As 2025 approaches, small businesses contemplating mergers must navigate an uncertain tax landscape. Capital gains tax rates will remain at 0%, 15%, and 20%, but with shifted income thresholds that could impact many business owners [76cd9eed]. Significant changes from the Tax Cuts and Jobs Act are set to expire at the end of 2025, which will affect various business deductions, adding to the complexity of financial planning for mergers [76cd9eed].

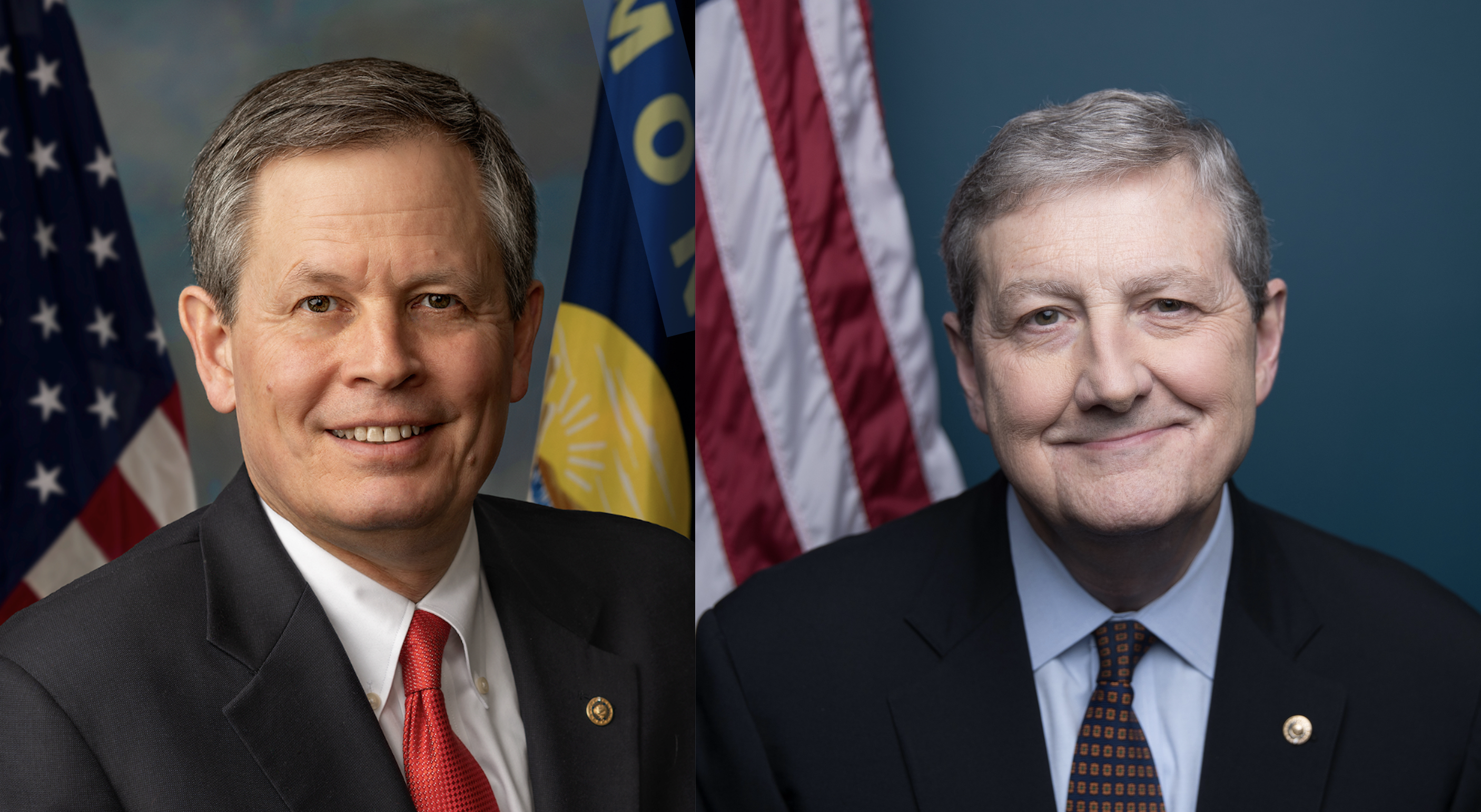

In a recent development, Florida Senator Rick Scott, alongside Senator Steve Daines, Majority Leader John Thune, and 32 other Republican senators, introduced the Main Street Tax Certainty Act on January 28, 2025. This legislation aims to make the 20% pass-through business tax deduction permanent, which is crucial for small businesses. Without action, 90% of small businesses could face tax increases, risking 2.6 million jobs nationwide and contributing to a potential loss of $325 billion to the U.S. GDP annually [a9840c17]. Kennedy emphasized that over 230,000 small businesses in Louisiana alone would face tax hikes if these deductions expire [5449cd01].

The deduction was established under President Trump’s 2017 Tax Cuts and Jobs Act and has garnered support from over 230 trade associations, including prominent organizations like the National Federation of Independent Business (NFIB) and the National Association of Manufacturers [a9840c17]. Business leaders are urged to consult with valuation experts early in the merger process to ensure they have a clear understanding of their business's worth and the potential tax implications. Proactive exit strategies are essential, especially given the looming possibility of tax reforms that could alter the financial landscape dramatically [76cd9eed].

Additionally, groups like Ernst & Young have warned of job losses if the Section 199A deduction sunsets, while economists Barro and Furman suggest that extending the deduction could boost economic growth [fd407c17]. Flexible timelines are recommended for navigating potential increases in capital gains taxes and changes in corporate tax regulations, as these factors could significantly influence the timing and structure of merger deals [76cd9eed].

In the context of small businesses, the urgency for clarity in tax strategy has never been more critical. As they prepare for potential mergers, understanding the implications of these tax changes will be vital for ensuring successful outcomes in an increasingly complex regulatory environment [76cd9eed]. Broad support from organizations like the U.S. Chamber of Commerce underscores the need for Congress to act swiftly to aid small businesses [fd407c17].