As 2025 unfolds, the yield on the 10-year U.S. Treasury has slipped to 4.48%, a decrease of about 3 basis points as of February 5, 2025. This decline in yields comes as traders look ahead to the upcoming U.S. jobs report, with expectations that the ADP payroll data will indicate an addition of 151,500 jobs in January, up from 122,000 in December [b47c9aae].

In tandem with these developments, the yield on the 2-year Treasury also decreased to 4.19%. Federal Reserve Vice Chair Philip Jefferson has emphasized the importance of caution in adjusting interest rates, reflecting the Fed's careful approach amidst fluctuating economic indicators [b47c9aae].

The market's sensitivity to employment data is heightened by ongoing trade tensions with China, which include a 10% tariff imposed by former President Trump and China's retaliatory measures. These factors are raising investor concerns and contributing to the cautious market sentiment [b47c9aae].

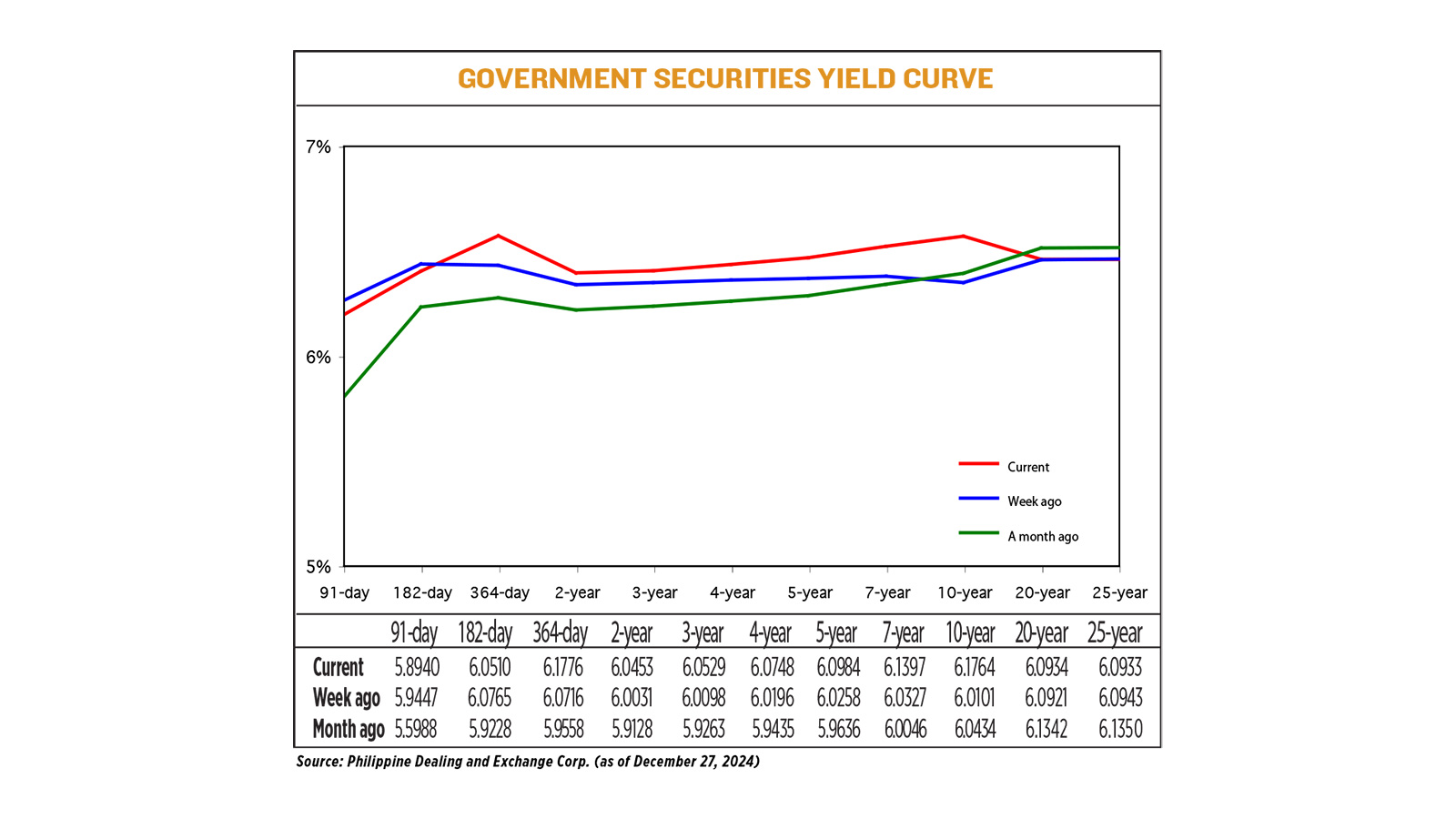

In the Philippines, yields on government securities have recently increased, with an average rise of 4.7 basis points week on week as of December 27, 2024. This trend is attributed to local inflation concerns and hawkish guidance from the U.S. Federal Reserve [eaba68cf].

The trading volume of government securities in the Philippines has decreased significantly, reflecting a cautious approach among investors. Specific movements in Treasury bills indicate a mixed response, with the 91- and 182-day bills decreasing slightly, while the 364-day tenor saw an increase [eaba68cf].

As the Federal Reserve continues to signal potential interest rate hikes, both the U.S. and Philippine markets remain sensitive to these developments. The interplay between local inflation, U.S. monetary policy, and domestic fiscal measures will likely shape the outlook for debt yields and overall market dynamics as we progress through 2025 [eaba68cf].