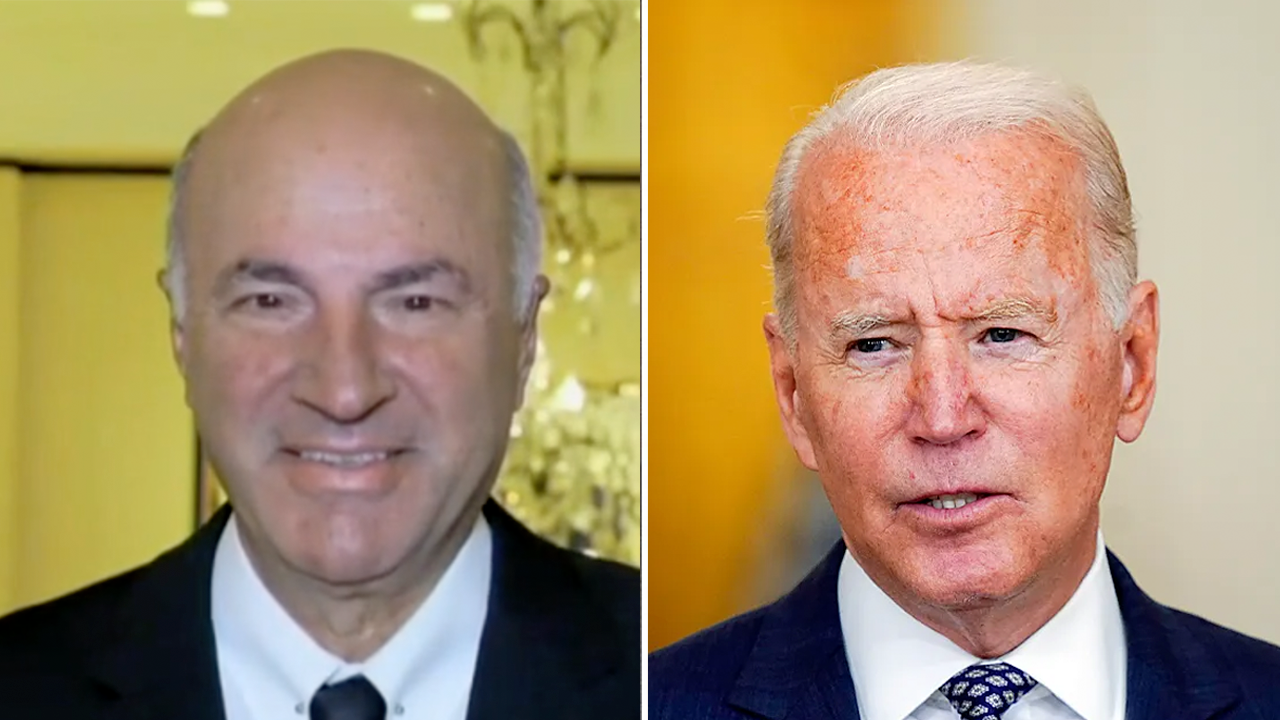

Kevin O'Leary, host of 'Shark Tank', has joined the chorus of critics of the Biden administration's decision to cancel student loans for 160,000 borrowers, amounting to $7.7 billion. O'Leary called the move unfair and un-American, arguing that borrowing money should come with the responsibility to pay it back. He expressed concern that taxpayers are being forced to foot the bill for well-off college graduates while others have worked hard to pay off their loans. O'Leary also warned that the student loan handouts could contribute to inflation. The Biden administration has taken several actions to clear student debt, including erasing $7.7 billion in federal student loans, increasing the maximum Pell Grant, and finalizing new rules to protect borrowers. However, O'Leary cautioned that the latest round of handouts may not work politically and could make independent voters unhappy [f8f6ee6c] [6698d358].

Peter Schiff, a conservative economist, has criticized President Joe Biden for forgiving $1.2 billion in student loans, accusing him of 'buying votes' ahead of the upcoming presidential election. Schiff argues that the money not used to repay loans is staying in Americans' wallets and fueling inflation by bidding up prices. He believes that everyone in America will ultimately pay higher prices as a result of this policy [6698d358].

