The U.S. economy continues to display resilience and growth despite ongoing challenges such as labor disputes, inflation, and high interest rates. According to NRF Chief Economist Jack Kleinhenz, the economy's ability to withstand these challenges is a positive sign [5c2f877b] [35641ad4]. Labor disputes across the country and the uncertainty caused by Congress are adding to the challenges faced by the U.S. economy. However, it is still managing to grow, which is noteworthy considering the impact of inflation and high interest rates. The ability to withstand these challenges is a testament to the economy's strength and resilience.

Despite the decline in consumer confidence, spending continues to rise. The just-ended third quarter was largely on par with the second quarter, and there is potential for a 'soft landing' in 2023 instead of a recession. The tight labor market is cooling in a favorable way, with job growth weakening without causing a significant increase in the unemployment rate. Job openings have increased, hiring has slightly ticked up, and unemployment insurance claims remain low. These factors indicate the potential for continued growth in the U.S. economy [35641ad4].

Global deal-making activities show signs of improvement in Q3 2023, with a rebound in the United States being the major driving factor. Despite headwinds such as high-interest rates and increased antitrust scrutiny, buyers with substantial liquidity are pursuing sizable targets. Executives from major global deal-makers have noted early signs of thawing and improving sentiments in the M&A market. However, challenges remain, including high rates and a tougher regulatory environment. The sustainability of the recovery is yet to be determined [3c98220d].

Nick Ng, Investment Committee chair and Lead Portfolio manager at Liberty One Investment Management, shares a hopeful outlook on the economic front. Despite some indicators predicting a recession, Ng believes that the economy is resilient and points to positive factors such as new construction projects, companies returning to the US, and the support of the consumer. He acknowledges concerns about high unemployment and higher interest rates but provides explanations for these factors. Ng asserts that the long-term economic outlook remains bright, both in the US and globally, and highlights the potential of industries that don't exist today to dominate the future. He encourages investors to focus on the tremendous opportunities ahead. [0d61e061].

The US economy demonstrates resilience amidst economic turbulence, with strategic investments and diversification contributing to a more stable and sustainable landscape. Growth and job gains surpass expectations, and the Federal Reserve delays interest rate cuts to control inflation. Despite predictions of a recession in 2023, the economy grew by 3.3% with consumer spending seeing a 5% surge [e76dc451]. The ongoing economic crisis in Pakistan serves as a reminder of the importance of addressing economic instability and seeking sustainable solutions for long-term prosperity. Economist David Doyle predicts two interest rate cuts this year and no recession through 2025. State leaders are diversifying their economies to create a more stable and sustainable economic landscape. The US government's emphasis on optimism and strategic investments has contributed to the country's unexpected resilience. The Federal Reserve delays interest rate cuts until the second half of the year to prevent inflation. The unemployment rate is expected to remain steady at 3.7%. The crisis in Pakistan highlights the need for addressing economic instability and seeking sustainable solutions. The US economy's resilience serves as a beacon of hope for other countries facing economic turmoil [e76dc451].

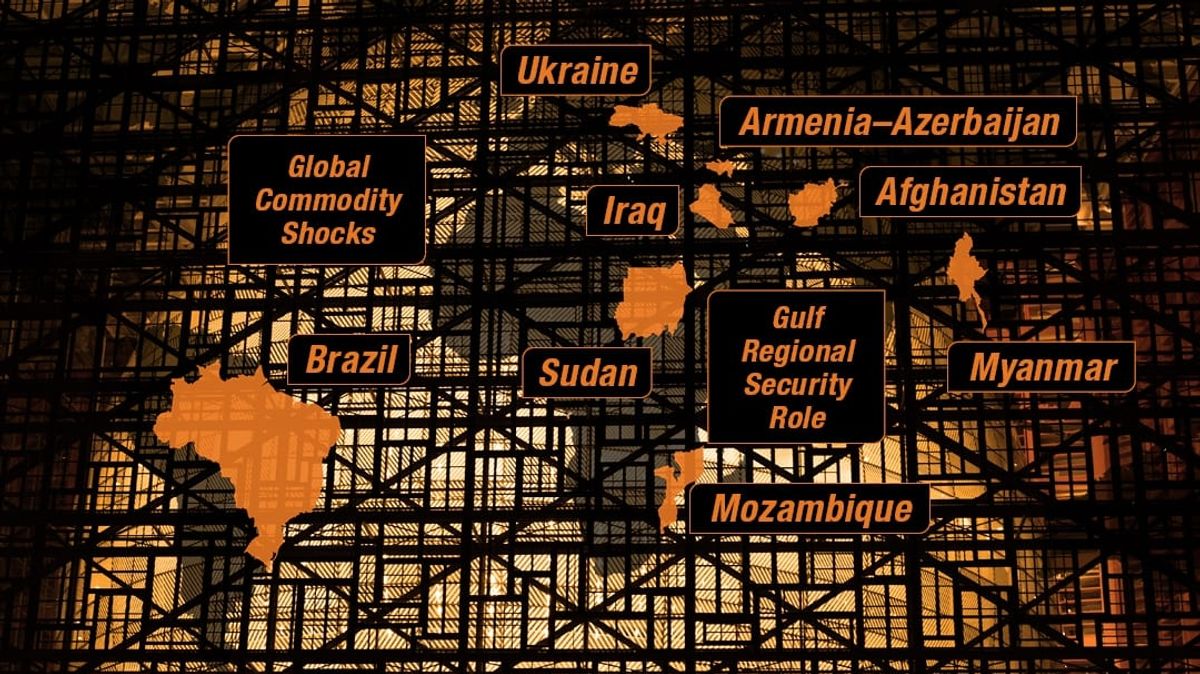

The US economy is growing faster than expected, with a strong GDP, soaring stocks, and a hot job market. It has outperformed the European Union, the United Kingdom, Japan, and other advanced economies. The article discusses how the US economy has overcome geopolitical tensions, the lingering effects of the pandemic, high inflation, and steep borrowing costs. Just last year, the US economy was at risk of recession. The reasons for its resilience are not explicitly mentioned in the article [90c56fa7].

