/tpg%2Fc9198ee3-508d-42b5-aff9-a868f65383ca.jpeg)

As China approaches the 75th anniversary of the People's Republic on October 1, 2024, the nation reflects on its remarkable economic journey. From a mere 4% of the global economy in 1949, China's share has surged to approximately 19% today, contributing 31% to global growth over the past decade [0d904f45]. This transformation has significantly altered global economic dynamics, particularly benefiting the Global South [ce2c0018].

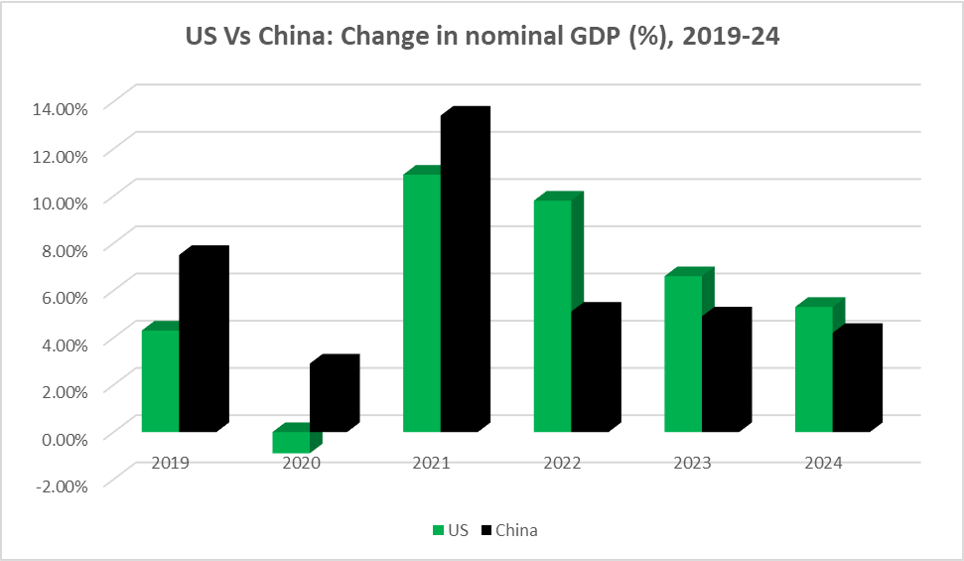

However, recent data indicates that in 2024, the U.S. economy grew by 5.3%, solidifying its position as the world's largest economy, while China's growth lagged at 4.2% [e761480b]. This widening GDP gap is attributed to U.S. inflation and aggressive monetary tightening in 2022-2023, contrasting with China's struggles with deflation [e761480b]. The disparity in GDP per capita is stark, with the U.S. at $82,769 compared to China's $12,614 in 2023 [652fe707][e761480b]. U.S. consumer spending, driven by wage increases and employment gains, was a significant factor in this growth, with American payrolls increasing by over 2.2 million in 2024 [652fe707].

Recent analyses had suggested that China was on track to surpass the U.S. economy by 2035, with economist Justin Lin Yifu predicting that China's growth rate of around 5% would outpace the U.S.'s 2.5% [1cbee9ff]. Lin emphasized that this trajectory was supported by China's robust export performance, which rose 10.7% year-on-year in December 2024, contributing to a record trade surplus of $992 billion for the year [1cbee9ff][652fe707]. However, the latest figures show that the U.S. merchandise trade deficit reached nearly $1.1 trillion, with a record monthly deficit of $122 billion in December [e761480b][652fe707].

Despite these challenges, China's exports to the U.S. reached $49 billion in December 2024, totaling $525 billion for the year, indicating resilience in the face of domestic demand issues [1cbee9ff]. The trade relationship between the U.S. and China remains intricate, with bilateral trade totaling 3.15 trillion yuan (approximately $432 billion) in the first eight months of 2024, a 4.4% increase year-on-year [5ede08ff].

However, the sustainability of this growth is uncertain as factory activity in China has contracted for the fourth consecutive month, and producer prices fell by 2.7% in August [98d06076]. The ongoing trade wars initiated by the Trump administration have shifted global economic leadership from the U.S. to China, with China contributing over 30% to global growth over the past decade [ce2c0018]. The primary threat to global recovery now lies in Western protectionism and sanctions, which could hinder China's continued economic ascent and its pivotal role in global growth [0d904f45].

In a recent opinion piece by Alex Lo, three theories have been proposed to explain why China's economic miracle appears to be hitting a wall. The neoclassical theory suggests that developing economies grow rapidly until they reach conditions typical of advanced economies, which China may have now achieved. Research indicates that China's per capita GDP rose from 6.6% of the U.S. level in 1995 to 25% in 2019, suggesting that its growth trajectory is not exceptional but rather typical for a country of its size [0df5e751]. Similar slowdowns were observed in Japan, Taiwan, and South Korea as they reached frontier levels of economic development.

Adding to the discussion, Jensen argues that instead of copying China's policies, the U.S. should focus on free trade, deregulation, and privatization to enhance its own economic performance [0bf034b4].

Moreover, Noah Smith in Asia Times highlights that while some charts suggest China has fallen behind since 2021, with a GDP growth rate of around 5% in 2024 compared to the U.S.'s 3.1%, the comparison is complicated by factors like currency depreciation and measurement issues. Nominal GDP comparisons indicate that China may be lagging, while purchasing power parity (PPP) metrics suggest otherwise. Smith emphasizes the importance of understanding these metrics in the context of geopolitical dynamics [1f6d9c01].

In conclusion, while concerns over incoming U.S. tariffs under President-elect Donald Trump loom as a challenge for China's export growth, the overall economic indicators suggest that China remains on a path to potentially becoming the largest economy by 2035, despite the U.S. outpacing it in recent growth figures [1cbee9ff][652fe707]. The National People's Congress in March is expected to announce growth targets and consumer initiatives to address these challenges [f7fbaa91].