The US economy has continued to demonstrate resilience in the face of higher interest rates, defying expectations of a recession. This resilience can be attributed to several key factors, including the role of household finances and company finances.

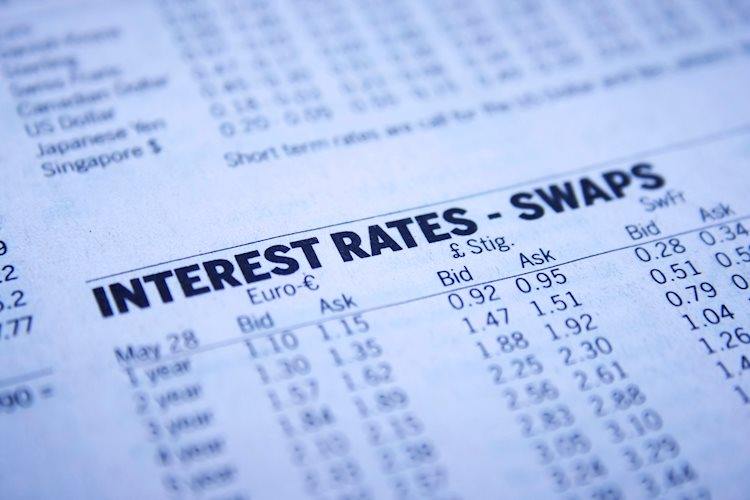

In the US, companies have contributed to the resilience of the economy through various channels such as staffing levels, investments, growth of profits, and dividends. Factors that have underpinned companies' resilience include company profitability, cash levels accumulated during the Covid-19 pandemic, the ease of capital markets-based funding, and low long-term rates [8cf9f7f8] [6d2d7500].

Company investments have been growing at about 5% year-on-year, maintaining a steady pace despite the increase in interest rates. This indicates that companies have been able to sustain their investment activities and support economic growth, despite the higher borrowing costs [8cf9f7f8] [6d2d7500].

The role of company finances, along with household finances, has played a crucial role in supporting the US economy's resilience. Household deleveraging, fixed-rate mortgages, rising financial income, increased net worth, and company profitability, investments, and cash levels have all contributed to the strength of the US economy in an environment of aggressive monetary tightening [8cf9f7f8] [fe9e24c1] [6d2d7500].

Despite recent market turmoil, the US economy has shown resilience. Positive economic indicators such as low unemployment rates and strong consumer spending have contributed to this resilience. The US economy has been able to withstand market fluctuations and maintain its strength [f49978ac].

However, it is important to exercise caution and recognize that aggregate data may not capture the heterogeneity of companies. Financially fragile companies need to be closely monitored, as they may be more vulnerable to the impact of high interest rates. If the situation of financially fragile companies worsens significantly, it could have spillover effects on the broader economy [8cf9f7f8] [6d2d7500].

Faced with a significant increase in official interest rates, companies have been surprisingly resilient. The Federal Reserve's latest Financial Stability Report gives some comfort based on a comparison of corporate bond yields and spreads to their historical distribution. Resilient earnings imply a robust debt-servicing capacity. However, firms with weak balance sheets are more sensitive to higher interest rates or a severe drop in growth. This could have repercussions for the broader economy [6d2d7500].

The article also mentions the potential impact of global events on the US economy, including trade tensions and geopolitical risks. It emphasizes the importance of monitoring economic indicators and maintaining a balanced approach to economic policies [f49978ac].

In conclusion, the US economy has shown resilience in the face of higher interest rates, thanks to the strength of both household and company finances. Household deleveraging, fixed-rate mortgages, rising financial income, increased net worth, company profitability, investments, and cash levels have all played a role in supporting the economy. Positive economic indicators such as low unemployment rates and strong consumer spending have contributed to the US economy's ability to withstand market turmoil. However, it is crucial to monitor financially fragile companies closely and manage the potential risks associated with high interest rates. Additionally, the potential impact of global events on the US economy should be taken into consideration [8cf9f7f8] [fe9e24c1] [6d2d7500] [f49978ac].