In the midst of the COVID-19 pandemic, the world witnessed the unprecedented allocation of emergency funds to combat the virus and support struggling economies. However, beneath the surface of this noble endeavor, a darker side emerged - one filled with controversies, misallocation, and fraud.

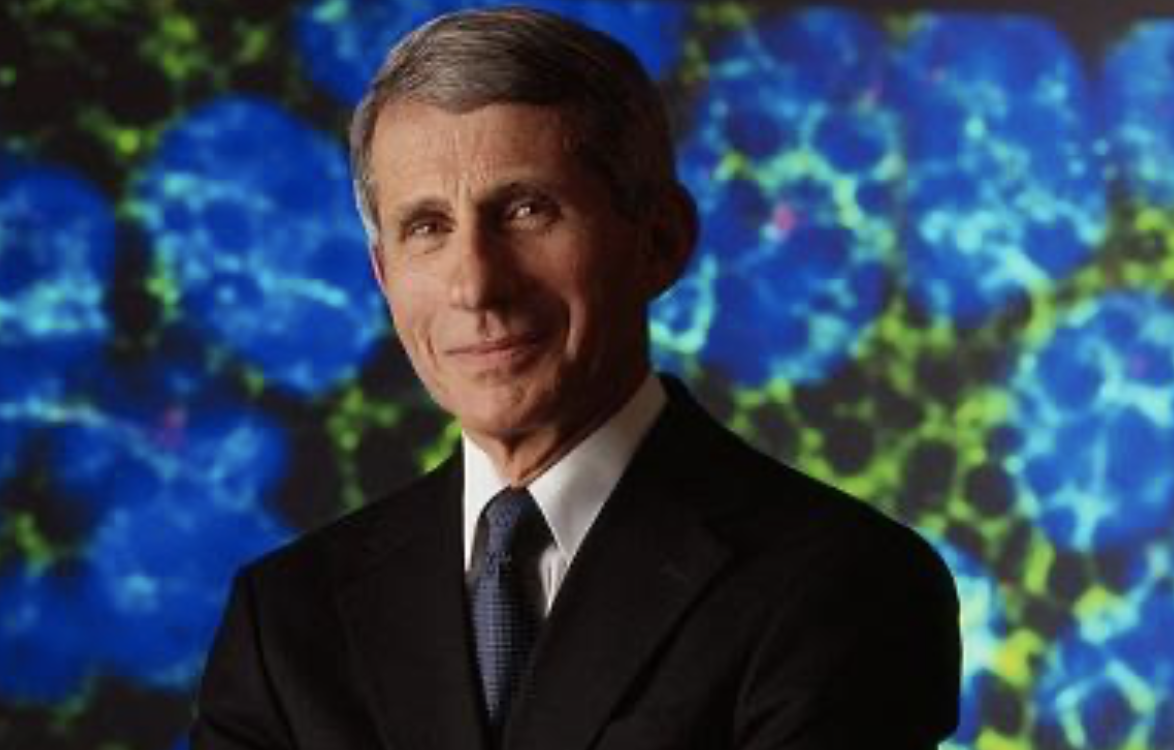

One of the key figures at the center of controversy was Dr. Anthony Fauci, the former director of the U.S. National Institutes of Health's National Institute of Allergy and Infectious Disease (NIAID). Despite his esteemed position, Dr. Fauci faced scrutiny for his financial success during his tenure. After retiring, it was revealed that he had a net household worth of $11.5 million, primarily derived from investments, awards, royalties, and salary increases. While Dr. Fauci claimed that all royalties went to charities, his financial disclosures sparked criticism, particularly in light of his pandemic response recommendations that led to extended lockdowns and negative impacts on the U.S. economy and the financial security of many Americans [99a1aabf]. These revelations raised questions about the financial motivations behind Dr. Fauci's decisions and the potential conflicts of interest that may have influenced his pandemic response [99a1aabf].

Another instance of misallocation came to light in Illinois, where Amy Gentry, an executive assistant to Illinois Emergency Management Agency Director Alicia Tate-Nadeau, billed the agency over $1 million since 2020 before resigning [bdc4a422]. Gentry's billings accounted for $240,000 between February and August 2021 alone [bdc4a422]. This revelation not only caused embarrassment for Illinois officials but also highlighted the issue of fraud and abuse in Congress's $5 trillion spending spree during the pandemic [bdc4a422]. The payments to Gentry were seen as a misallocation of taxpayer funds and a diversion of resources from more valuable activities, creating waste [bdc4a422].

