The U.S. banking landscape is facing significant challenges as a wave of bank closures coincides with increasing risks of bank failures. Recent reports indicate that over 110 bank branches are set to shut down from Thanksgiving 2024 to January 2025, affecting major institutions like Wells Fargo, U.S. Bank, Bank of America, and Chase. This trend is part of a broader pattern, with S&P Global reporting 439 bank closures in the third quarter of 2024 alone, marking the highest number since early 2022. In total, 944 closures have occurred from January to September 2024, highlighting a growing consolidation in the banking sector. [8fbc02e1]

Simultaneously, the financial health of many banks is under scrutiny. A recent analysis revealed that 282 out of 4,000 U.S. banks are facing risks primarily due to exposure to commercial real estate and the pressures of higher interest rates. The situation is particularly dire for hundreds of small and regional banks, which are experiencing significant stress. Notable recent collapses, such as Silicon Valley Bank, Signature Bank, and Credit Suisse, have raised alarms about the stability of the banking system. [41ff3935]

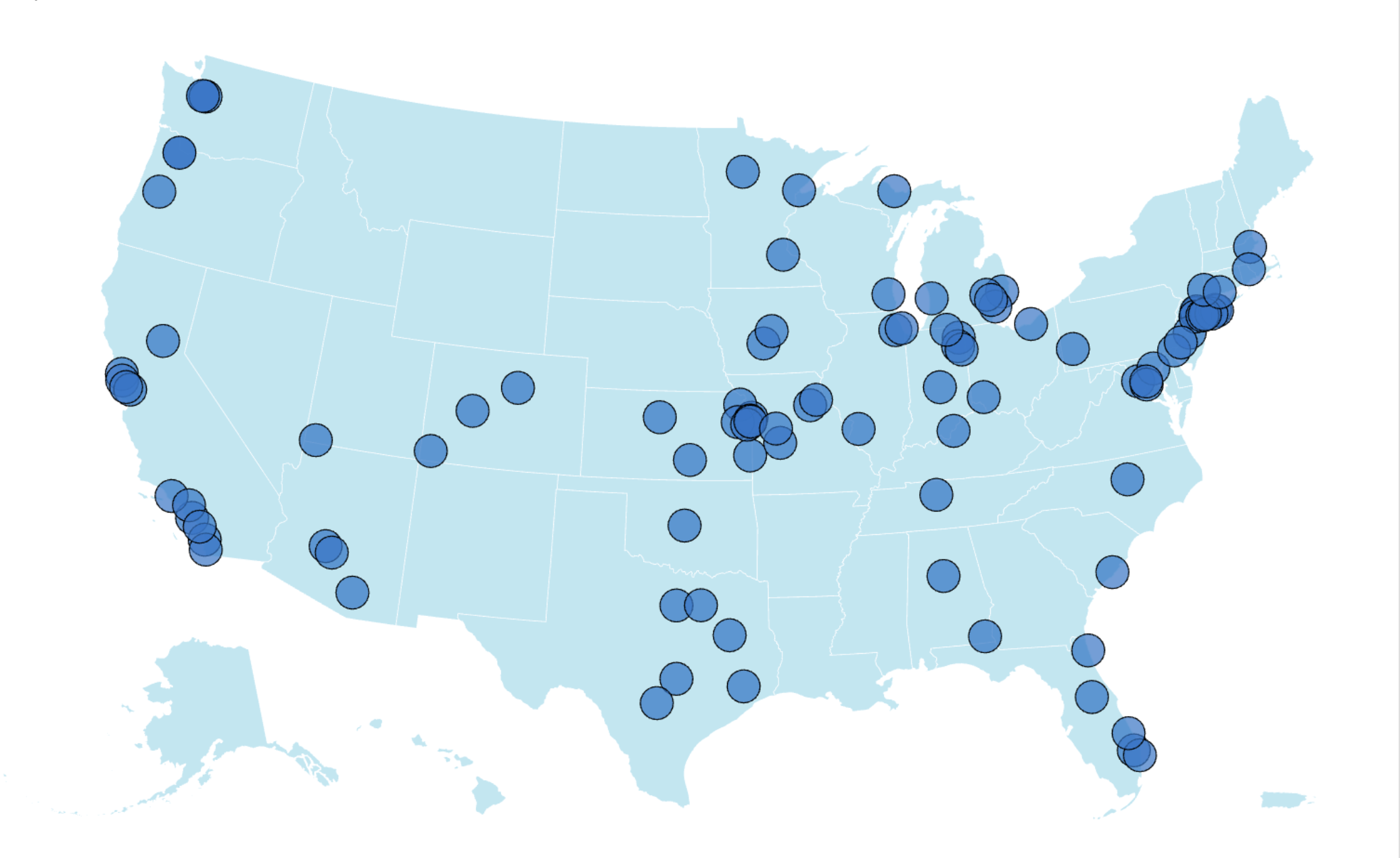

The trend of bank closures has raised concerns about the emergence of banking deserts, impacting approximately 760,000 Americans. States like Pennsylvania and New Jersey have seen significant losses, with 439 and 342 branches closed respectively from 2019 to 2023. As traditional branches diminish, reliance on mobile banking has surged, with a recent Morning Consult survey revealing that 55% of customers now prefer mobile banking, while only 8% visit physical branches. [8fbc02e1]

Despite the reduction in the number of banks, community banks remain vital to local economies. Christopher Maher, CEO of OceanFirst Financial, emphasizes their role in providing personalized services and understanding the unique needs of their communities. These banks often cater to small businesses and individuals who might not have access to larger financial institutions. [cd6d7471]

Consumer sentiment towards banks remains relatively positive, with a recent survey conducted by Morning Consult indicating that 85% of Americans with a bank account are either 'very satisfied' or 'satisfied' with their primary bank. Additionally, 94% rated their bank's customer service as 'excellent', 'very good', or 'good'. This survey, commissioned by the American Bankers Association, highlights the trust consumers place in banks, with 86% believing that their banks will protect them from fraud. Rob Nichols, president of the ABA, emphasized the importance of consumer satisfaction and the role of banks in the economy. [24b09ee0]

Looking ahead, the future of banking is expected to be shaped by innovations in digital services, which could further influence consumer choices and the overall structure of the banking system. As the industry evolves, supporting community banks will be crucial for maintaining a diverse and resilient financial ecosystem. [cd6d7471]