As Bangladesh prepares for its graduation from Least Developed Country (LDC) status in 2026, exporters are voicing serious concerns about the potential negative impacts on the trade sector. Anwarul Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries (BCI), warned that if the graduation is not deferred by three years, it could lead to severe economic repercussions, including the closure of 100 garment factories and the potential for an additional 200 to shut down [83dfdedf]. The garment sector is particularly vital, employing 40% of the workforce and accounting for 85% of the country’s total exports [83dfdedf].

The urgency of these concerns is underscored by the competitive landscape in which Bangladesh operates. By 2027, Vietnam is set to benefit from a Free Trade Agreement (FTA) that will provide zero-tariff access to the European Union, while Bangladesh will face a 12% duty by 2029 [83dfdedf]. This disparity raises fears that Bangladesh’s apparel industry could lose its competitive edge, further exacerbating the economic challenges posed by LDC graduation.

Chowdhury also criticized the International Monetary Fund (IMF) policies and the rising interest rates, which he believes are detrimental to the economic environment in Bangladesh. He called for an interim government to prioritize employment, investment, production costs, and inflation to safeguard the economy during this transitional period [83dfdedf].

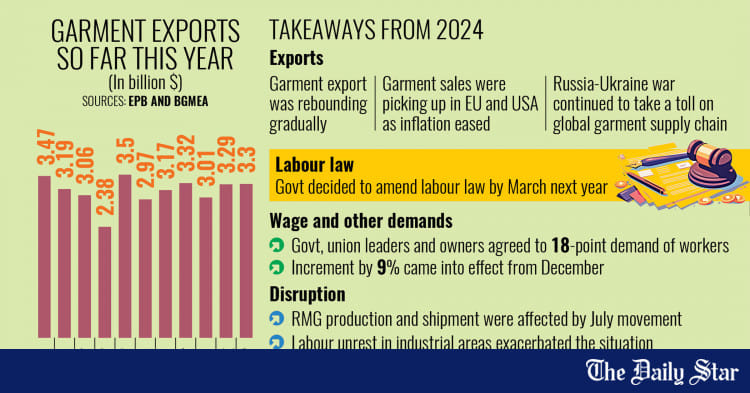

In the context of these developments, the apparel industry has already been grappling with significant challenges, including energy crises, dollar shortages, and labor unrest, which have affected export performance. Despite a recent increase in apparel shipments by 16.25% year-over-year, the cumulative exports from January to November 2024 showed a slight decline of 0.44% compared to the previous year [15f70b8e].

As Bangladesh navigates these complex issues, the call for a strategic approach to LDC graduation becomes increasingly critical, as the nation seeks to maintain its economic stability and growth in the face of mounting pressures from both domestic and international markets [83dfdedf].