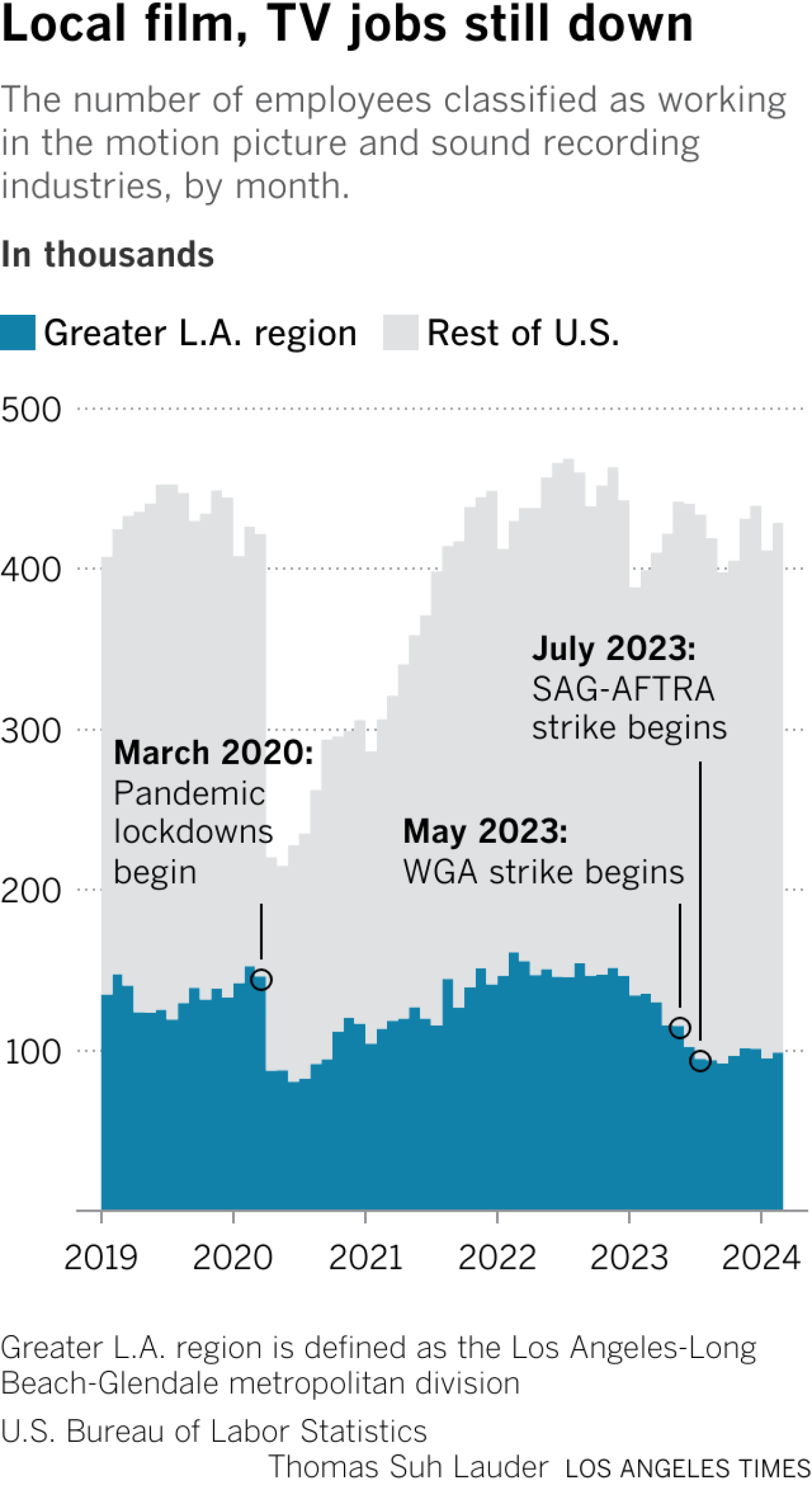

Hollywood is currently grappling with significant job losses, with employment in Los Angeles County's motion picture and sound recording industries dropping to about 100,000, which is 20% less than pre-pandemic levels. This decline is part of a broader economic disruption affecting the entertainment sector, as studios cut back on spending and shift production to cheaper locations. The average weekly earnings for employees in these industries were reported at $2,600 last year, reflecting the ongoing challenges faced by workers in this field. [d13dc15b]

In the past decade, California's share of U.S. employment in motion pictures has decreased from nearly 40% to less than 30%. This decline coincides with a global decrease in film and TV production, which fell by 7% in the first quarter of 2024 compared to the same period in 2023. The rise of streaming services has further diminished theater attendance, leading to concerns about the long-term viability of traditional feature films. Experts note that the industry is experiencing a crisis reminiscent of the 1950s, with significant competition emerging from international markets, particularly South Korea and India. [d13dc15b]

In addition to these challenges, the recent wildfires in Los Angeles have been described as the worst natural disaster in the region's history, further exacerbating the situation. Over 10,000 buildings were destroyed or affected by the fires, leading to over 40,000 applications for assistance. In response, British film studios are preparing to assist Hollywood, with experts and studio executives planning to address issues such as the exit of tradespeople, rising labor and insurance costs, and the displacement of talent. [0a34e77a]

Hollywood figures are increasingly looking to the UK for future productions, with significant investments expected to be redirected there. Notably, Pinewood Studios is undergoing an £800 million expansion, which is projected to create 8,000 jobs. The UK film industry generated approximately £20.49 billion in revenue in 2021, highlighting its robust position in the global market. This collaboration between US and UK studios is seen as a potential lifeline for Hollywood's recovery as it navigates these unprecedented challenges. [0a34e77a]

The high cost of living in Los Angeles is also driving workers away, despite the unique creative infrastructure that remains unmatched in the region. As the audience continues to shift towards streaming platforms, the traditional Hollywood model faces increasing pressure to adapt. This combination of factors has led to a precarious situation for many in the industry, prompting calls for a reevaluation of strategies to sustain employment and production in the face of changing consumer behaviors. [d13dc15b]