Indians are increasingly investing in multifamily real estate in the U.S., particularly in regions benefiting from the CHIPS and Science Act, which was enacted in August 2022. This act aims to bolster the semiconductor industry with $500 billion in funding and is expected to create over 500,000 jobs within the next 5 to 10 years [2d1300da]. The gross rental yields in these areas range from 8% to 15%, making them attractive for investors seeking stable returns [2d1300da].

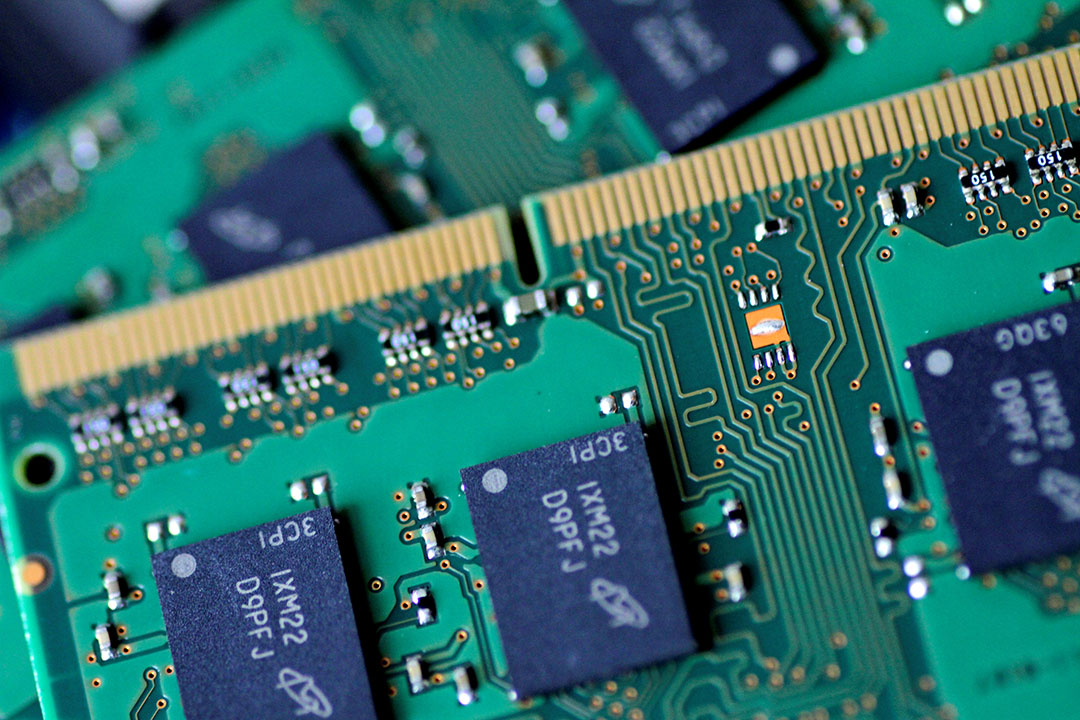

Key investment hotspots include Arizona, where Intel is expanding its operations with a $7.87 billion investment expected to create 30,000 jobs; New York, where Micron is investing $100 billion and generating 20,000 jobs; Ohio, with Intel's expansion also promising 30,000 jobs; Texas, where Samsung is establishing a $17 billion facility that will create between 10,000 to 15,000 jobs; Oregon, with Intel's investment leading to 30,000 jobs; and Utah, where Texas Instruments is building a $1.6 billion plant, creating 500 to 800 jobs [2d1300da].

This trend of Indian investment aligns with the broader movement of U.S. semiconductor companies exploring opportunities in the Philippines, as highlighted by Secretary Frederick D. Go, who noted the semiconductor industry as a priority for investment [f182eca9]. The Philippines has a robust semiconductor export sector, generating $50 billion in 2023 and supporting approximately 3 million jobs [f182eca9].

As U.S. companies consider expanding their operations in the Philippines, the collaboration could lead to significant advancements in technology and job creation in the region, further strengthening the semiconductor supply chain amidst global competition [f182eca9]. The combined efforts of both domestic and international investments are crucial for the U.S. to maintain its competitive edge in the semiconductor industry, especially given the geopolitical tensions and supply chain vulnerabilities that have emerged in recent years [113bb9a9].

The Semiconductor Industry Association (SIA) has praised the finalization of CHIPS Act incentives by the U.S. Department of Commerce to support Texas Instruments' semiconductor manufacturing facilities in Texas and Utah, which are expected to create thousands of jobs and enhance U.S. economic strength [66f7f06b]. Since the introduction of the CHIPS Act, 90 new projects across 28 states have been announced, totaling hundreds of billions in investments and creating over 58,000 jobs [66f7f06b].