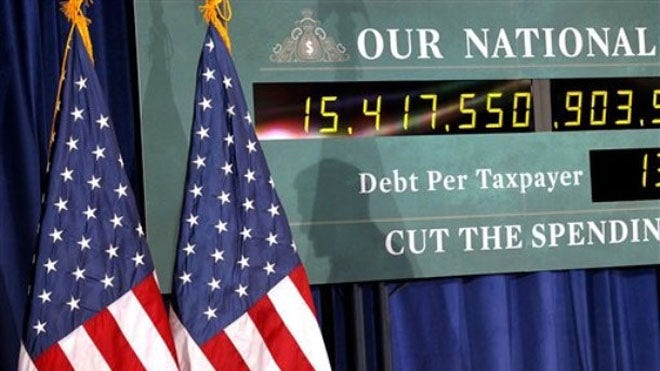

As of February 4, 2025, the U.S. national debt has reached a staggering $36 trillion, with approximately 20% of this amount, over $7 trillion, classified as intergovernmental debt. This category includes funds owed to programs like Social Security and federal employee pensions, which have historically run surpluses that allowed them to purchase government debt [a33b9ef7]. The government now repays this intergovernmental debt with interest, although it is important to note that this type of debt is not traded in markets and does not directly affect borrowing costs [a33b9ef7].

The total debt owed to the public stands at $29 trillion, with significant portions held by the Federal Reserve (15%) and foreign entities, primarily China and Japan (30%) [a33b9ef7]. The current national debt is now 20% larger than the U.S. economy, raising serious concerns about fiscal sustainability and the potential for economic instability [a33b9ef7].

As of January 25, 2025, the national debt was already a pressing issue, with Mike Murphy from the Committee for Responsible Budget Policy warning that the growing national debt threatens both national security and economic stability. Interest payments on the debt are approaching $1 trillion annually, which exceeds national defense spending [a08b4c7a].

The bond market has been urging Congress to address America's budget problems, with long-term yields around 5%, potentially leading to a debt ratio exceeding 120% of GDP by 2035. Experts estimate that $9 trillion in spending cuts and tax increases will be necessary over the next decade to stabilize the debt at 100% of GDP [54cd10c5].

Treasury Secretary Janet Yellen announced on January 18, 2025, that the U.S. government would hit the statutory borrowing limit by January 21, prompting the initiation of 'extraordinary measures' to avoid default [cc7346d7]. These measures include freezing investments in the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund until March 14, 2025 [b85f4f30]. The current borrowing ability is $36.08 trillion, close to the $36.1 trillion debt limit, and Yellen urged Congress to act quickly to ensure financial stability [b85f4f30].

The Congressional Budget Office (CBO) has projected that the U.S. national debt is set to increase by an additional $23.9 trillion over the next decade, a figure that does not account for potential tax cuts proposed by President-elect Donald Trump, which could exceed $4 trillion [c1ad45fd]. This projection highlights the urgency of addressing the growing fiscal challenges, with annual budget deficits expected to reach 6.1% of GDP by 2035, surpassing the historical average of 3.8% over the past 50 years [c1ad45fd].

Former President Trump has criticized the failure to address the debt ceiling in 2023, while Scott Bessent, Trump's Treasury Secretary nominee, acknowledged the complexity of the debt ceiling during his confirmation hearing [cc7346d7]. Bessent has prioritized extending tax cuts but must consider revenue-neutral solutions to avoid exacerbating the deficit [54cd10c5]. The Biden administration is leaving office with a record-breaking federal deficit of $711 billion for the first quarter of FY 2025, indicating a widening gap between government revenue and expenditures [905c4594].

Entitlement programs like Social Security, the largest spending program at $1.5 trillion annually, are expected to grow unsustainably, further straining the federal budget. Proposed reforms could include raising the retirement age to 70, which could save approximately $100 billion [54cd10c5]. Additionally, a 2% surtax on incomes above $100,000 could raise $1 trillion over ten years, and eliminating itemized deductions could generate between $2 trillion to $3.5 trillion [54cd10c5].

The growing debt crisis has prompted discussions on how to manage this financial burden without sacrificing essential services or triggering inflation. Ellen Brown, an advocate for innovative economic solutions, suggests several strategies for addressing the national debt, including issuing debt-free money, swapping existing debt for equity, and having the Federal Reserve purchase government debt directly [9c6e05e6]. Historical precedents, such as debt jubilees in ancient Mesopotamia, provide context for these proposals, highlighting the possibility of debt relief mechanisms that do not rely solely on austerity measures [9c6e05e6].

