The US economy is facing a puzzling situation as there is a divergence in the data, making it unclear whether the economy is contracting or accelerating. NDR's Kalish highlights this discrepancy between state and national data, with state-level unemployment data suggesting an economic downturn [d190a989] [ee8844f5]. This conflicting information adds to the duality of the current US economy state, with positive data indicating growth and the risk of a recession looming [45dca20d] [ee8844f5].

The Federal Reserve is closely monitoring the situation, as positive economic data increases the chances of the central bank tightening its monetary policy, but also raises the risk of a recession [45dca20d]. The Fed's quantitative tightening program and climbing US Treasury bond yields are causing concerns for the central bank and the government [45dca20d].

Recent PMI data showed a slight expansion in US manufacturing and services [45dca20d]. However, this contrasts with the puzzling divergence in the state and national data, which makes it difficult to determine the overall trajectory of the US economy [d190a989].

In addition to the conflicting economic data, gold prices have surged due to the Middle East crisis, indicating a flight to safety by investors [45dca20d]. Major technology companies have reported mixed financial results, further adding to the uncertainty in the economic landscape [45dca20d].

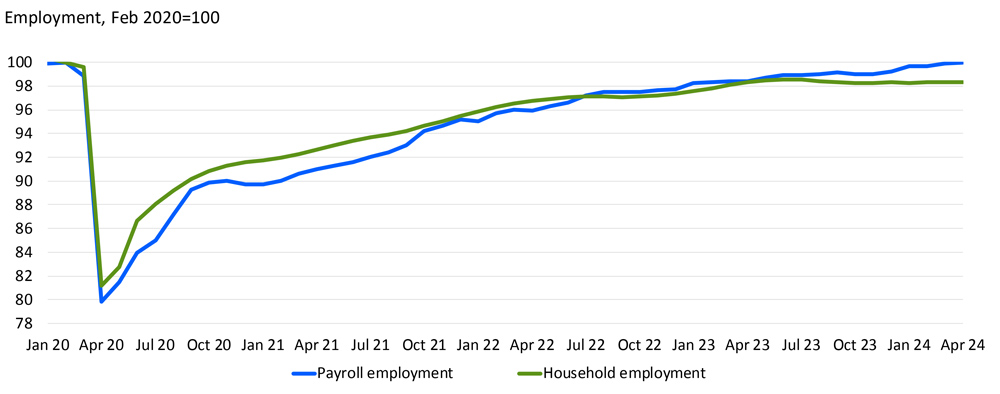

Financial Sense Wealth Management's CIO, Chris Puplava, discusses the widening gap between the US government's portrayal of a robust economy and the concerning state-level unemployment data [ee8844f5]. Indicators such as rising state-level unemployment, temporary help layoffs, and other factors suggest an economic downturn [ee8844f5]. The charts provided show the growing divergence between household and nonfarm payroll data, a drop in fully employed individuals, and a drop in temporary employment [ee8844f5]. The article also mentions the S&P 500 Breadth, Russell 2000 Breadth, and Russell 3000 Breadth as additional indicators [ee8844f5]. The author raises concerns about the state of the economy and the potential for a recession [ee8844f5].

The upcoming week will see significant macroeconomic data releases and central bank meetings, which will provide further insights into the state of the US economy [45dca20d] [d190a989].

A new study by Andrew Fieldhouse and David Munro, along with other researchers, examines the recoveries of US states from economic shocks. The study utilizes a newly developed dataset that shows economic recoveries have become more uniform across states. The researchers find that the migration response to bad shocks has disappeared in recent decades, with employment and unemployment still responding to shocks but without the outmigration that was observed in earlier postwar decades. The study also reveals that states' economies have become more similar over time, with convergence in industrial composition and income per capita. The findings have implications for macroeconomic stabilization policy at the federal level and suggest that regionally targeted policies may need to be reconsidered. The study also highlights the importance of understanding the nature of shocks, as different types of shocks can lead to different recovery patterns. [eaac5e9b]

According to Fitch Ratings' latest media metrics report, economic growth remains solid for US state governments overall, although initial data point to weaker medians in the coming months. The medians for 33 states with fiscal 2023 annual comprehensive financial reports (ACFR) reviewed by Fitch are either stabilizing or show some signs of modest weakening. State budgetary results from fiscal 2023 and mid-year fiscal 2024 indicate that revenue growth is slowing and, in some cases, even declining. Slower macro-economic growth and tax policy changes will continue to be a primary catalyst for credit conditions. Very high ratings reflect Fitch's view that states will continue to act prudently in managing a more challenging budget environment as they prepare for the next inevitable downturn [2e34553a].

Moody's Analytics presented economic forecasts for New York state and the U.S. at the Spring Economic Conference held by the NYISO. The forecasts indicate that while the economy is recovering, 'scars remain' [b32fb2aa]. The study also highlights the importance of understanding the nature of shocks, as different types of shocks can lead to different recovery patterns [eaac5e9b].

The Federal Reserve is closely monitoring the jobs report for indications of weakness [298ce18f]. The report plays a crucial role in shaping the Federal Reserve's monetary policy decisions [298ce18f]. The central bank is analyzing the report to assess the health of the economy and determine whether any adjustments to monetary policy are necessary [298ce18f]. The jobs report is an important economic indicator that provides insights into the labor market and overall economic conditions [298ce18f]. The Federal Reserve's focus on the jobs report reflects its mandate to promote maximum employment and stable prices [298ce18f].

The US economy is at a critical juncture, with conflicting data and concerns of a recession. The divergence in state and national data, along with mixed financial results from major technology companies, adds to the uncertainty. The Federal Reserve's monitoring of the situation and the upcoming macroeconomic data releases and central bank meetings will provide further insights into the state of the US economy. Additionally, a new study highlights the uniformity of economic recoveries across US states and the implications for macroeconomic stabilization policy. Fitch Ratings' report indicates solid economic growth for US state governments overall, but with signs of modest weakening in some areas. Moody's Analytics presents economic forecasts that indicate ongoing recovery with remaining challenges. The Federal Reserve's focus on the jobs report underscores its role in shaping monetary policy decisions and assessing the health of the economy [298ce18f].