The global push for green hydrogen is gaining momentum as countries recognize its critical role in achieving net-zero emissions. Recent discussions at COP29 in Baku emphasized the importance of green hydrogen in decarbonizing hard-to-electrify sectors such as steel and shipping. The international community has pledged to increase clean hydrogen production six-fold, with the European Union aiming for 10 million tonnes of green hydrogen by 2030 [5abe7191].

In Namibia, the Green Hydrogen Programme recently hosted a panel discussion on November 18, 2024, to assess the socio-economic benefits of the country's green hydrogen industry. Keynote speaker Obeth Kandjoze, Director General of the National Planning Commission, emphasized the alignment of the initiative with Namibia's socio-economic goals, aiming to diversify the economy, create jobs, reduce poverty, and address income inequality. The Ex-ante Socioeconomic Impact Assessment presented advanced economic modeling techniques to forecast significant impacts, including the potential creation of 120,000 jobs during the investment phase and 30,000 jobs annually during the operational phase. Additionally, the assessment projected an increase in GDP of N$129 billion during the investment phase and N$177 billion annually thereafter, with household income expected to rise by N$99.4 billion during the investment phase and N$87.9 billion annually during operation [4d704a24].

Southeast Asia is also exploring the establishment of low-carbon hydrogen hubs, with Malaysia planning to develop three hubs by 2050 and Singapore positioning itself as a 'hydrogen service hub.' However, geopolitical challenges and the need for regional collaboration among ASEAN nations pose significant hurdles to these ambitions [2bd58c2].

The return of Donald Trump as a potential U.S. President raises concerns about the future of clean energy support in the United States, which could impact the green hydrogen sector. Despite this uncertainty, private sector initiatives and state-level policies continue to drive hydrogen development in the U.S. [5abe7191].

In Colombia, the hydrogen association has set ambitious targets for electrolysis capacity and aims to reduce production costs to US$1.70/kg by 2030, positioning itself as a competitive player in the green hydrogen market [2f681cb6]. Meanwhile, the U.S. Treasury Department's proposed guidelines on clean energy investment and production tax credits for green hydrogen projects have sparked debate, with concerns that they may hinder industry growth [cad3863b].

Technological advancements are also playing a crucial role in reducing the costs associated with green hydrogen production. Enhanced electrolyser efficiency is expected to lower production costs, although environmental challenges such as water and electricity demands remain significant [5abe7191].

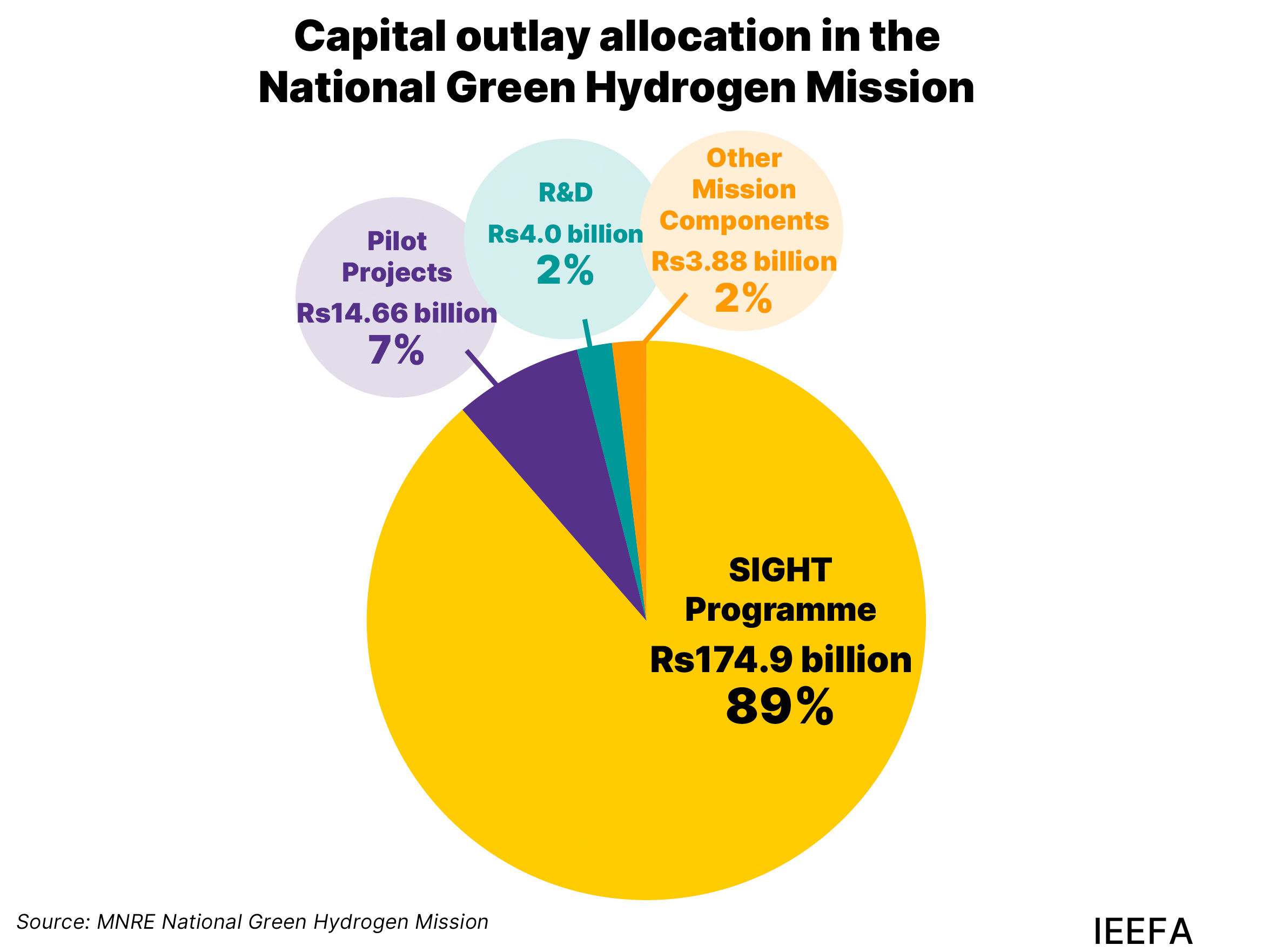

India is making strides in the green hydrogen sector, investing $2.1 billion to promote local electrolyser manufacturing and green hydrogen production through its Strategic Interventions for Green Hydrogen Transition (SIGHT) program [ee381706].

As the competition for dominance in the global clean energy race intensifies, countries like China, the U.S., and Australia are positioning themselves to lead in the green hydrogen industry. China currently controls 50% of global electrolyser capacity, while Australia has allocated $8 billion to kickstart its green hydrogen sector [0aaf3429][46e908c8].

In conclusion, while the green hydrogen industry faces challenges amid political and market uncertainties, its long-term potential remains robust. The global landscape is rapidly evolving, with significant investments and strategies emerging worldwide, making it essential for regions like Southeast Asia and Namibia to keep pace with these developments [2bd58c2][5abe7191].