Jinping prioritizes high-tech production over consumer needs, leading to overcapacity in industries and export-driven strategies [759dd0f1].

In a recent analysis, Ian Fletcher advocates for a strategic industrial policy to enhance high-value industries in the U.S., critiquing free trade for contributing to job losses and regional decline, particularly in light of the China Shock [1fa587b6]. Fletcher emphasizes the need for targeted government investment, tariffs, and strategic procurement to rebuild critical sectors, citing successful examples from Taiwan's semiconductor industry and Germany's manufacturing focus [1fa587b6]. He warns of potential technological decline in the U.S. and supports tariffs for critical industries, calling for a balanced approach to trade and government intervention [1fa587b6].

This evolving narrative underscores the complexities of international trade dynamics as policymakers grapple with the implications of tariffs and trade policies, focusing on fostering innovation and preparing the workforce for the challenges of a dynamic global economy.