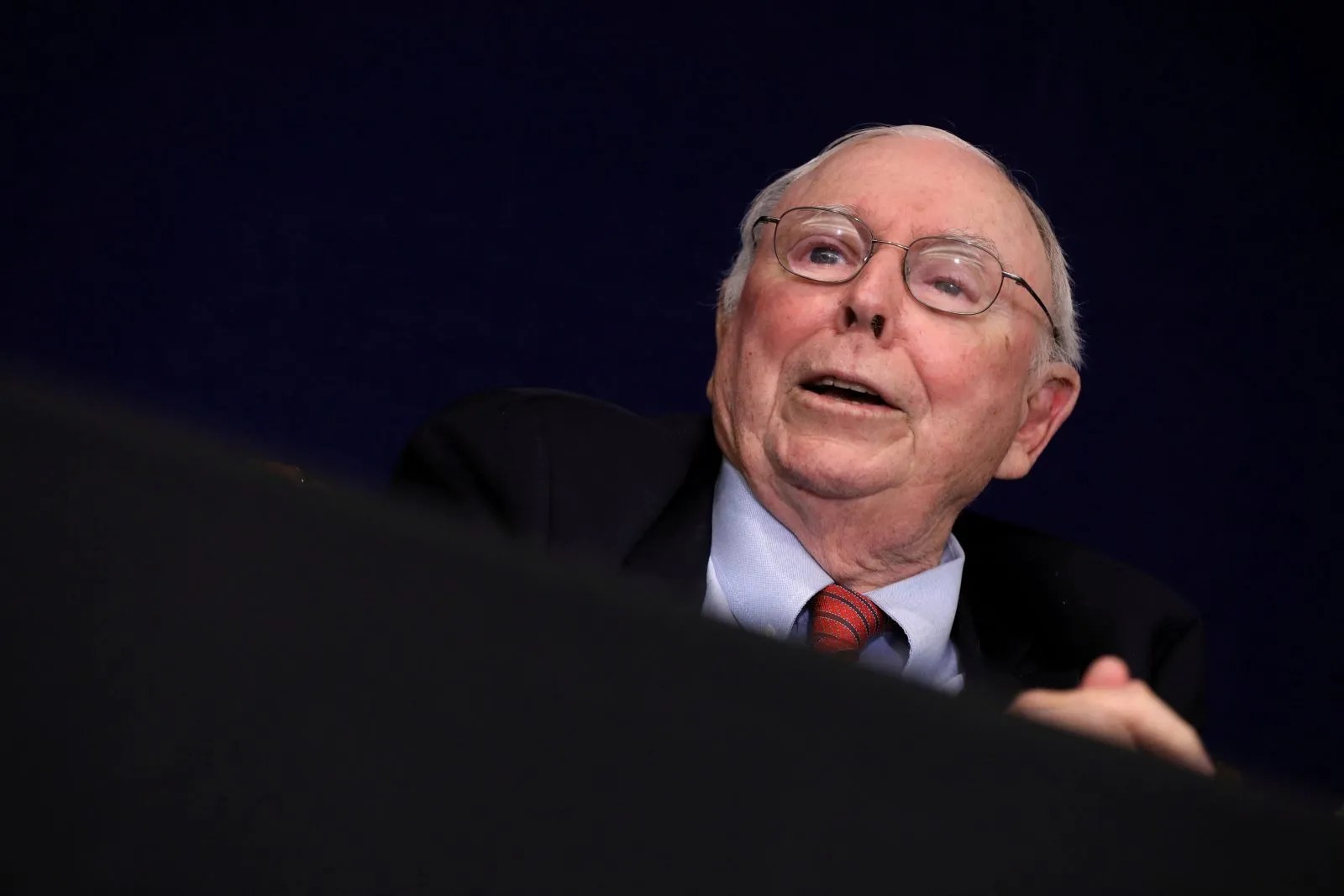

In the chronicles of global finance, the tale of Charlie Munger's retirement from Berkshire Hathaway stands as a monumental event, rich in symbolism and profound implications. Munger, a colossus in the investment arena, concluded his distinguished tenure in 2023, signaling the end of an era that saw Berkshire Hathaway evolve under his and Warren Buffett's stewardship. Their combined wisdom, characterized by deep insight and an almost Zen-like approach to disentangling complex investment enigmas, has been pivotal in shaping the company's philosophy. [0292ac55]

Munger's legacy is a complex weave of sharp insights and forthright critiques, notably of systemic flaws in the U.S. healthcare sector, creating a void that yearns for a successor of comparable stature and foresight. At this crucial juncture, the investment community's gaze turns to Li Lu, a figure enveloped in interest and speculation.

