In Pennsylvania, a crucial swing state for upcoming elections, the impact of inflation is severely affecting renters, forcing many to choose between paying rent and buying food. Recent reports indicate that rents have surged by 50% over the past three years, exacerbating the financial strain on families [5959c68a]. In Dauphin County, the eviction threat rate stands at a staggering 16%, highlighting the urgent housing crisis faced by many residents [5959c68a].

Sonia Perez, a retiree who lost her home to a fire, now struggles to manage her monthly rent of $275, illustrating the tough choices many are forced to make [5959c68a]. Similarly, Xzavia, a single mother, faced eviction after transitioning to part-time work. With assistance from Beahive Affordable Housing Outreach, she received $500 to help with her situation, but the challenges remain daunting [5959c68a].

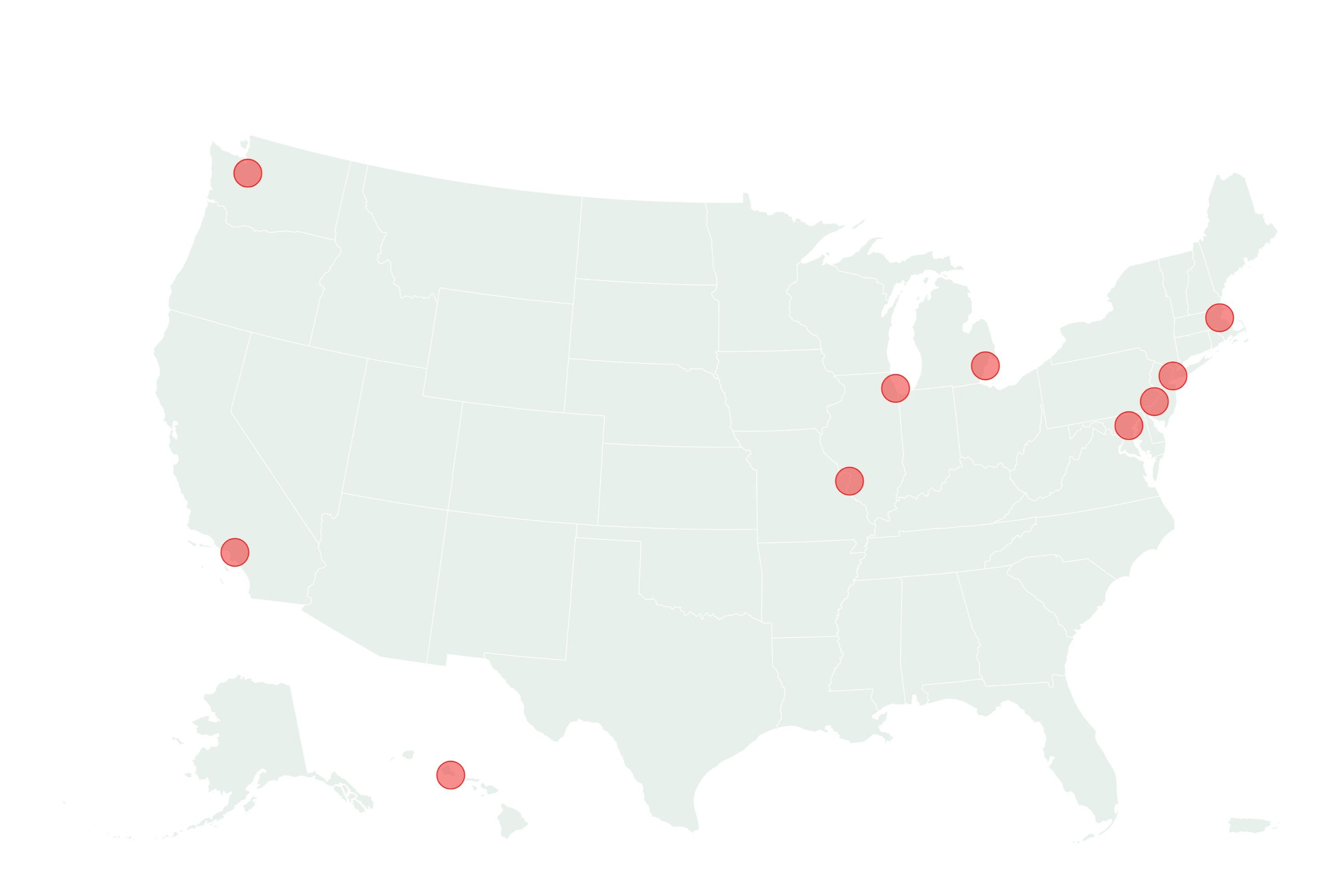

The broader context of inflation in the U.S. shows that areas like Urban Honolulu, HI, are experiencing the highest inflation rates at 96.51%, with significant increases in consumer prices across major cities [1ede8382]. This trend is part of a national pattern where 74% of Americans express concern about rising food prices and 69% about housing costs [2338915b].

In Pennsylvania, both Vice President Kamala Harris and former President Donald Trump have proposed differing housing policies, but immediate relief for struggling renters remains uncertain [5959c68a]. The COVID-19 pandemic has further complicated the situation, leading to job losses and increased rent, particularly affecting low-income households with children. Research indicates that 52% of these households faced food insufficiency during this period [c531c8cc].

To combat these challenges, the federal government allocated $46 billion in emergency rental assistance (ERA) from 2020 to 2022. Households receiving ERA reported lower rates of food insufficiency (46%) and being behind on rent (28%) compared to those waiting for assistance (49% and 63%, respectively) [c531c8cc]. Notably, single female-led households experienced an 8 percentage point reduction in child food insufficiency with ERA support [c531c8cc]. Despite these efforts, long-term economic sufficiency remains a challenge due to high housing costs, underscoring the urgent need for effective solutions [a57b6d77].