As we navigate through 2025, the global economic landscape is marked by significant transformations, particularly in the technology sector. Advanced Micro Devices, Inc. (NASDAQ: AMD) has emerged as a top investment choice, with financial analysts projecting a 2% GDP growth for the U.S. economy this year. This growth is attributed to easing global policies and increased capital investments, which are seen as key drivers for companies like AMD [932bb73f].

AMD reported impressive financial results, with $6.8 billion in revenue and a 50% gross margin in Q3 2024. The company is recognized for its innovative collaborations, especially with Fujitsu in artificial intelligence, positioning itself favorably against competitors like Intel and Nvidia. Despite the market's volatility, AMD's strong financial performance and strategic initiatives are expected to bolster its growth prospects [932bb73f].

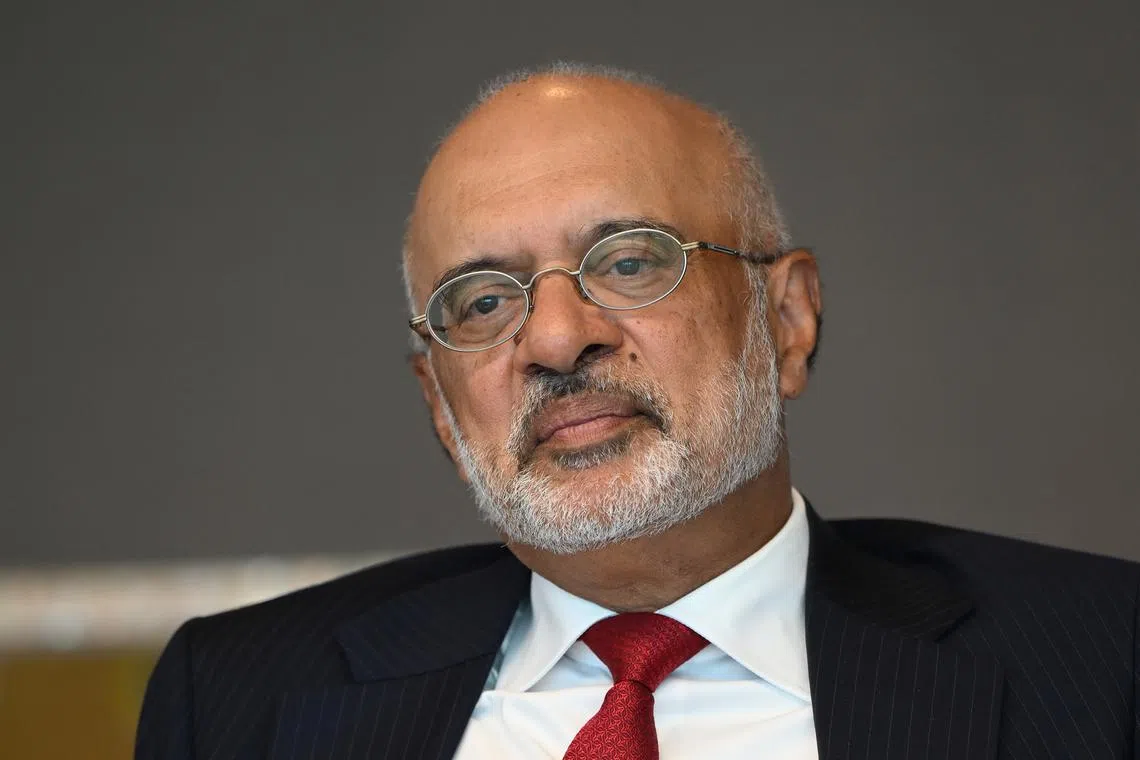

In the broader economic context, Piyush Gupta, CEO of DBS, has highlighted the U.S. as a potential growth engine, supported by robust retail sales and job creation. However, he also cautions about rising consumer loan delinquencies and high household debt, which could pose challenges to sustained economic growth [fb681d99]. Inflation is anticipated to slow to around 2% by late 2025, with potential interest rate cuts from the Federal Reserve, which could further influence market conditions and investor sentiment [932bb73f].

Ruchir Sharma has noted a significant shift in the global economic landscape, with the U.S. economy now constituting less than 30% of the global economy. Despite this, the American stock market has shown resilience, outperforming by an average of 6.6% per year over the past 15 years, fostering a TINA (there is no alternative) mindset among investors [eb79f39e].

In contrast, India is ramping up capital expenditure on infrastructure, which is expected to contribute to its growth, albeit at a slower rate of 6-6.5% for FY 2025. Martin Wolf has emphasized the need for significant reforms to achieve higher growth rates, while Gupta projects that the U.S. will continue to benefit India through strong economic ties [fb681d99][d88857a0].

The semiconductor industry, where AMD plays a crucial role, is pivotal for both economic and technological advancement. As the demand for advanced computing and AI technologies grows, AMD's strategic positioning in this sector is critical. Villamin from UBP has identified 'connector economies' in Asia, particularly India and Singapore, as key investment opportunities, reflecting a cautious yet optimistic outlook on global equities [c4cd9243].

As the year progresses, investors are encouraged to remain vigilant and informed about these global economic shifts. The interconnectedness of these economies means that developments in one region can significantly influence others. AMD's focus on innovation and strategic partnerships, combined with favorable economic conditions, positions it well for future growth in 2025 and beyond [932bb73f].