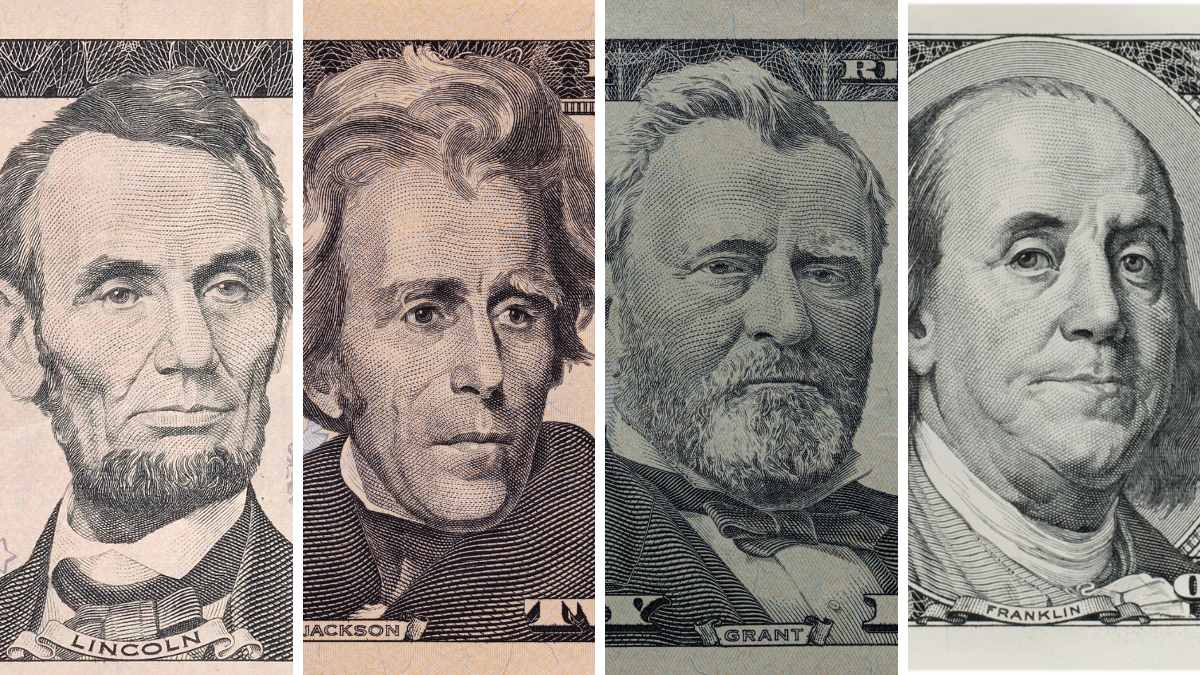

As the United States transitions towards a cashless economy, significant changes are on the horizon for its currency. The U.S. government has confirmed the official issuance of newly designed $5, $20, $50, and $100 bills, set to begin in October 2025. This redesign aims to enhance security features and prevent counterfeiting, reflecting the government's ongoing efforts to modernize its currency [860bbbfc].

Recent data indicates that 41% of Americans no longer use cash for most purchases, a notable increase from 24% in 2015. Conversely, only 14% of Americans now rely on cash for nearly all transactions, down from 24% in the same timeframe. This trend is particularly pronounced among older adults, with 71% of those over 50 still carrying cash, compared to only 45% of those under 50 [48df2785].

The decision to redesign the $100 bill, featuring Benjamin Franklin, is part of a broader initiative to phase out old bills that will no longer be accepted in transactions. Damaged bills will also face circulation restrictions, prompting citizens to check the condition of their currency before making transactions [860bbbfc]. Harvard economist Kenneth Rogoff has long advocated for the elimination of large denomination notes, arguing that doing so could help reduce unlawful actions and enhance monetary policy control [9279ac90].

The $100 bill may soon be removed from circulation as part of crime-fighting strategies and the rise of digital payments. Over 60% of transactions in the U.S. are now electronic, which raises concerns about the relevance of high-denomination notes in a digitizing economy [a5dc9fa5]. Counterfeiting issues, including sophisticated 'supernotes', further undermine trust in the financial system, prompting discussions about the necessity of maintaining such bills [a5dc9fa5].

The ongoing discussions about the future of cash have been further fueled by the U.S. Mint's continued production of pennies. Despite the fact that minting a penny costs three cents, the Mint has an estimated 240 billion pennies that are not in circulation. This raises questions about the practicality of maintaining such low-value coins in a rapidly digitizing economy [48df2785].

In light of these changes, the Biden administration has been exploring the potential for a central bank digital currency (CBDC) since 2022. However, progress has been slow, with security concerns surrounding digital currency remaining a significant hurdle. The need for robust security measures is critical as the U.S. considers the implications of a cashless society [48df2785]. The Bahamas launched the first CBDC in 2020, and countries like China, Japan, and Sweden are currently testing their own digital currencies, highlighting the global shift towards digital money [48df2785].

Despite the decline in cash transactions, cash remains essential for certain demographics. For instance, 30% of households earning below $30,000 still rely on cash for most purchases, highlighting the importance of physical currency for lower-income individuals [48df2785]. This demographic reliance on cash underscores the need for a balanced approach as the U.S. moves towards digital alternatives.

The Federal Reserve has allocated substantial funds for printing new bills, amounting to $931.4 million in 2023, amidst debates on the efficiency of transitioning to digital currency and the potential elimination of small-value coins [48df2785]. The TSA reported that Americans left nearly $1 million in coins at airport security checkpoints in 2023, indicating that while cash usage is declining, it is still a part of everyday life for many [48df2785].

As the U.S. grapples with the implications of a cashless economy and the upcoming issuance of new dollar bills, the balance between innovation and tradition will be crucial. The ongoing discussions about the future of currency, including the potential for a CBDC, reflect the complexities of modern financial systems and the diverse needs of American consumers [48df2785][9279ac90][860bbbfc][a5dc9fa5].