Growing volatility in the New York Stock Exchange (NYSE) is driving a search for defensive assets, as investors seek shelter amidst the turbulence. The Cboe Volatility Index, also known as the fear gauge, reached its highest level in nearly seven months, reflecting investor nervousness as the S&P 500 experienced a slide for the week. Rising bond yields, geopolitical tensions, and weaker-than-expected earnings reports have contributed to the increased volatility in the market. Defensive sectors such as utilities and consumer staples have been affected, while US government bonds are on track for a third straight annual loss. Despite the challenging environment, investors are seeking shelter and diversifying their portfolios. In response to the market turbulence, investors are considering various defensive strategies. Some are turning to defensive sectors such as utilities and consumer staples, which tend to be more resilient during market downturns. Others are seeking refuge in traditional safe-haven assets like Japanese yen and U.S. government bonds. The dollar and gold are also being seen as potential safe-haven options. Additionally, short-term debt and money market funds are being considered as alternatives to the Treasury market, which has experienced significant volatility. Analysts from UBS have highlighted the importance of defensive sectors and safe-haven assets in navigating the current market conditions [1eedc642].

US stock investors are turning to affordable options hedges as the Cboe Volatility Index (VIX) nears four-year lows. Options volume on the VIX reached 1.2 million contracts, setting a pace for the highest level in about three weeks. The VIX, also known as 'Wall Street's fear gauge,' is currently at 12.51, just above the four-year low of 11.81. Traders are capitalizing on the relatively inexpensive defensive options contracts to acquire portfolio hedges. A notable VIX trade involved a $16.8 million acquisition of 250,000 call options positioned to benefit if the volatility index rose above 17 by mid-February. The heightened hedging activity on Friday contrasted with a generally subdued level of defensive trading in recent weeks [e8ebb084].

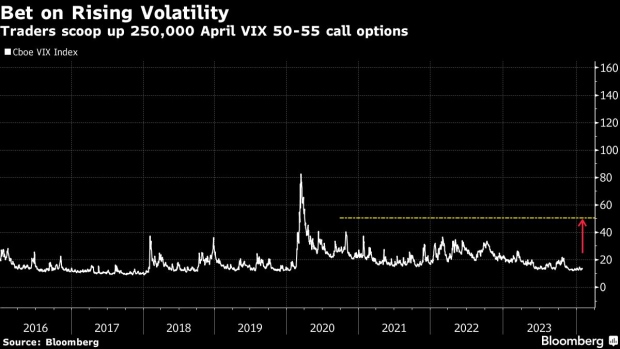

Traders are making big bets on stock market volatility as the S&P 500 retreats from its record high and investors anticipate potential interest rate cuts by the Federal Reserve. A trader recently bought 50,000 call options on the VIX Index, betting that it could reach 50 by April. Similar trades have been made in recent days, bringing the total volume of VIX calls with 50 and 55 strikes to 250,000. The transactions involve buying VIX 16 put and selling VIX 16 call contracts to hedge the directional exposure. The low and un-volatile VIX has driven down the prices of VIX call options, making it an attractive opportunity to bet on rising volatility. Policymakers have pushed back against immediate rate cuts, and geopolitical conflicts and economic uncertainty continue to weigh on investor nerves [b50c24be].

Cboe Global Markets Inc (CBOE) filed its annual 10-K report on February 16, 2024, revealing a robust balance sheet and a strategic focus on proprietary products. Cboe's proprietary products, such as SPX options and VIX options and futures, drive substantial trading volumes and transaction fees. The company operates globally across diverse asset classes and has a strong presence in the volatility space. However, it faces regulatory challenges, compliance costs, and dependence on subsidiary performance. Cboe has expanded into digital assets through the acquisition of ErisX, now Cboe Digital, and has strategic relationships with index providers. The company must navigate market volatility, competition, and technological risks to sustain its success [72d084ba].

The US economy shows soft business conditions, lingering inflation, and concerning household debt. The S&P 500 continues to reach all-time highs while the volatility index remains low. Owning VIXY in small amounts as a hedge to the S&P 500 and timing it properly can be beneficial. VIXY is an ETF that provides exposure to volatility and goes long short-term VIX futures contracts. It has a track record of losing significant value over time due to the upsloping shape of the VIX futures curve. Buying VIXY today as a speculative play can produce gains if timed properly. The VIX breached the 13 level to the downside, reaching intraday lows of 12.6. Holding VIXY in small amounts, coupled with the S&P 500, and timed properly has historically produced better risk-adjusted returns. The author, Daniel Martins, is a Napa, California-based analyst and founder of independent research firm DM Martins Research [c955d0a3].

VIXCO (VIX) achieves a low risk analysis based on proprietary system gauging manipulation potential. The risk gauge score translates to a low risk investment at the moment. The price of VIXCO is 18.22% lower over the last 24 hours, with a current value of $0.019366441. The token's market capitalization is $12,001,197.48, and $17,054,876.67 worth of the currency has been traded over the past 24 hours. VIXCO's price movement over the past day of trading leads to a low risk ranking as its recent price movement relative to trading volume gives traders confidence in its manipulability [0b2ed44d].