As of February 5, 2025, the U.S. economy is navigating a complex landscape marked by both positive manufacturing growth and challenges in the services sector. The U.S. manufacturing sector expanded in January 2025 after 26 months of contraction, with the ISM manufacturing gauge rising to 50.9, indicating growth from December's 49.2. Similarly, the S&P Global PMI increased to 51.2 from 49.4, reflecting a broader trend of recovery. New orders surged to 55.1, marking the strongest performance since May 2022, while the production gauge climbed to 52.5, the best result since March. Optimism about the production outlook reached a 34-month high, and manufacturers increased staffing levels for the third consecutive month, reflecting growing confidence among factory managers despite ongoing threats from tariffs and a strengthening U.S. dollar. The manufacturing sector accounts for 10.3% of the economy, highlighting its significance. [f764f858]

However, the Services PMI® for January registered at 52.8%, missing analysts' expectations. Despite all four subindexes—Business Activity, New Orders, Employment, and Supplier Deliveries—remaining in expansion territory, the PMI reading is the lowest for January since 2010. The Business Activity Index fell to 54.5%, and the New Orders Index was at 51.3%. The Employment Index rose to 52.3%, supported by ADP's report of 183,000 jobs added in January. Notably, 14 of 18 services industries reported growth, up from nine in December. [adc8ca1a]

In the Mid-America region, the Creighton University Mid-America Business Conditions Index rose to 51.1 in January 2025 from 48.7 in December 2024, indicating a positive shift in economic conditions. The employment index improved to 51.1 from 46.4, suggesting job gains for manufacturers following a loss of 93,000 jobs nationally in 2024. Additionally, the Business Confidence Index soared to 61.4 from 52.8, reflecting increased optimism among supply managers, despite over 70% expressing concerns about President Trump's tariffs. [4d10e591]

President Trump has announced a 25% tariff on imports from Canada and Mexico, alongside a proposed 10% tariff on Chinese imports starting February 1, 2025. Although the tariffs on Mexico and Canada have been paused, the 10% tariff on China remains in effect. These tariffs could pose risks to economic growth, potentially offsetting the gains made in other areas. Following the tariff announcement, stocks declined, and the dollar strengthened, indicating market reactions to the potential for increased trade barriers. [f662445c]

The January price gauge rose to 62.0, indicating inflationary pressures, while the inventory index rose to 52.8. The export index fell to 41.7, contrasting sharply with the import index, which reached a record high of 67.5. This suggests that while domestic manufacturing is improving, the fear of tariffs has driven imports to unprecedented levels. [4d10e591]

The Core Consumer Price Index (CPI) report for December indicates ongoing disinflation, which may provide some relief from inflationary pressures. The significant gain in the 1-to-10 year U.S. Treasury spread, now at 1402.6%, suggests that investors are adjusting their expectations in response to these economic developments. [3908ec9f]

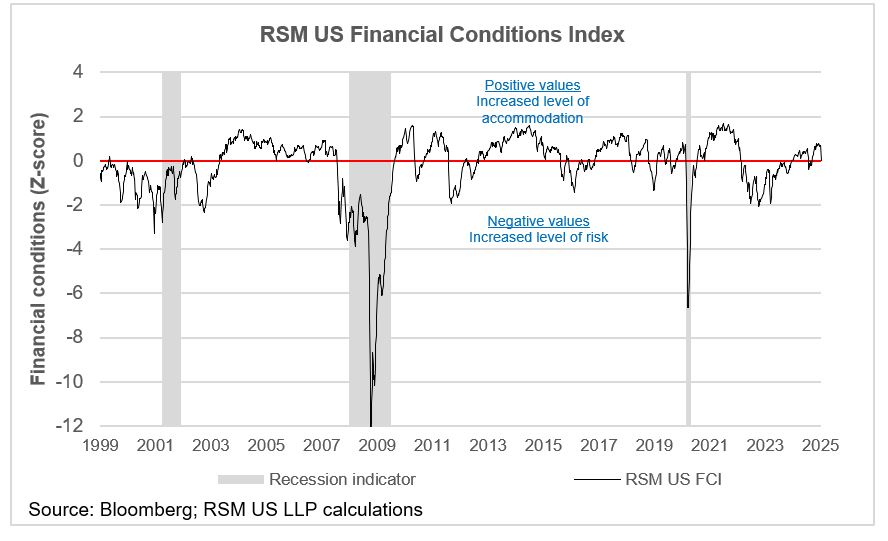

In the broader context of financial conditions, the RSM US Financial Conditions Index, as of January 16, 2025, indicates supportive growth conditions, although recent market volatility has led to a decline in major stock indices. The Federal Reserve held rates steady at 4.25%-4.5% on January 29, 2025, complicating monetary policy decisions amid high real borrowing costs. [25b8e57c]

The interplay between improving economic indicators, particularly in manufacturing, and the mixed signals from the services sector will be crucial in shaping the U.S. economic outlook. While the tightening of financial conditions has raised concerns about credit availability and lending volumes, the recent positive trends in employment and business sentiment may provide a buffer against potential economic disruptions. [3908ec9f]