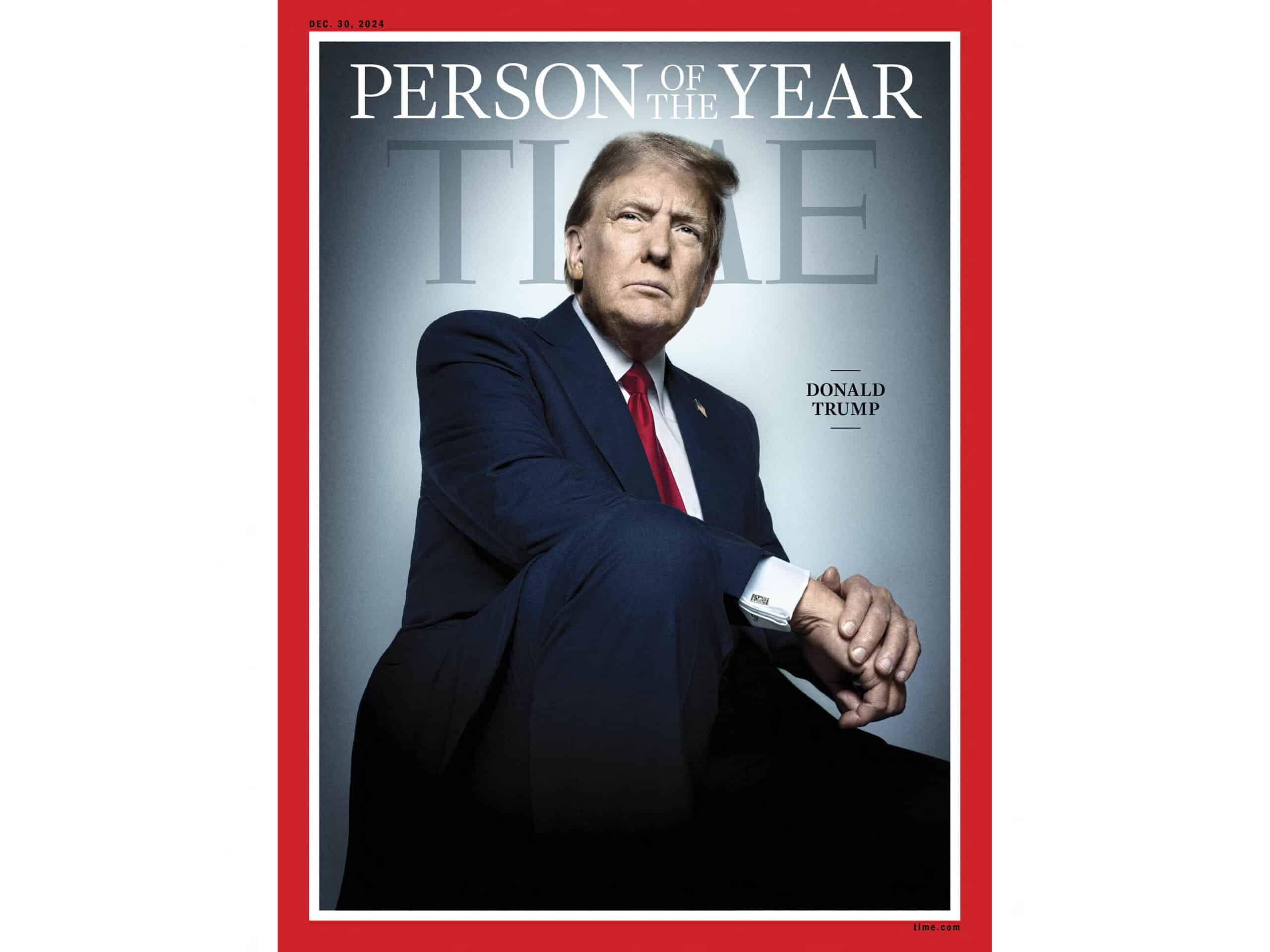

On December 12, 2024, Time Magazine named Donald Trump its 'Person of the Year' for 2024, highlighting his historic political comeback and significant influence on American and global politics [122de057]. This accolade comes after Trump defeated Vice President Kamala Harris in the November 5 election, securing a return to the presidency on January 20, 2025, with Republican majorities in both chambers of Congress [2808d937].

Editor-in-chief Sam Jacobs noted that Trump's victory reshaped the American presidency, a sentiment echoed by many who view his return as a pivotal moment in U.S. politics [2808d937]. Trump's journey back to power has been marked by controversy, including a conviction for business fraud and surviving two assassination attempts earlier in 2024 [2808d937]. His administration is expected to pursue aggressive policies, including mass expulsions of undocumented immigrants and imposing major tariffs, reflecting his populist agenda [2808d937]. Additionally, Trump has expressed skepticism regarding continued U.S. support for Ukraine amid the ongoing Russian invasion, signaling a potential shift in foreign policy priorities [2808d937].

Critics of Trump have raised alarms about the implications of his return to power, especially given the chaotic nature of his previous term. Prominent Republicans have labeled his administration as a 'ship of fools,' with figures like Marco Rubio and Mitt Romney openly criticizing his character and leadership style [690446d4]. Despite these concerns, Trump's ability to galvanize a significant voter base remains evident, as approximately 75 million Americans supported him in the recent election [690446d4].

The upcoming mid-term elections in November 2026 will be crucial for the Republican Party, as they will determine the party's ability to maintain control and influence Trump's governance [690446d4]. As Trump prepares to take office, the interplay between his administration's policies and the broader economic landscape will be closely scrutinized, with many questioning whether his second term will lead to stability or further chaos [690446d4].

In the context of economic policy, Trump's plans for aggressive tariffs and potential trade wars have raised concerns among economists and market analysts, who warn of possible disruptions to trade and economic stability [5e513744][e9cdc4d2]. As he embarks on this new chapter, the risks posed by his policies to the economy and overall governance remain a focal point for both supporters and detractors alike [690446d4].

The recognition as TIME's Person of the Year underscores Trump's significant impact on global events, joining the ranks of previous winners like Taylor Swift, Volodymyr Zelensky, and Elon Musk [122de057]. This announcement reflects not only his influence in the U.S. but also his role in shaping international discourse and policy [122de057].