Turkey's economic landscape continues to be shaped by President Recep Tayyip Erdogan's unconventional views on monetary policy. Erdogan has long maintained that high interest rates are the root cause of inflation, a stance that contradicts the global consensus among economists. His rejection of mainstream economic principles has led to the dismissal of multiple central bank governors, reflecting a turbulent approach to managing the economy. Recently, Turkey's inflation rate has been reported at 62.1%, a significant concern for both policymakers and citizens alike [9546fb0a].

The Turkish lira has experienced a dramatic decline, plummeting from 5.71 to 34.08 against the US dollar since 2019, highlighting the currency's instability and the challenges faced by the Turkish economy. Despite Erdogan's controversial policies, he remains unlikely to adopt aggressive interest rate hikes, which he believes would exacerbate inflation rather than control it [9546fb0a].

In contrast, the US economy is grappling with its own inflation issues, with rising interest rates failing to effectively curb price increases. The US economy grew by 2.8% in the second quarter of 2024, but high-income households, which account for 40% of US consumption, continue to feel the pinch of inflation. This situation has led US asset managers to question the Federal Reserve's interest rate policies [9546fb0a].

In a recent forecast, Brendan McKenna, an economist at Wells Fargo, projected that Turkey's inflation would range between 55-60% for 2024 and drop to 30-35% in 2025. He anticipates interest rate cuts in early 2025, reflecting a potential shift in the Central Bank's approach. McKenna acknowledged the Central Bank's optimism but warned of geopolitical risks that could impact the economy [3d134f41].

Turkey's economic structure is heavily reliant on imports, which constitute 35.5% of its GDP, while exports account for only 23%. This imbalance poses additional challenges for Erdogan's administration as it navigates the complexities of both domestic and international economic pressures [9546fb0a].

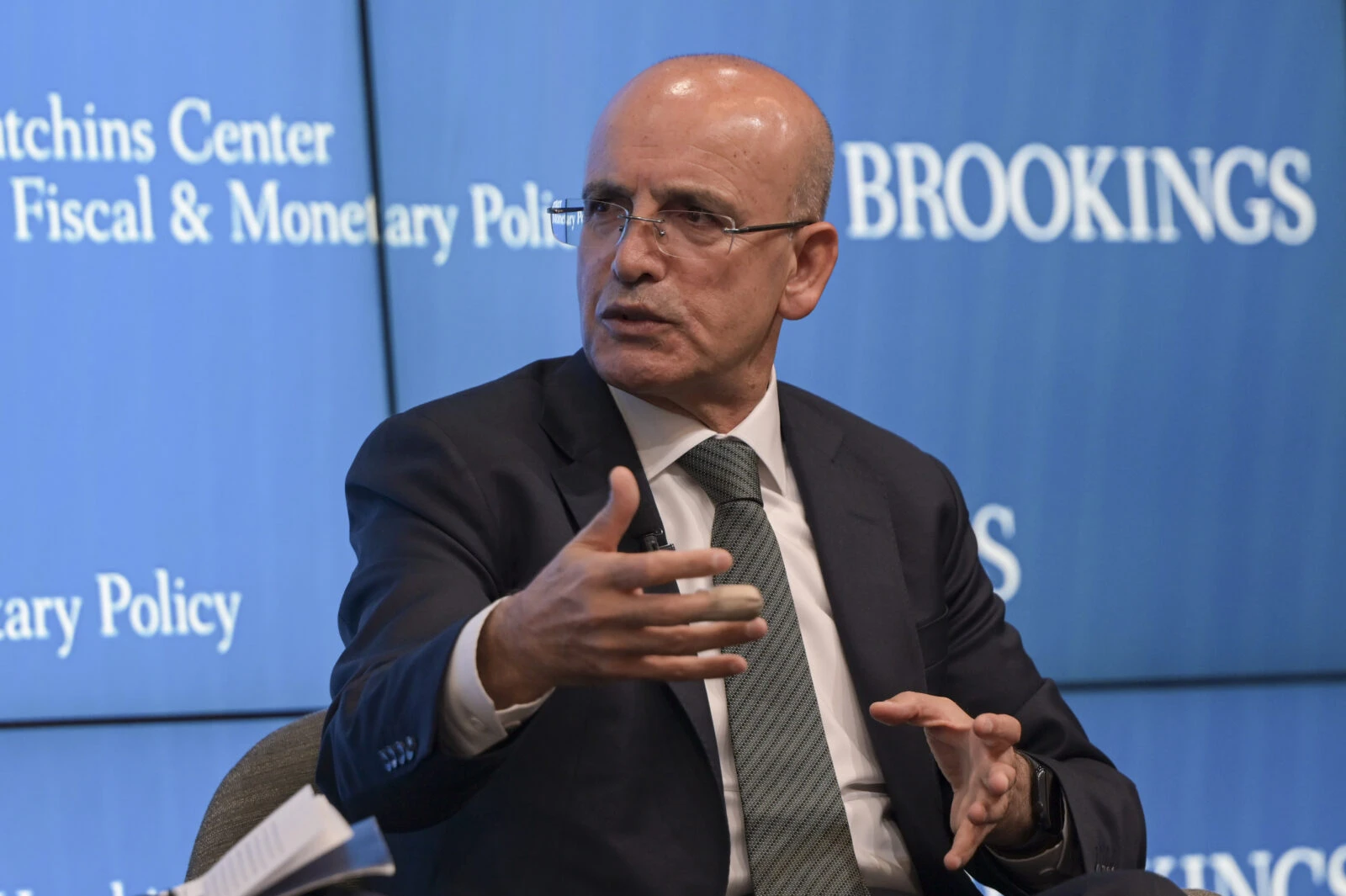

In the context of these developments, Turkey's finance chief, Mehmet Simsek, has expressed optimism about stabilizing the economy through rational monetary policies. He believes that the inflow of foreign capital, which has exceeded $25 billion since March, is a positive sign for Turkey's economic future. Simsek is focused on avoiding excessive lira appreciation to protect Turkish exporters while also working towards regaining investor confidence [3194c9d4].

Recently, Simsek forecasted that inflation could drop to single digits by the end of 2026, attributing this positive outlook to the government's economic program. He expects inflation to hit around 30% by the end of 2024, emphasizing the importance of price stability for sustainable growth. Simsek also noted a contraction in the current account deficit due to increased oil and gas production, which he sees as a sign of economic strength [36e74b68].

The central bank, under Governor Fatih Karahan, is committed to maintaining a tight monetary policy to combat soaring prices. The central bank has raised interest rates significantly since March and is determined to see a sustained decline in inflation. However, the central bank acknowledges that it is too early to declare a trend change following a recent dip in inflation rates [a9bbf6fa].

As Turkey grapples with these economic challenges, the interplay between Erdogan's policies and the broader economic environment will be critical in determining the country's financial stability moving forward. Additionally, McKenna's forecast suggests that a contraction in Turkey's economy is unlikely, and he anticipates a double-digit increase in the minimum wage, which could further influence consumer spending and economic growth [3d134f41].