Starbucks Malaysia is grappling with a significant long-term sales decline attributed to an ongoing anti-Israel boycott. This situation has been compounded by entrenched consumer sentiment, as highlighted by Maybank, which warns that the brand may continue to suffer due to shifting public attitudes. Berjaya Food Berhad, which operates Starbucks outlets in Malaysia, reported a pre-tax loss of 31.82 million ringgit (approximately $7.1 million) for the fourth consecutive quarter, with revenue plummeting over 50% year-on-year to 124.19 million ringgit ($28 million). Additionally, more than 10% of its 400 branches have temporarily closed due to the boycott's impact on sales [893def31].

Maybank has projected that losses for Berjaya Food could reach 65 million ringgit ($14.5 million) this year, reflecting the deepening crisis. RHB Bank had previously advised investors to sell their holdings in Berjaya Food last December, indicating a lack of confidence in the company's recovery prospects. Notably, 50 out of 408 outlets have closed, including those in prominent locations such as Suria KLCC mall [893def31].

Despite the challenges faced by Starbucks, coffee consumption in Malaysia increased by 5% in 2022, and market research suggests that the coffee sector is expected to grow from $843 million to $1.1 billion by 2029. However, social media sentiment indicates a notable shift in consumer preferences away from Starbucks, further complicating the company's position in the market [893def31].

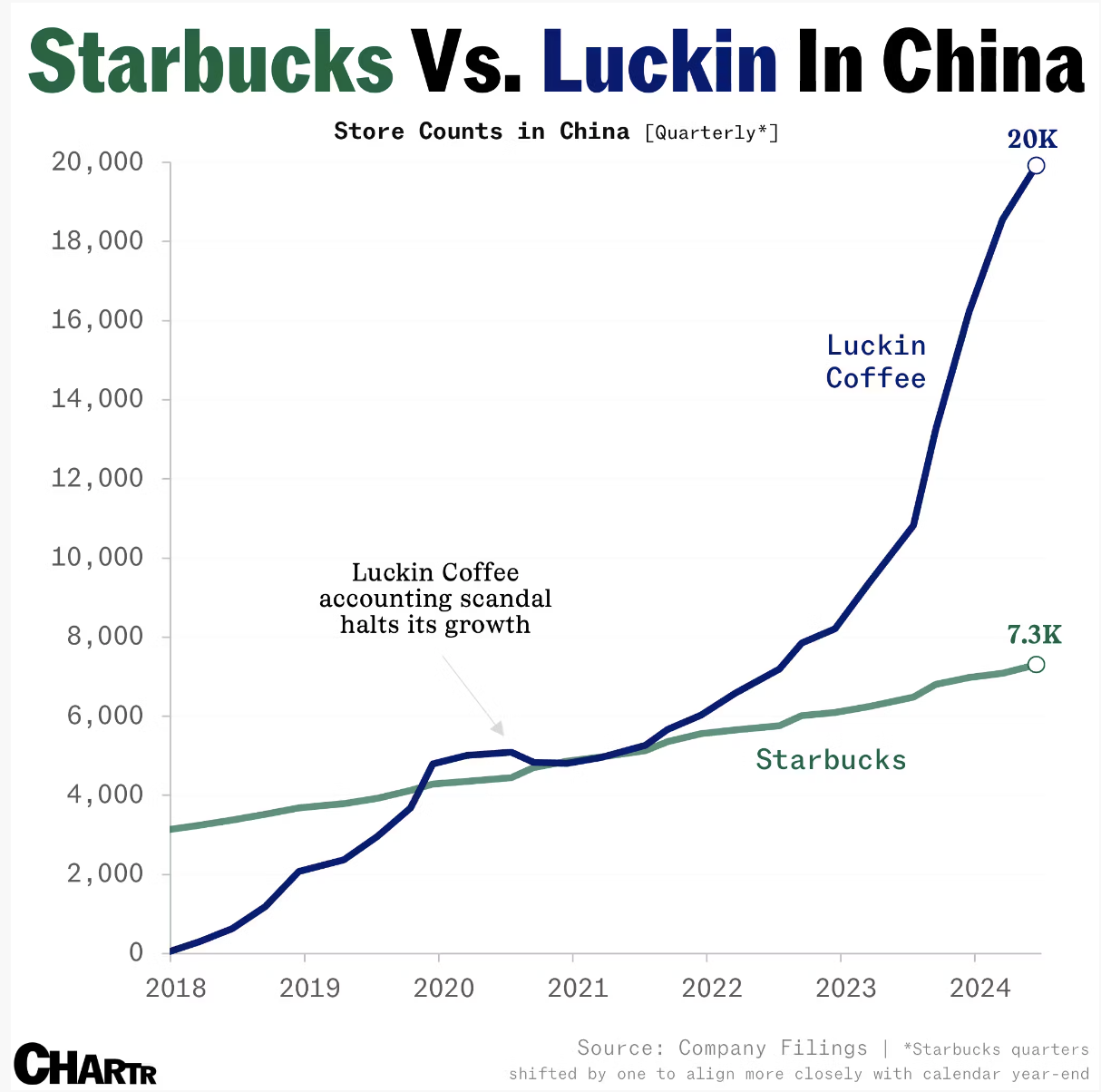

As Starbucks contends with these challenges in Malaysia, it also faces increased competition from Luckin Coffee, which plans to enter the U.S. market in 2025. This dual pressure from both local and international competitors underscores the need for Starbucks to adapt its strategies in response to evolving consumer sentiments and market dynamics [36f5f7d1].