/tpg%2Fb36b905c-6196-42ab-8f3c-96b4ceca8289.jpeg)

On January 30, 2025, the Bank of Canada (BoC) announced a reduction of its key policy rate by 0.25% to 3%, marking the sixth consecutive cut since June 2024. This decision comes amid rising uncertainty due to U.S. tariff threats, as former President Donald Trump announced potential 25% tariffs on Canadian imports effective February 1, 2025. Analysts warn that the tariffs could significantly strain the Canadian economy, with the BoC warning that retaliatory tariffs could reduce Canadian growth by 2.5 percentage points in the first year and 1.5 percentage points in the second year [c36a7adb].

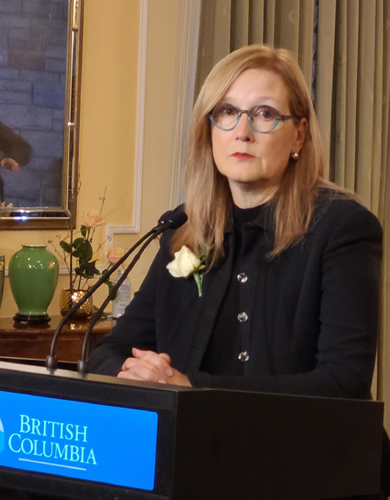

In response to these looming tariffs, BC Finance Minister Brenda Bailey convened a meeting on January 31, 2025, with 13 private sector forecasters from across Canada to discuss the economic forecast for British Columbia. The economists expressed concerns about the uncertainty stemming from the U.S. administration and the potential impact of the tariffs on Canadian goods. Bailey emphasized the need for export diversification and increased productivity, particularly through advancements in artificial intelligence [de80a521].

Experts predict that the interest rate gap between Canada and the U.S. will persist at 1-2% for the next decade, largely due to differing economic conditions. Currently, the U.S. Federal Reserve's key rate is set between 4.25% and 4.5% [950d61b2]. The last significant gap was observed from 2003 to 2006, and the Canadian dollar has been trading below 70 cents U.S. for over a month, influenced by this disparity [950d61b2]. According to BMO's Shelly Kaushik, further cuts from the BoC are anticipated this year, which may widen the interest rate gap even more [7f339b6b].

The BoC has revised its GDP growth forecasts down to 1.8% for both 2025 and 2026, a decrease from previous estimates of 2.1% and 2.3%. If the tariffs are enacted, Canadian exports, which account for 20% of the economy, could decline significantly, risking job losses and further depreciation of the Canadian dollar. The central bank estimates that potential tariffs could reduce Canada’s GDP by 2.4% in the first year [b9e1609b]. Tiff Macklem, the governor of the Bank of Canada, emphasized the need for caution, stating that tariffs reduce economic efficiency [b9e1609b].

In a related development, the Federal Reserve opted to maintain its policy rate at 4.25-4.50%, with Chairman Jerome Powell clarifying that the removal of the phrase 'progress towards the inflation goal' was merely a 'language cleanup' and not indicative of a policy shift [a2f86249]. The Fed's decision comes as the U.S. trade deficit for December was reported at -$122.1 billion, and the Atlanta Fed's GDPNow growth estimate for Q4 was slashed to 2.3% from 3.2% [a2f86249].

In the broader context, the anticipated cuts by the BoC follow a trend of central banks adjusting their rates in response to evolving economic conditions. Earlier in January, analysts had predicted an 83% probability of a rate cut, reflecting ongoing adjustments to inflation and economic pressures [426306e2]. The unemployment rate was reported at 6.7% in December 2024, indicating some labor market challenges despite the central bank's efforts [b9e1609b].

Globally, the Bank of England has also opted to keep its rates unchanged at 4.75% as inflation exceeds its target [c6e3e849]. As central banks navigate these challenges, the implications of their decisions on inflation, growth, and overall financial stability remain a focal point for economists and policymakers alike [426306e2].

In a recent update, Canada's 5-year bond yield fell to 2.55%, the lowest since June 2022, as the U.S. imposed 25% tariffs on Canadian goods and 10% on oil and gas. Ryan Sims of TMG noted that lower yields are occurring amid economic turmoil, while Ron Butler expects further rate cuts, predicting insured rates could drop by 20-25 basis points and conventional rates by up to 30 basis points [784d0f9e]. RBC Economics has warned that the tariffs could raise unemployment by 2-3 percentage points, and TD Economics predicts a recession if the tariffs last 5-6 months [784d0f9e]. Tiff Macklem cautioned that the tariffs could also increase inflation, complicating the economic landscape further [784d0f9e].

In a stark warning, Stephen Poloz, former governor of the Bank of Canada, stated that Canada’s economy is fragile and ill-prepared for the potential U.S. tariffs. He highlighted that ongoing trade tensions have fostered a cautious investment climate, causing businesses to hesitate in making investments due to uncertainty. Poloz noted that household spending is declining per capita and that Canada has been in a weak economic position for nearly two years, a situation masked by high immigration. He drew parallels between the current climate and the economic environment during Donald Trump’s first term, when Canadian investments shifted to the U.S. He criticized Canadian fiscal policy for focusing too much on household support rather than stimulating business investment, suggesting that before the pandemic, Canada had a stronger economy characterized by low unemployment and targeted inflation [38ac911b].

As the government prepares for Budget 2025, scheduled for release on March 4, 2025, Bailey reiterated the government's commitment to support affected sectors and emphasized the importance of both people and businesses in the economic strategy [de80a521].