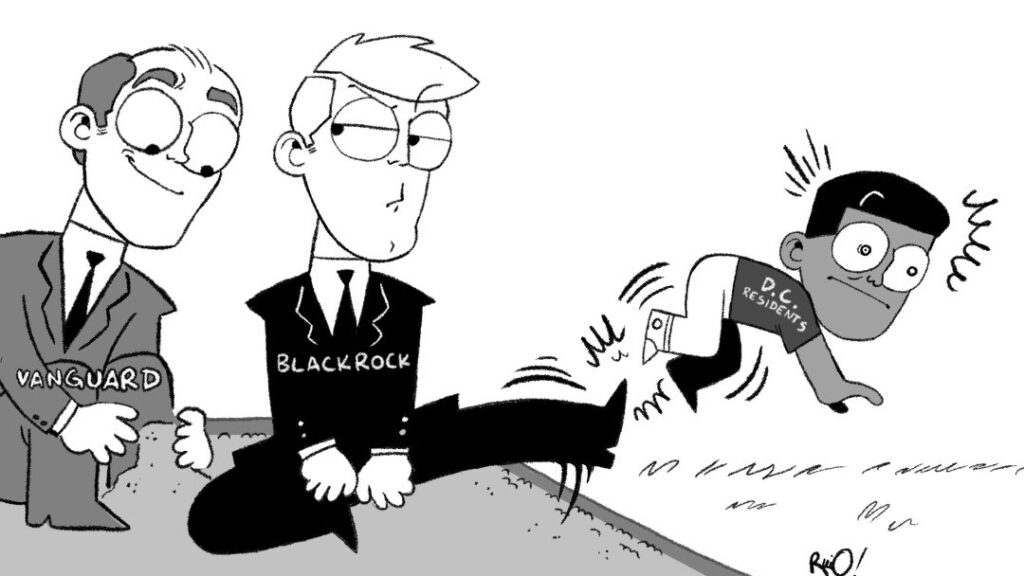

The increase in corporate investment in residential real estate in the multifamily sector is contributing to housing market supply shortages and rising prices, negatively affecting first-time homebuyers and renters [4483efc1]. The multifamily sector has been leading in terms of deal volume, indicating that investors are cashing in on the housing market's growth [4483efc1]. While corporate investment in residential properties can stabilize prices and benefit municipalities, it can also limit overall residential ownership and lead to wealth transfer from individual families to investors [4483efc1]. Private equity firms own a significant number of apartment units in the country, which could impact college graduates and students who are already burdened with student loan debt [4483efc1]. Additionally, there are concerns about the rising cost of living and the impact on renters, including rent increases, poor maintenance, and additional fees [4483efc1].

The article highlights the potential consequences of corporate investment in residential real estate and its implications for affordability and wealth distribution [4483efc1].

RLC Residences recognizes the importance of creating a conducive environment that fosters success. One avenue that it pushes for is the strategic choice of condo renting. Convenience, right amenities for a balanced lifestyle and right rental price are some of the things that RLC Residences believes are important to look at when it comes to condo living. Choosing a condominium in a prime location can significantly impact daily life. For starters, traffic won't be as big of a problem if condo dwellers live near where they work. RLC Residences ensures its properties are located in areas that offer accessibility to central business districts, essential institutions and recreational hubs.