Lexington, Kentucky has emerged as one of the top 10 mid-size U.S. cities for attracting Generation Z graduates, according to a recent assessment by Commercial Cafe. This ranking highlights the city's appeal to young professionals who prioritize close-knit communities, vibrant cultural scenes, and economic opportunities. Lexington boasts a Gen Z population of 10.5%, with 28% of job postings specifically targeting recent graduates, making it an attractive destination for new entrants into the workforce [1edc4d17].

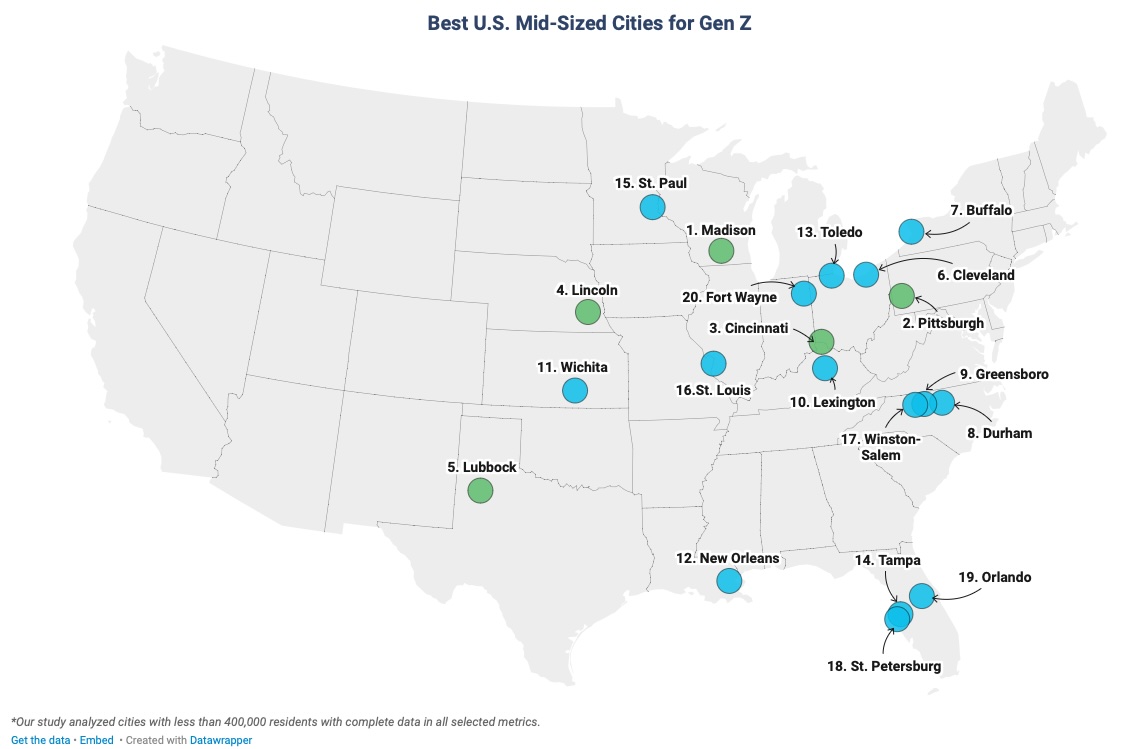

Leading the list is Madison, Wisconsin, which scored 73.5 points and has a Gen Z population of 15.6%. Following closely is Pittsburgh, Pennsylvania, with a 10.9% Gen Z demographic and a strong educational enrollment that supports its appeal to young graduates. Other notable cities in the ranking include Cincinnati, Lincoln, and Lubbock, all of which offer diverse job opportunities and affordability [1edc4d17].

The assessment considered various factors such as employment opportunities, affordability, and access to green spaces, which are increasingly important to younger generations. Lexington's vibrant music scene and local distilleries further enhance its attractiveness, aligning with Gen Z's preferences for cultural engagement and community involvement [1edc4d17].

As cities compete to attract and retain young talent, Lexington's ranking underscores its potential for economic growth and urban development, positioning it as a favorable environment for both living and working [1edc4d17].