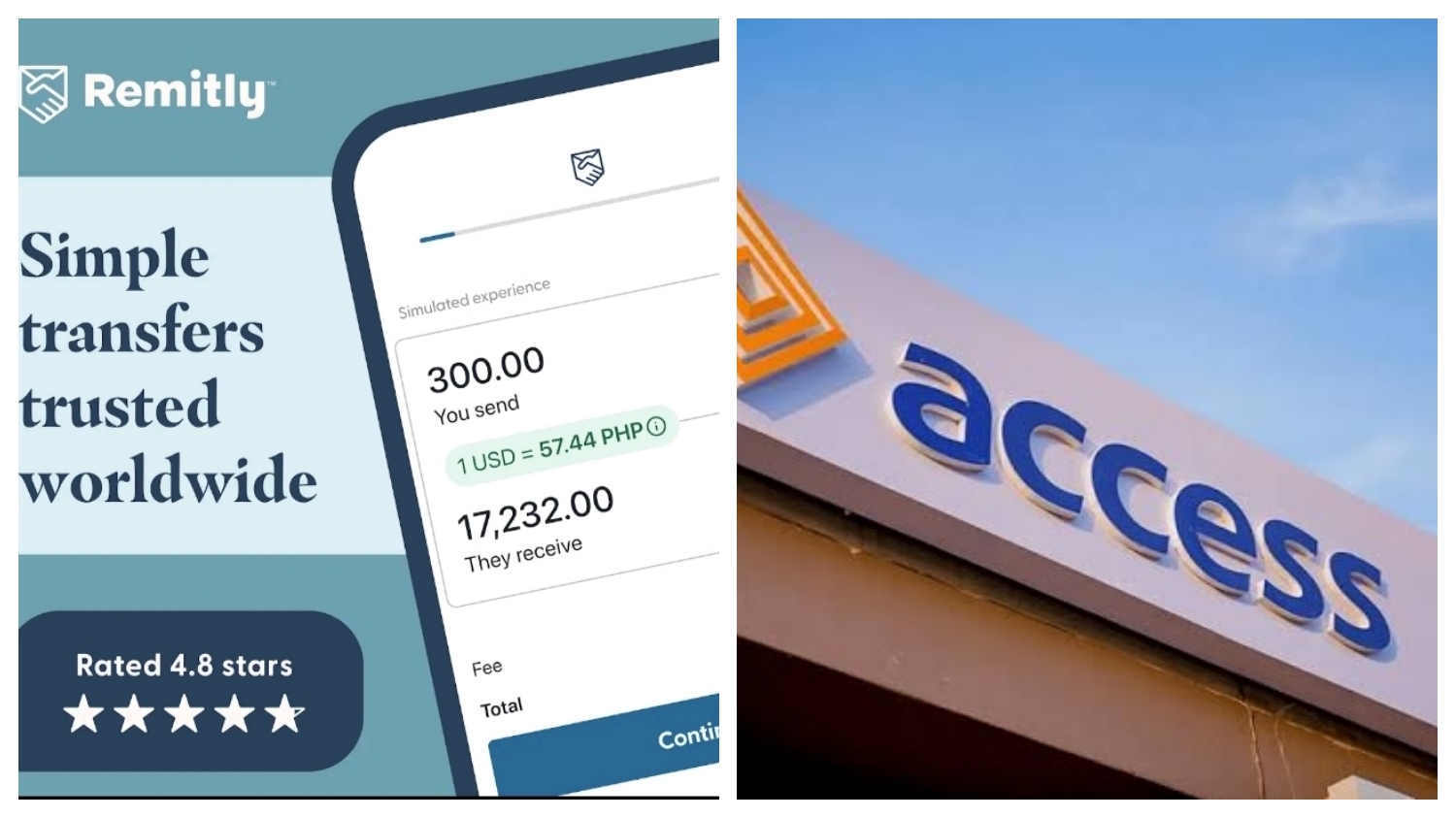

In a frustrating incident, a Lagos-based lawyer has been waiting for N300,771 that was sent to his Access Bank account via Remitly since June 6. Despite his efforts to resolve the issue by providing bank statements and contacting both Remitly and Access Bank, the money remains missing. Access Bank has acknowledged the complaint and stated that its team is working on resolving the issue. On the other hand, Remitly has informed the lawyer that they cannot provide information directly to someone not associated with the account. The lawyer and his brother have been in contact with both companies but have not received a resolution or a refund [9941f078].

This incident highlights the challenges that can arise in the process of remitting money, particularly when using digital platforms. It also underscores the importance of effective communication and prompt resolution of customer complaints in the financial services sector. As technology continues to play a significant role in money remittance services, service providers must ensure that they have robust systems in place to address any issues that may arise and provide timely assistance to their customers. In this case, the lawyer's experience serves as a reminder for individuals to exercise caution and be aware of the potential risks involved when using digital remittance platforms [9941f078].

Despite incidents like this, Remitly Global has received a bullish outlook from Pernas Research, an investment research firm. Pernas Research believes that Remitly Global is well-positioned to dominate the digital remittance market due to its superior platform and the global shift from cash to digital. They predict that Remitly can double its market share in 3-5 years. This positive outlook aligns with the growing demand for efficient and secure money remittance services. With the global shift away from cash, Remitly Global has the potential to significantly expand its market share and contribute to the growth of the digital remittance industry [de171296].

In addition to Remitly's efforts to enhance its business, the company is seeking the patronage of Nigerians living in the U.S. Mohammed Mardah, the director of Remitly, has emphasized the company's commitment to supporting cultural events organized by Nigerian associations and urged for stronger partnerships with Nigerian community associations. Remitly operates as an online remittance service providing international money transfers to over 159 countries, including Nigeria. Mardah stressed the importance of partnership and collaboration with the Nigerian community in the U.S. and noted the company's foundation on community support and reinvesting in African communities across the diaspora [01e5e203].

The incident involving the Lagos lawyer's missing remittance highlights the need for continued improvement in the efficiency and reliability of digital remittance services. Service providers must prioritize customer satisfaction and promptly address any issues that may arise. As technology continues to evolve, it is crucial for companies like Remitly to ensure that their systems are secure and their customer support is responsive. This incident serves as a reminder for individuals to exercise caution and be vigilant when using digital remittance platforms, and to seek resolution for any problems encountered [9941f078].

Filipinos, who have been sending remittances through personal bank-to-bank deposits and online money transfers, are also adapting to evolving methods of sending remittances. While many Filipinos still rely on traditional methods, they are slowly embracing digital methods. Wilma O'Brien, who has been sending remittances to her family in the Philippines since the 1990s, now prefers online money transfers for their convenience and speed. However, she believes that older recipients may have difficulty with technology and internet access. O'Brien is not interested in learning about or investing in cryptocurrency due to concerns about scams. This highlights the need for education and support to ensure that individuals of all ages can adapt to digital remittance methods [8bc4347c].

The combination of technology and innovative solutions offered by Remitly Global and other companies demonstrates the transformative power of technology in the financial services sector. As organizations leverage technology to enhance corporate governance and facilitate efficient money remittance services, they are able to drive economic growth, improve financial inclusion, and meet the evolving needs of consumers in a digital world [de171296].