Schiff's criticism of President Biden's student debt cancellation is part of his broader concern about inflation. He has previously criticized former President Donald Trump's belief that increasing oil drilling is the solution to U.S. inflation, arguing that Trump failed to address government spending during his first term, which is a crucial factor in controlling inflation. Schiff also criticizes the Federal Reserve for not doing enough to cool inflation and advises investors to buy gold [5e1befcf] [6698d358].

Economists have differing views on the inflationary effects of student debt cancellation. The Levy Economics Institute suggests that the inflationary effects would be 'macroeconomically insignificant,' while the Committee for a Responsible Federal Budget estimates an increase of 10 to 50 basis points in the first year. It remains a topic of debate among experts [6698d358].

President Joe Biden is facing criticism from Republicans for vowing to cancel student loan debt ahead of the upcoming election. The Biden administration plans to forgive up to $20,000 in debt for some borrowers, which economists warn could be disastrous for the US economy. The plan is estimated to impact 30 million borrowers when combined with previous efforts to cancel $146 billion for four million borrowers. Republicans accuse Biden of bribing young voters and ignoring the Supreme Court's rejection of the plan last year. Economists argue that the president's economic policies have been disastrous for young voters, particularly in terms of their ability to buy a home. Republican Congressman Dan Crenshaw suggests that Biden is trying to deceive voters with promises he can't deliver on [039a0194].

Critics of President Biden's student debt cancellation scheme argue that it will have long-term consequences for America. Mayor Melvin Carter of St. Paul had his student debt canceled, which was paid for by U.S. taxpayers. This confirms that student debt cancellation worsens income inequality. The scheme also adds to the national debt, which is fiscally reckless. Loan debt forgiveness is likely to lead to higher tuition costs and create perverse incentives for future borrowers. Biden's student loan forgiveness scheme has been challenged by the Supreme Court, but he continues to push forward. The scheme demonstrates a disregard for the Constitution and the limits of his authority. The system of legalized plunder, as seen in Biden's scheme, rewards favored constituencies at the expense of the general fund. Critics suggest that the scheme may serve as a reminder of the importance of fiscal restraint and limited government [c2322ac0].

In a recent development, an appeals court has approved an injunction that stops President Joe Biden from implementing his latest student loan forgiveness plan. The plan, introduced in April, aimed to exempt additional income from payment calculations and decrease the maximum percentage of discretionary income used to calculate monthly payments. The 10-year cost of the rule was estimated at $475 billion. The U.S. Supreme Court had previously struck down another effort to forgive student loans. Judge John A. Ross of the U.S. District Court Eastern Missouri Division had issued a stay on parts of the rule last month. The ruling covers the entire rule. Attorneys general from seven states filed the lawsuit against the plan. The U.S. Department of Education has not yet responded to the ruling [7a9b5436].

Gordon College, a Christian school in Wenham, Massachusetts, may have to repay over $7 million of COVID-19 relief funds after its request for loan forgiveness was denied. The college argued that the denial was due to religious discrimination, but a federal judge ruled that the school had no evidence to support its claims. The college had applied for the Paycheck Protection Program (PPP) loan in April 2020 to help with the financial impact of the pandemic. The loan was based on the number of employees, and organizations with less than 500 employees were eligible for loan forgiveness. However, Gordon College initially counted its employees based on units of time worked, which resulted in a count of 496 employees. Later, the Small Business Administration (SBA) clarified that the count should be based on a head count, including both full-time and part-time employees equally. By this definition, Gordon College had 639 employees and was no longer eligible for loan forgiveness. The college claimed that it was unaware of the SBA rule until November 2021. The college filed a lawsuit against the SBA in March 2023, alleging religious discrimination. The lawsuit mentioned that 25 other schools had their loans forgiven despite counting employees the same way as Gordon College. However, the judge dismissed the college's claims, stating that there was no evidence linking the employee count to religious practices. The college can appeal the decision or continue the case on other grounds. [fe4e6a29]