/tpg%2F6ea8fe65-d3e7-40ab-af5a-5777e9c58316.jpeg)

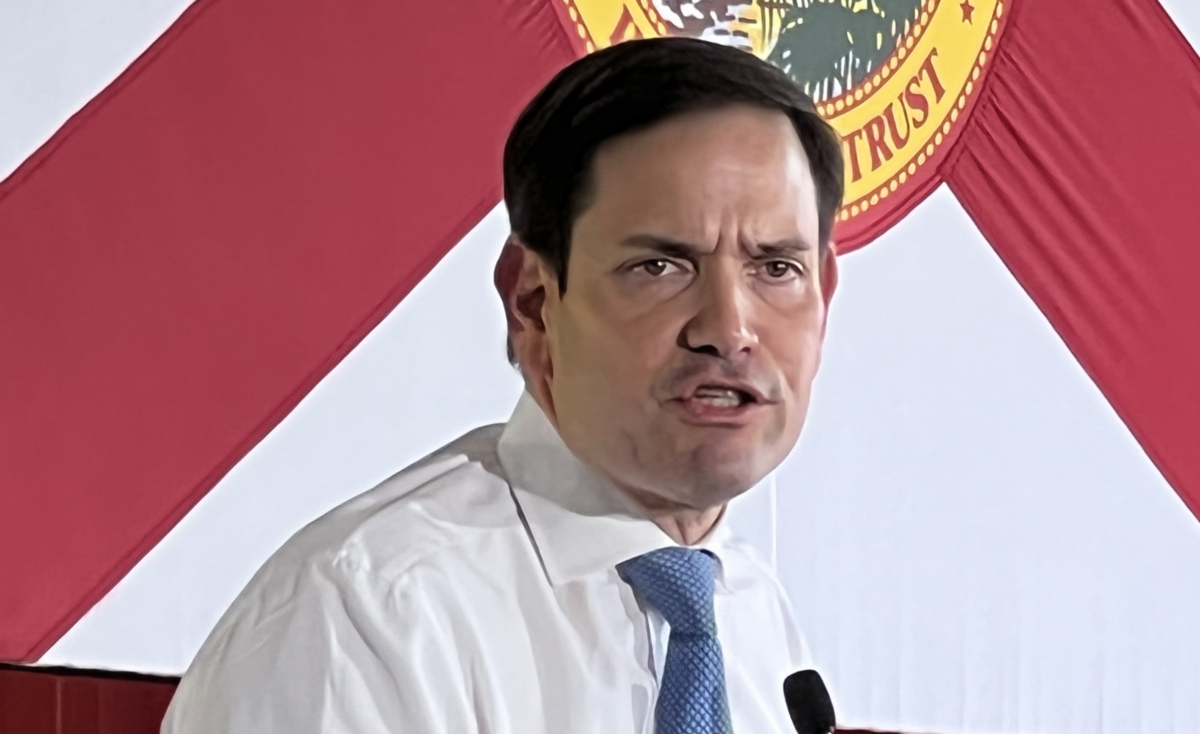

On January 6, 2025, Marco Rubio was appointed as Secretary of State under the Trump administration, marking a significant shift in U.S. foreign policy direction. Known for his aggressive stance on international relations, Rubio has been a vocal advocate for military interventions and has consistently supported sanctions against countries such as China, Russia, North Korea, and Iran [363e51e4]. His recent push for Taiwanese independence represents a departure from established U.S. policy, raising concerns about escalating tensions in the Asia-Pacific region [363e51e4].

During his Senate confirmation hearing on January 16, 2025, Rubio warned of a growing threat from the Chinese Communist Party (CCP), emphasizing the United States' increasing dependence on Chinese products. He predicted that within a decade, critical aspects of American life would hinge on decisions made in China. Rubio specifically highlighted China's targeting of American agriculture and its military expansion as pressing issues [945208e2]. His concerns were echoed by Florida Senator Rick Scott, who criticized China's practices and called for greater accountability [945208e2].

On January 22, 2025, Rubio met with India's External Affairs Minister S. Jaishankar at the State Department. During this meeting, Rubio emphasized the Trump administration's commitment to strengthening economic ties with India and addressing irregular migration concerns. This discussion followed a Quad ministerial meeting and underscored the importance of the India-U.S. partnership, covering regional issues, critical technologies, defense cooperation, energy, and the Indo-Pacific region [52119b9f]. Jaishankar expressed delight in the meeting and noted the extensive bilateral partnership, looking forward to advancing strategic cooperation [52119b9f].

Rubio's controversial past includes his support for U.S. military actions in Libya and Iraq, as well as his backing of Israel's military operations, which has drawn criticism from various quarters [363e51e4]. His family ties to the drug trade have led to the moniker 'Narco Rubio,' further complicating his political image [363e51e4]. Despite previously criticizing Trump, Rubio has emerged as a key ally, suggesting a shift in his political strategy influenced by significant figures like Sheldon Adelson [363e51e4].

As Secretary of State, Rubio's policies may align closely with the hardline approach advocated by other Trump administration officials, including David Perdue, the newly appointed ambassador to China. Perdue's focus on tariffs and trade negotiations will likely intersect with Rubio's aggressive foreign policy stance, particularly regarding China and Taiwan [d2a25b2a]. The combination of these appointments signals a potentially confrontational U.S. foreign policy that prioritizes military readiness and economic sanctions as tools for international diplomacy [363e51e4][d2a25b2a].

On January 25, 2025, Rubio clashed with Chinese Foreign Minister Wang Yi during their first telephone call regarding Taiwan. Rubio emphasized the second Trump administration's commitment to U.S. interests and support for allies in the region while expressing serious concern over China's coercive actions. In response, Wang warned Rubio against Taiwan's separation from China and urged the U.S. to uphold its one-China policy. Earlier that week, Rubio had met with foreign ministers from Japan, India, and Australia, warning against unilateral actions by China. He also discussed China's aggressive behavior in the South China Sea with Vietnam's foreign minister, suggesting that without clear U.S. deterrence, China could invade Taiwan by the end of the decade [8ec0ae64].

Additionally, on January 26, 2025, Rubio made history as the first individual of Cuban descent to serve as Secretary of State. This appointment presents a unique opportunity to recalibrate U.S.-Cuba relations, which have been shaped by historical grievances and geopolitical considerations. The Obama administration initiated a thaw in relations, but the embargo imposed in 1960 has led to significant suffering among the Cuban population. Rubio's Cuban heritage influences his perspective, and he faces the challenge of addressing entrenched political ideologies within his party. He has indicated the need for a compassionate approach to U.S.-Cuba relations, suggesting a reevaluation of the effectiveness of the embargo and the importance of engaging in dialogue with Cuba to acknowledge U.S. complicity in Cuban suffering. This moment presents an opportunity for reconciliation and constructive engagement with Cuba [cee9861d].

On February 1, 2025, Secretary of State Marco Rubio announced the reinstatement of the Cuba Restricted List, targeting businesses linked to the Cuban military, intelligence, and security sectors. This move aims to limit financial support to entities accused of suppressing Cuban citizens and prohibits specific financial transactions with organizations tied to Cuba’s military. The renewed measure signals U.S. commitment to restricting economic engagement with state-affiliated entities and aligns with broader foreign policy objectives promoting human rights and democratic governance in Cuba [b91c0ed6].