On February 4, 2025, President Donald Trump signed an order imposing tariffs on video game imports from Canada, China, and Mexico, introducing a 10% tax on imports from China, with additional tariffs on Canadian and Mexican goods expected to follow. The Entertainment Software Association (ESA) has voiced strong concerns, stating that these tariffs could adversely affect American consumers and the video game industry, particularly through increased prices for physical gaming consoles and accessories. [b4dfffb5][49a0e527][1fecf9dd][9acb9c42]

The ESA formally requested consultation with the Trump administration regarding the proposed tariffs, emphasizing the importance of video games as a major entertainment sector and urging the administration to engage with the private sector to mitigate potential economic harm. They highlighted that tariffs could negatively impact hundreds of millions of Americans and the industry's contributions to the U.S. economy. [b3a5b0f6]

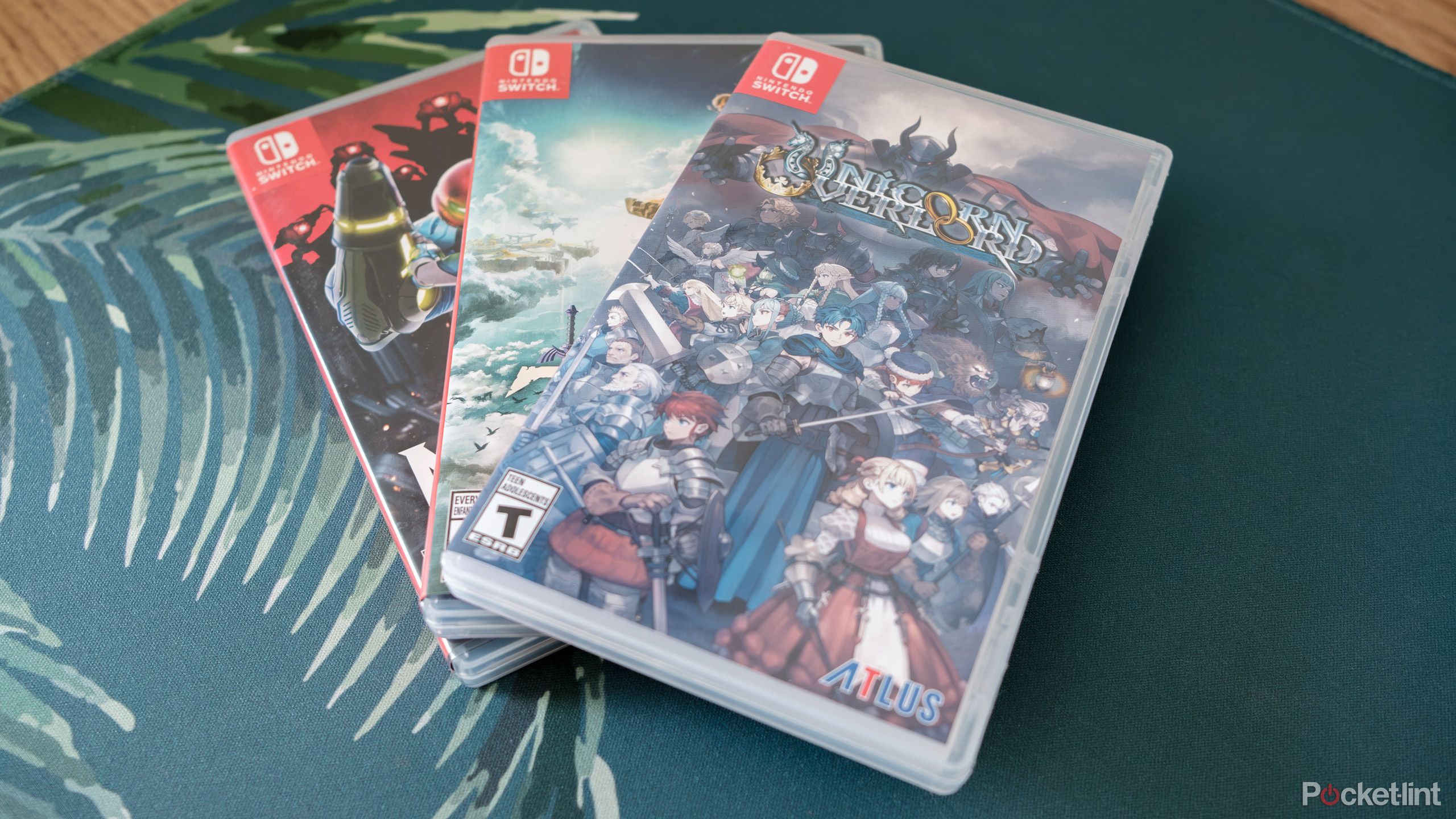

Industry expert Mat Piscatella predicts a decline in physical game releases and higher prices for both digital and physical games. Concerns have arisen that the anticipated release of Grand Theft Auto 6 could see its price soar to as much as $100, significantly impacting consumer purchasing decisions. Most disc copies of video games are produced in Mexico, and if tariffs are enforced without exemptions, the base price for GTA 6 could rise, surpassing the price of its predecessor, GTA V, which launched in 2013. [b4dfffb5][9acb9c42]

In addition to the tariffs on gaming consoles, Trump has suggested imposing tariffs on computer chips imported from Taiwan, aiming to promote domestic manufacturing. This move could further complicate the supply chain for the gaming industry, which relies heavily on these components. [9acb9c42]

Nintendo has already begun shifting some of its production to Vietnam to mitigate the tariff impacts on the upcoming Nintendo Switch 2. As the situation unfolds, the Canadian government is actively negotiating with the Trump administration regarding these tariffs, while China has vowed to defend its interests against the U.S. trade measures. [9acb9c42]

Economic analysts predict that the broader implications of these tariffs will lead to increased costs for American households, with estimates suggesting an average loss of over $830 in 2025. The gaming industry, already facing challenges from supply chain disruptions, may find itself further strained by these new tariffs. [49a0e527][1fecf9dd]

As trade tensions escalate, the global economy is reacting negatively, with stock markets showing signs of volatility. The potential for a destructive global trade war looms large, and analysts caution that the consequences could extend beyond just the gaming sector, affecting various industries and consumers across the board. [49a0e527][1fecf9c42]