In a broader context, the Institute of International Finance (IIF) reported that global debt has surged to nearly $323 trillion, with emerging markets nearing $105 trillion in debt, which represents 245% of their GDP [beb9b574]. This global context underscores the urgency of addressing national debt issues, particularly as the U.S. faces a projected federal deficit that could rise to 8.5% of GDP by fiscal 2054 [7c912c94].

Warren Buffett has warned that the escalating debt crisis may necessitate tax hikes as the government struggles to manage its fiscal responsibilities [7c912c94]. Approximately 20% of U.S. government spending is now dedicated to servicing this debt, projected to exceed $1 trillion in 2025 [f66fe655]. In light of these challenges, a recent survey by the Conference Board found that national debt is perceived as the top threat to business operations, reflecting the concerns of over 1,200 C-Suite executives [60424864].

In response to these challenges, Trump has appointed Scott Bessent as Treasury Secretary and Elon Musk to lead a newly established 'Department of Government Efficiency,' aiming to tackle the national debt and improve fiscal responsibility [f66fe655][e6d61e75]. However, Trump's proposed tax cuts could add an estimated $7.75 trillion to public debt, raising further concerns about fiscal sustainability [607434f1][9875dac1].

Experts like Martin Armstrong have suggested that the national debt could be 40% lower if money were issued directly, rather than through traditional borrowing methods, which raises inflation concerns linked to excessive borrowing rather than printing money [9c6e05e6].

As Congress prepares to address the extension of the Tax Cuts and Jobs Act (TCJA) from 2017, which is set to expire in late 2025, the implications of extending these cuts without adequate funding have become a focal point. Ernie Tedeschi, director of economics at the Budget Lab at Yale University, warns that extending the TCJA without funding could lower real GDP per household by $1,400 in 2034 and $5,300 in 2049 [cee46306].

Tedeschi suggests that tariffs proposed as a funding mechanism could be economically damaging, potentially raising only $2.7 trillion instead of the estimated $4.4 trillion. Instead, he advocates for a destination-based cash flow tax (DBCFT), originally proposed by Paul Ryan in 2016, which could raise sufficient revenue with a lower rate of 16% [cee46306].

To tackle the national debt, Trump has proposed two policy bundles, focusing on reforming entitlement programs and implementing a 5% reduction in non-defense discretionary spending, which is estimated to save approximately $3.5 trillion over the next decade [e6d61e75]. However, experts warn that achieving long-term fiscal stability will require the implementation of smart policies. Brian Riedl has criticized the notion of renewing tax cuts after the deficit has tripled, while Democrats argue that Trump's tax cuts favor the wealthy, further reducing revenues for essential programs [f66fe655].

In a related development, more than three dozen state financial officers have expressed grave concerns regarding the national debt, advocating for a resolution that declares it a threat to national security. They emphasize the need for a long-term congressional plan to restore U.S. solvency, projecting that the cost of servicing the debt in 2024 will exceed $1 trillion [a840ce14].

As both the U.S. and global economies navigate their respective challenges, the implications of rising global debt, trade tensions, and supply-chain disruptions could exacerbate financial vulnerabilities. Meeting global emissions targets could add an estimated $38 trillion to global debt by 2028, raising concerns about liquidity crises as significant amortizations are due in 2025 and 2026 [beb9b574]. Investors are urged to consider the implications of their debt strategies carefully, balancing the potential for growth against the risks that excessive leverage can introduce [d795af63].

In this context, Bitcoin has emerged as a potential hedge against sovereign bond defaults, currently valued at around $219,000. Its limited supply and decentralized nature enhance its appeal as a safe-haven asset, although volatility remains a significant risk for investors [4a97b025]. Analysts predict a decrease in Bitcoin's volatility in 2023, and countries like China and the UAE may establish national reserves of Bitcoin, reflecting a broader trend of seeking alternative investments during economic downturns [4a97b025].

As the upcoming fiscal policies under Trump's administration are closely scrutinized, the potential impact on the national debt and overall economic stability remains a critical concern for policymakers and citizens alike [e6d61e75]. The reinstated debt ceiling adds urgency to the situation, with Treasury Secretary Janet Yellen warning that the U.S. will hit its debt limit between January 14 and January 23, 2025, further complicating the fiscal landscape [c364f0e5].