The US economy is currently facing rising costs, declining consumer confidence, and an economic environment that resembles the stagflation of the 1970s [d2ad037d]. Inflation, stagnant wages, and uncertainty in the economy are causing people to be cautious with their spending [d2ad037d]. This is impacting businesses and individuals across various sectors [d2ad037d]. The 1970s stagflation period was characterized by high inflation, inconsistent economic growth, unbridled government spending, and geopolitical conflicts [d2ad037d]. The current economic situation is similar, with increased government spending, conflicts in Russia/Ukraine and Israel/Hamas, and high inflation [d2ad037d]. Consumer confidence is low, with home affordability at an all-time low, credit card delinquencies rising, and auto loan delinquencies at their highest level since 2012 [d2ad037d]. The Misery Index, a measure of unemployment and inflation, is trending up [d2ad037d]. To survive and potentially thrive financially, individuals are advised to reduce their lifestyle budget, pay off variable rate debt, accumulate savings, and invest in building valuable skills [d2ad037d]. The current economic challenges are expected to persist for the foreseeable future [d2ad037d].

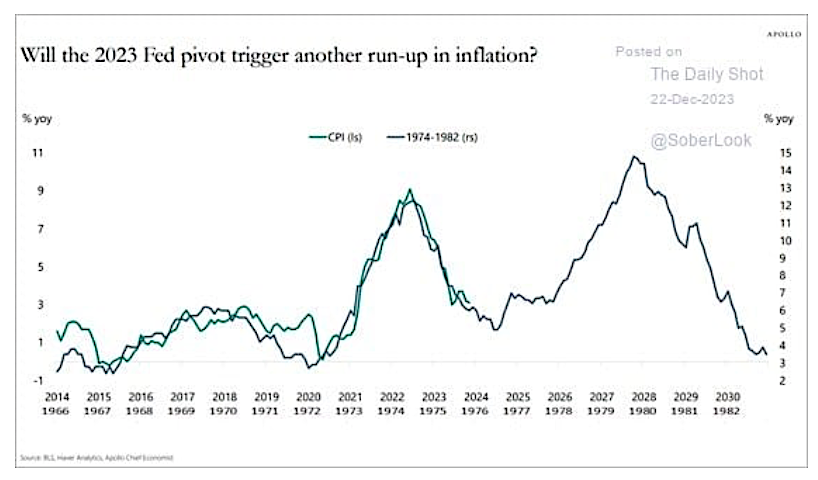

This article discusses the possibility of a repeat of the high inflation experienced in the 1970s and its potential impact on the economy and financial markets [15894509]. The author compares recent inflation rates to those of the late 1960s, 70s, and early 80s [15894509]. The article highlights the importance of understanding the causes of inflation during that period and whether similar conditions exist today [15894509]. The article also mentions that sustained high inflation can have negative effects on stock and bond returns, as well as the well-being and morale of the nation's citizens [15894509]. The author plans to continue the discussion in future articles, exploring the oil price shocks, price-wage spiral, and the role of the money supply in the inflationary period [15894509]. The article concludes by suggesting that comparing the current economic environment to that of the 1970s can help assess the likelihood of a similar inflationary roller coaster [15894509].

Fifty years ago this month, Harold Wilson returned as Britain’s prime minister after winning the first 1974 election against a backdrop of paralyzing strikes, soaring inflation, and terrorist bombings [d57a415f]. The 1970s have hung around like a bad smell in the public imagination ever since [d57a415f]. Inflation peaked at a postwar high of almost 27% in 1975, and the nation needed a bailout from the International Monetary Fund the following year [d57a415f]. The punk movement, which disrupted the music industry, sprang from disaffected youth convinced they had no future [d57a415f]. The 1978-79 “Winter of Discontent” saw more working days lost than at any time since the 1926 General Strike [d57a415f]. However, the article argues that not everything about the 1970s was bad and that it deserves a reassessment [d57a415f]. The decade's tarnished reputation is merited, but there were also positive aspects that have been overshadowed [d57a415f].

The comparison between the US economy's current situation and the 1970s stagflation period provides valuable insights into the potential impact of high inflation on the economy and financial markets [15894509]. By examining the causes and consequences of inflation during the 1970s, analysts can better understand the risks and challenges that lie ahead [15894509]. It is crucial to consider the role of government spending, geopolitical conflicts, and consumer confidence in shaping the economic landscape [d2ad037d]. Additionally, the article from Bloomberg highlights the need to reassess the 1970s and challenge the negative perception associated with that era [d57a415f]. This broader perspective allows for a more nuanced understanding of the past and its implications for the present [d57a415f].

Recent GDP figures revealed a decrease in the US economy's growth rate compared to its recent outstanding performance [505c7858]. Some individuals speculated that the nation was suffering from stagflation, a stagnating economy coupled with increasing inflation [505c7858]. However, Federal Reserve Chair Jerome Powell argued against the presence of stagflation [505c7858]. Instead, he mentioned the term 'slackflation,' which refers to persistent but manageable inflation in an economy with slack [505c7858]. The US experienced economic slack recently, as exhibited in the latest job report [505c7858]. While the unemployment rate increased slightly, economists still considered the job gains to be solid [505c7858]. On the inflation front, the monthly inflation rate eased slightly in April [505c7858]. Despite recent improvements, progress in achieving the Fed's 2% inflation target might be slowing down [505c7858]. However, the current inflation rate is far from that of the 1970s and '80s [505c7858]. The article also mentions warnings about the potential risks of high US national debt and the impact of tariffs and inflation on the US economy [505c7858]. It concludes by noting that while the current economic struggles are significant, they do not compare to the challenging times of the 1970s [505c7858].

In conclusion, the US economy's current state resembles the stagflation of the 1970s, with high inflation, declining consumer confidence, and rising costs [d2ad037d]. The comparison between the two periods provides valuable insights into the potential challenges and risks that lie ahead [15894509]. It is essential to understand the causes and consequences of inflation during the 1970s to assess the likelihood of a similar inflationary roller coaster in the present [15894509]. Furthermore, reassessing the 1970s allows for a more balanced understanding of that era and its impact on the economy and society [d57a415f]. Despite the current economic struggles, the US economy's situation is not comparable to the challenging times of the 1970s [505c7858].