The US economy continues to defy expectations and set the pace for global economic recovery. Despite challenges such as inflation, tariffs, and an uneven recovery, the US economy demonstrates resilience, surpassing global counterparts in GDP growth, job creation, and stock market performance. The US added 353,000 jobs in January, signaling the strength of the labor market. The Federal Reserve is considering interest rate cuts to stimulate the economy. Inflation is being managed more effectively than in other countries. The US dollar has emerged as a stable currency. Challenges include high food costs, the impact of tariffs on job creation, stress in the commercial real estate sector, and uneven distribution of economic gains [1de5be39].

The St. Louis Fed Financial Stress Index remains steady at -0.619 for the second week, indicating the resilience of the U.S. economy. Mixed market signals include negative contributions from bond market volatility and inflation expectations, while spreads between yields on corporate bonds and 10-year Treasury securities suggest increased investor appetite for riskier assets. The STLFSI has remained below zero for 60 consecutive weeks, reflecting a positive trend. However, caution is advised as the index's limited existence makes historical patterns less reliable. Vigilance is necessary in uncertain times [4fee7e6c].

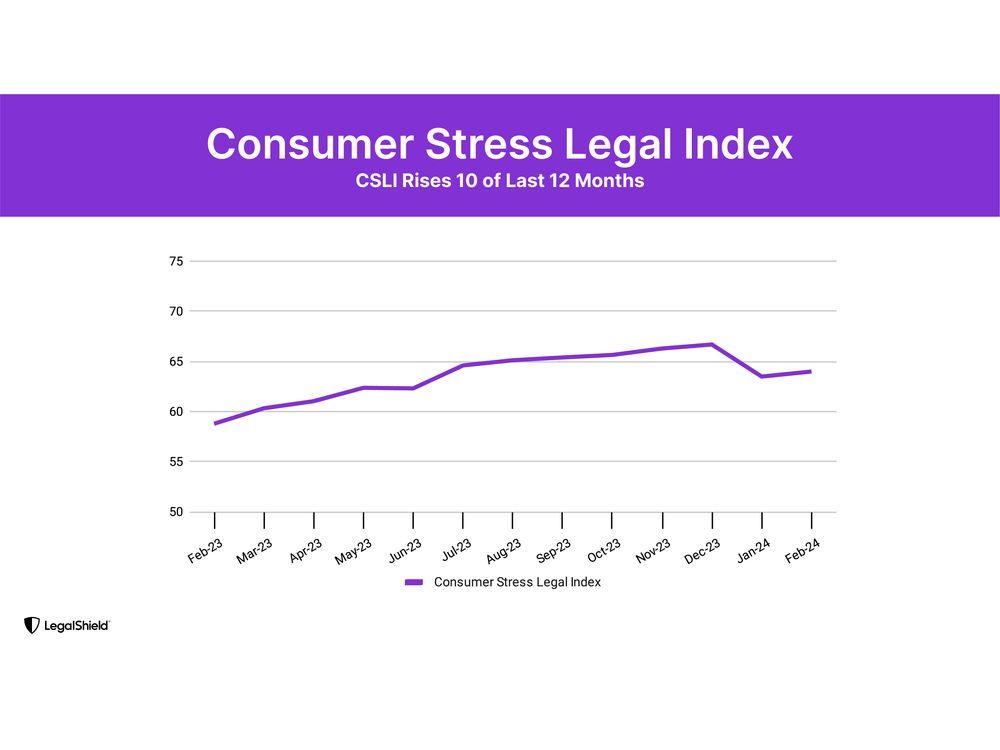

LegalShield's February Consumer Stress Legal Index (CSLI) highlights an uptick in financial stress among U.S. consumers. The February headline number of the index is 64, an 8.8% gain year over year. The rise in stress aligns with the drop in The Conference Board's Consumer Confidence Index and the decline in the University of Michigan's Consumer Sentiment Index. The CSLI is a 60-90 day leading indicator of the Consumer Confidence Index. The index is based on more than 150,000 monthly requests from American consumers for legal help. The Consumer Finance Index rose by 0.6 points to 100.9, with billing disputes increasing by 3.8% over January. Loan modification inquiries have risen by 353% year over year, with Gen X and Millennials being particularly affected. The Housing Construction Index fell to its lowest reading since February 2019, indicating a decline in new home construction. The Housing Sales Index also fell to its lowest level since May 2011. LegalShield's Foreclosure Index rose slightly, while the Bankruptcy Index eased. The CSLI is based on a dataset of more than 35 million consumer requests for legal assistance since 2002 [40be5c52].

The volume of requests for legal assistance over financial issues remains well below long-term averages, according to a report from LegalShield. While many consumers complain about their financial situation, most don't seek legal help to address their concerns. This could be a favorable sign for the economy and might have repercussions for the 2024 presidential election. LegalShield's analysis suggests that if consumer legal stress in battleground states remains low, it could indicate favorable results for incumbents, including President Biden. The company tracks consumer requests for legal help and compiles this information into an overall Consumer Stress Legal Index, which includes bankruptcies, housing issues, and other financial problems. Currently, the mood in battleground states reflects lower financial stress, potentially indicating a victory for President Biden. LegalShield has been providing legal-assistance plans for decades and has been tracking patterns in the data to determine how consumer requests for help might translate into voting patterns. [f49950be]