Connective Portfolio Management LLC, an investment firm, has reduced its holdings in Amazon.com, Inc. (NASDAQ:AMZN) by 65.5% in the fourth quarter. The firm sold 4,700 shares, leaving them with 2,480 shares worth $377,000. This adjustment in their stake reflects the ongoing trend of investors adjusting their positions in Amazon.com. Other large investors, such as Mayflower Financial Advisors LLC, PayPay Securities Corp, Laurel Wealth Planning LLC, Sanctuary Wealth Management L.L.C., and Swaine & Leidel Wealth Services LLC, have also made changes to their stakes in the company [dd8e7bab].

Oak Family Advisors LLC, another investment firm, has increased its position in Amazon.com, Inc. by 196.6% during the fourth quarter. They now own 13,774 shares of the e-commerce giant's stock worth $2,093,000. This increase in position by Oak Family Advisors LLC further contributes to the evolving landscape of ownership in Amazon.com [642c46f2].

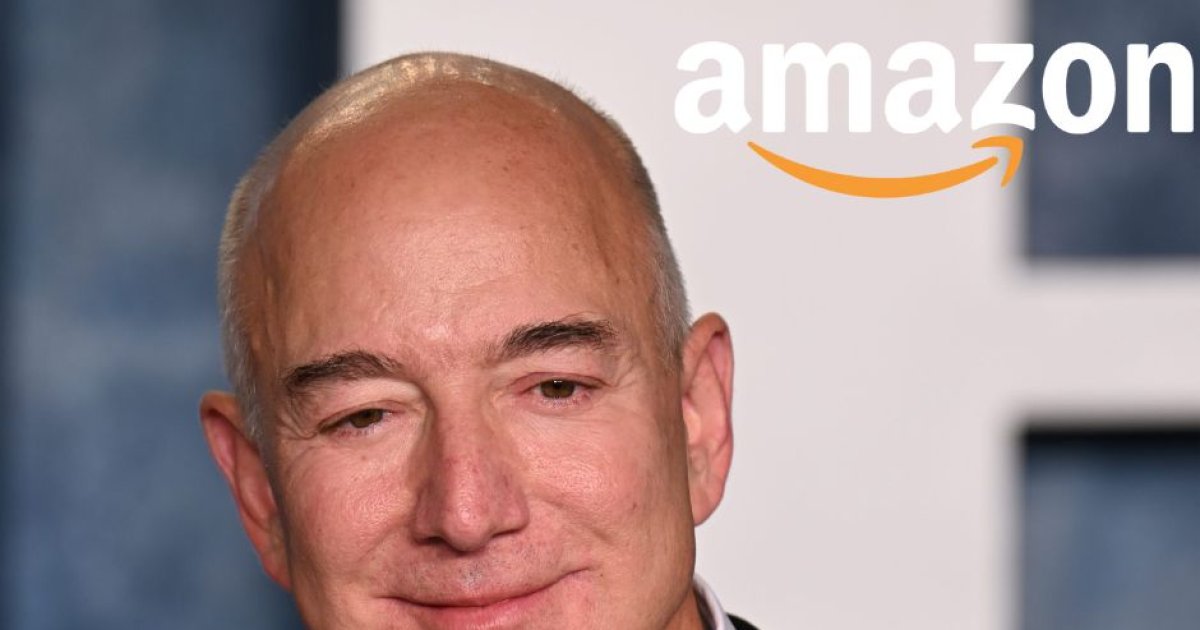

In addition to the changes made by Connective Portfolio Management LLC and Oak Family Advisors LLC, CEO Adam Selipsky sold 500 shares of Amazon.com stock on January 4th, and insider Jeffrey P. Bezos sold 5,998,849 shares on February 7th. These divestments by key figures within the company further contribute to the evolving landscape of ownership and wealth distribution in Amazon.com [dd8e7bab] [b9829f34].

SouthState Corp, an institutional investor, has reduced its holdings in Amazon.com, Inc. (NASDAQ:AMZN) by 0.6% in the fourth quarter, selling 954 shares and leaving it with 158,705 shares. The stake is valued at $24.11 million, making it SouthState Corp's 8th largest position. Other hedge funds and institutional investors have also bought and sold shares of Amazon.com [a5ac6601].

Amazon.com reported $1.00 earnings per share for the last quarter, beating analysts' estimates of $0.81. The company's quarterly revenue was $169.96 billion, up 13.9% from the previous year. Amazon.com has a market capitalization of $1.88 trillion and a price-to-earnings ratio of 62.31. The stock has a 52-week low of $97.71 and a 52-week high of $183.00. The company operates through three segments: North America, International, and Amazon Web Services (AWS). Analysts have given Amazon.com a 'buy' rating, with an average target price of $198.09 [dd8e7bab].

Cowen AND Company LLC, a hedge fund, has purchased 84,857 shares of AltC Acquisition Corp. (NYSE:ALCC) valued at approximately $896,000. This investment by Cowen AND Company LLC reflects the ongoing trend of hedge funds adding to or reducing their stakes in companies. AltC Acquisition Corp. does not have significant operations and intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other business combination with one or more businesses. The stock of AltC Acquisition Corp. is currently trading at $9.01 on the NYSE [d9677166].

Halpern Financial Inc. increased its position in Amazon.com, Inc. (NASDAQ:AMZN) by 5.3% in the first quarter, according to the company's 13F filing with the Securities & Exchange Commission. The institutional investor owned 16,810 shares of Amazon.com's stock after acquiring an additional 840 shares during the quarter. Other large investors have also recently modified their holdings of the company. Amazon.com currently has an average rating of 'Buy' and an average target price of $215.37. In related news, CEO Adam Selipsky sold 500 shares of the business's stock in a transaction dated April 4th. The shares were sold at an average price of $184.00, for a total value of $92,000.00. Following the sale, the CEO now directly owns 131,600 shares in the company, valued at approximately $24,214,400. Amazon.com's stock is currently trading at $189.08, with a 50-day moving average of $182.78 and a 200-day moving average of $171.37. The company has a market cap of $1.97 trillion and a P/E ratio of 52.96. Amazon.com reported $0.98 EPS for the quarter, beating analysts' consensus estimates of $0.83. The company's quarterly revenue was up 12.5% on a year-over-year basis. Amazon.com engages in the retail sale of consumer products and develops and produces media content. [dd8e7bab] [cbe41903]

Safeguard Financial LLC increased its stake in Amazon.com, Inc. (NASDAQ:AMZN) by 340.3% in the first quarter. They now own 9,220 shares of the company's stock worth $1,663,000. This increase in position by Safeguard Financial LLC further contributes to the evolving landscape of ownership in Amazon.com [354e77db].

Wall Street analysts have given Amazon.com a consensus rating of 'Buy' with an average target price of $215.37. The company reported $0.98 earnings per share for the quarter, beating the consensus estimate of $0.83. Insider transactions include the sale of shares by VP Shelley Reynolds and CEO Adam Selipsky. Amazon.com engages in the retail sale of consumer products and operates through three segments: North America, International, and Amazon Web Services (AWS) [354e77db].

Jeff Bezos, founder of Amazon, announced his intention to sell 25 million shares, worth almost $5 billion. This comes after Amazon's record-high stock price and positive first-quarter financial results. Bezos will still own about 912 million Amazon shares, or 8.8 percent of the outstanding stock. He is ranked the second-richest person in the world with a net worth of $214.4 billion. Bezos may be seeking to raise capital for his space venture Blue Origin, in which he has already invested between $10 billion to $20 billion. Bezos stepped down as Amazon CEO in July 2021 and was succeeded by Andy Jassy. [8c8f0399] [bea68aae]