However, the misallocation and controversies surrounding COVID-19 emergency funds were not limited to individual cases. An expert claims that the COVID relief funds distributed by Congress, totaling nearly $4.7 trillion, did not reach those who needed it most. Instead, a significant portion of the funds went to individuals and entities that did not have a genuine financial need. The expert also highlights that many federal programs were looted, both legally and illegally, during the pandemic. For example, 140 contractors owned by the Chinese Communist Party (CCP) received up to $400 million from the paycheck protection program, which was intended for small businesses. The expert estimates that criminals and crime syndicates worldwide stole between $400 billion and half a trillion dollars. This is considered the largest public fraud in the history of the United States [d97b8982].

In Washington state, it was revealed that $340 million in federal COVID funds were diverted to provide $1,000 checks to immigrants who were ineligible for federal economic impact payments due to their immigration status. The funds were administered through the Coronavirus State and Local Fiscal Recovery Fund (SLFRF) and approved by the Washington state legislature in April 2021. The program, called the Washington COVID-19 Immigrant Relief Fund, began in 2020 and ended in early 2023. The funds were categorized as a 'cash transfer' expenditure under the SLFRF. This diversion of funds has sparked controversy and raised questions about the appropriate use of federal COVID funds [8b2a61d7].

Meanwhile, in West Virginia, Governor Jim Justice refuted accusations of misspending COVID-19 funds. The U.S. Department of Education is investigating whether the state's COVID-19 funds were spent properly. Governor Justice stated that there is no $465 million 'clawback' on the table and no allegation of misspending or mishandling of funds. The investigation is focused on COVID-19 funds sent directly to county school boards and higher education institutions. The only contention is how much of the state's spending went into education in proportion to overall spending. Talks with the U.S. Department of Education are ongoing [80c9fc91].

In addition to these controversies, President Joe Biden's National Science Foundation (NSF) has come under criticism for spending millions of dollars in emergency COVID funds on grants unrelated to COVID. The NSF has awarded more than $23 million in American Rescue Plan grants since January 2023 that are unrelated to COVID. Examples include a $246,000 grant to Amherst College to study floodplains' response to climate change, a $7 million grant to the University of Texas at Austin to develop a welcoming environment for marginalized researchers, and a $181,000 grant to California Polytechnic State University to investigate the structural organization of a school of fish. This revelation undermines congressional Democrats' defense of the spending package, which economists say helped contribute to inflation and was not tied to the pandemic. Many American schools spent only 7% of the $122 billion in federal aid allocated to them by the American Rescue Plan. The White House and the NSF have not responded to requests for comment [52b6e83a].

As investigations into the fraud continue, measures have been taken to extend the statute of limitations to bring fraudsters to justice. Lawmakers are debating the success of relief spending and accountability for the theft. The GOP-led House Oversight and Accountability Committee is actively investigating pandemic relief spending. The challenge lies in balancing the need for swift assistance with safeguarding against fraud. Gene Sperling, the White House American Rescue Plan coordinator, believes it is possible to provide fast delivery to those in need without compromising anti-fraud measures [3ed8e874].

The controversies, misallocation, and fraud surrounding COVID-19 relief funds have cast a shadow over the noble intentions of these emergency measures. It serves as a stark reminder of the importance of transparency, accountability, and stringent safeguards in times of crisis. Only through diligent oversight and responsible allocation can we ensure that resources reach those who truly need them, and that the public's trust is not betrayed.

In addition to the controversies surrounding COVID-19 relief funds, there is another development that sheds light on the benefits of Brexit. The European Union's mammoth Covid recovery fund, designed to reboot the Continent's southern economies and forge a fiscal union, is being wasted with accusations of fraud, corruption, and misallocation of resources. Britain avoided this disastrous fund by leaving the EU. The fund, launched with €723bn, has faced investigations into fraud and misallocation of funds, with suspects arrested and assets seized. The EU now faces the challenge of unraveling what happened to the money and repaying the borrowed funds, potentially leading to political backlash and extra taxes. The UK avoided being on the hook for billions and remains shielded from the fiscal union some in the bloc are pushing for. The Covid recovery fund is turning into a catastrophe from which the EU may never fully recover [add0ec46].

The EU recovery fund has both advantages and disadvantages. On the positive side, the fund aims to provide financial support to member states affected by the COVID-19 pandemic, with a total budget of €750 billion. It includes grants and loans, with the grants being non-repayable funds. The fund is seen as a step towards greater fiscal integration in the EU and could help stimulate economic recovery. However, there are concerns about the size of the fund and the potential for it to increase the EU's debt burden. There are also debates about the conditions attached to the funds and the distribution of the money among member states. Overall, the EU recovery fund is a significant initiative with the potential to support member states in their economic recovery, but it also raises important questions and challenges [042bc97d].