Li Lu's story is akin to a narrative from the annals of cinema, marked by resilience and intellectual rigor. His journey from the tumultuous Tiananmen Square protests to the zenith of financial acumen encapsulates a saga of transformation. As a refugee-turned-scholar in the United States, Li Lu encountered Warren Buffett's investment philosophy at Columbia University, an experience that would shape his future. This revelation led him to establish Himalaya Capital Management in 1997, a testament to focused investment strategies and in-depth analysis of a selective yet impactful portfolio.

Li Lu's investment landscape is characterized by strategic boldness, evident in significant stakes in titans like Alphabet, Bank of America, and Apple. His approach, while resonant with Buffett's value investing principles, is distinct, marked by keen analysis and unwavering conviction.

Despite Li Lu's formidable reputation and rumored succession to Buffett, he intriguingly distances himself from this narrative at Berkshire Hathaway, adding a layer of enigma to his persona and the unfolding future of Berkshire Hathaway post-Munger.

Li Lu's life narrative, interwoven with defiance, adaptation, and victory, transcends mere financial prowess. It is a narrative of resilience, the significance of perspective, and the relentless pursuit of convictions. His journey, intertwined with political turmoil and personal transformation, offers a unique viewpoint on the current investment landscape, a domain rife with possibilities, challenges, and significant shifts.

As Munger's chapter at Berkshire Hathaway concludes, the investment world watches intently, pondering questions of leadership, strategic direction, and the conglomerate's global financial impact. In this context, Li Lu emerges as a luminary of investment wisdom, his narrative encapsulating the essence of navigating the complex currents of the financial domain.

This narrative of Munger's departure and Li Lu's potential ascendancy also intertwines with broader themes defining our era—identity theft, the nuanced discourse on financial inequalities, strategic tax planning, and debt management complexities. Each element contributes to a rich mosaic portraying the dynamic, multifaceted world of finance and investment.

Li Lu's remarkable life journey has profoundly influenced his investment philosophy. Born in China during the Cultural Revolution and a participant in the Tiananmen Square protests, his immigration to the United States and education at Columbia University shaped his worldview. His experiences, including leading student movements and surviving political upheaval, have given him a unique perspective on resilience and complexity in finance. After graduating, his path led him to a hedge fund and ultimately to founding Himalaya Capital, where his investments in companies like Baidu and BYD reflect his journey's influence. [586f3a42]

Li Lu's narrative extends beyond financial mastery to philanthropy, showcasing his impact on broader societal issues and serving as a reminder of how personal experiences can inform professional outlooks. [2ba876ae]

The investment world continues to speculate about Li Lu's potential role as Buffett's successor at Berkshire Hathaway. His exceptional journey and investment success make him a figure of interest and respect. The future of Berkshire Hathaway and the broader investment landscape remains a captivating prospect as the baton is passed to the next generation.

In the backdrop of Munger's legacy, his pro-China views have also come under scrutiny. Munger supported Costco's expansion into China, which saw significant success with the Shenzhen store opening in January 2024, attracting 10,000 visitors. He praised China's economic management and advocated for closer U.S.-China ties, even stating at the 2023 Berkshire meeting that both nations share blame for the economic tensions that have arisen. However, bipartisan sentiment in the U.S. has shifted against China, with President Biden announcing tariffs on Chinese imports in May 2024, targeting key sectors like steel, semiconductors, and electric vehicles. This shift has led to a notable decline in U.S. exports to China, which fell over 20% in 2023, and 40% of American businesses in China planning to redirect their investments. Munger's investment in BYD, a Chinese carmaker, further highlights the competitive threat posed to U.S. automakers, illustrating the complexities of U.S.-China trade relations and the political economy shaping current policies. [d01e5a22]

Li Lu, in a heartfelt eulogy for Munger, commended his ethical approach to wealth generation and commitment to lifelong learning. Munger, revered for his ability to connect and his philanthropy, is seen as a modern capitalist philosopher by Lu. His influence, particularly through 'Poor Charlie's Almanack,' resonates strongly in China, where he is revered as a modern-day Confucian figure. Lu believes Munger's vision of modern Confucianism is crucial for China's modernization and its role on the global stage.