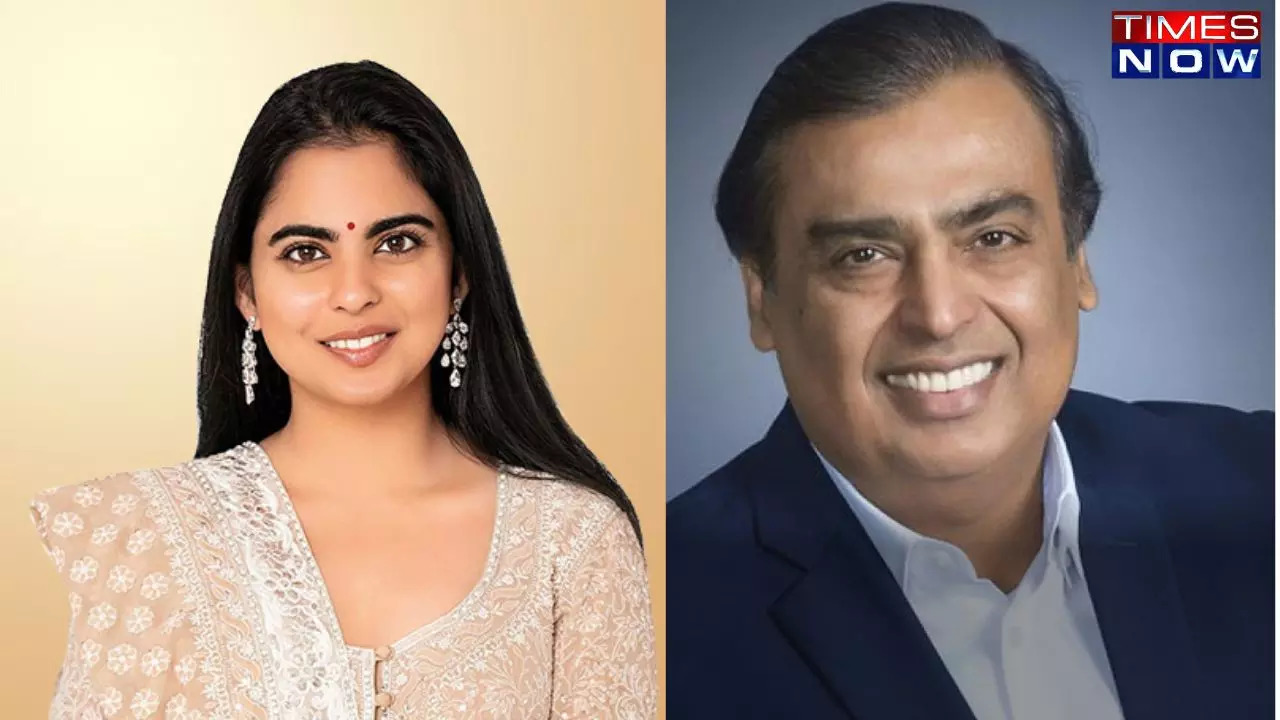

Timberland, the iconic American footwear brand, has made its return to India through Isha Ambani's Reliance Retail. The brand's products are now available on the e-commerce platform AJIO, marking a significant comeback after Timberland exited the Indian market in 2015 due to intense competition and legal disputes with local brand Woodland. This strategic move is part of Reliance's broader initiative to strengthen its retail portfolio by incorporating global brands, enhancing its market presence in the fashion sector.

The relationship between Timberland and Reliance is not new; the two companies previously had a licensing agreement in 2009. Timberland's re-entry into India comes at a time when Reliance Retail Ventures has reported a modest 1.3% rise in net profit, amounting to Rs 2,386 crores for the July-September quarter. However, Reliance's shares experienced a decline of approximately 2% due to softer earnings in the second quarter.

Woodland, which has been a dominant player in the Indian footwear market since its establishment in 1992, is expected to face increased competition with Timberland's return. The parent company of Woodland, Aero Group, was founded in the 1950s and has maintained a strong foothold in the market. The reintroduction of Timberland is likely to shake up the dynamics of the Indian footwear market, prompting existing brands to innovate and enhance their offerings to retain customer loyalty. [663a8a29]