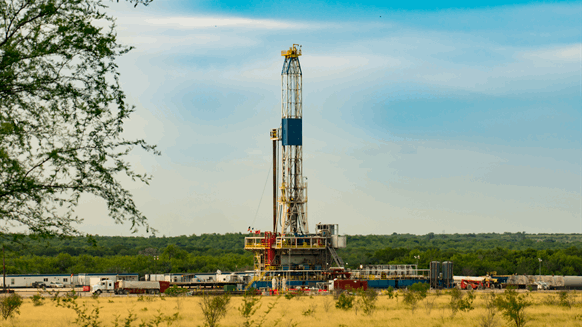

The Swiss National Bank (SNB) has recently faced criticism from environmental NGOs for its reported $9 billion investment in 69 oil and gas fracking companies. Fracking makes up over half of SNB's approximately $16 billion invested in fossil fuel extraction. The SNB spokesperson declined to comment on the matter. Fourteen of Switzerland's cantons, which account for 69% of the population and own 27% of SNB shares, have rejected fracking. The NGOs argue that the SNB should respect the rejection of fracking as a norm and value of Switzerland.

In response to the criticism, the SNB has issued a statement reaffirming its commitment to responsible investing and compliance with Swiss norms. The bank asserts that its investment portfolio adheres to strict sustainability criteria and takes environmental and social factors into account. However, critics argue that investing in fracking companies contradicts Switzerland's commitment to reducing greenhouse gas emissions and transitioning to renewable energy sources. The SNB's statement aims to address these concerns and maintain public trust in its investment practices.

This controversy highlights the tension between financial considerations and environmental concerns in investment decisions. It also raises questions about the role of central banks in promoting sustainable and responsible investing. The SNB's investment in fracking companies has sparked a broader debate about the alignment of investment portfolios with national values and goals.

The SNB's commitment to providing liquidity assistance to all banks in Switzerland, serving as a lender of last resort, has also been reaffirmed. The Vice Chairman of the SNB, Schlegel, emphasized that this commitment extends to all banks, not just systematically relevant lenders, ensuring that they can access necessary liquidity in times of crisis. This commitment plays a crucial role in maintaining overall financial stability in the country.

Overall, the SNB is facing scrutiny over its investment choices and the alignment of its portfolio with sustainability goals. The controversy surrounding its investment in fracking companies highlights the challenges faced by central banks in balancing financial stability and responsible investing in an evolving global landscape.