In the world of stock market investing, gaining insights and developing effective strategies are crucial for success. Recently, several financial institutions and experts have shared their perspectives on the stock market and offered valuable guidance. The Boyar Value Group and Claret Asset Management have released client letters, discussing the factors influencing the stock market and presenting investment opportunities. Tidefall Capital Management, a concentrated investment fund manager, has also shared their views on equities in the current environment.

Baron Discovery Fund's Q3 2023 Quarterly Letter reveals the fund's performance and investment decisions, highlighting the impact of crosscurrents on the stock market. Despite challenges, the fund remains positive about long-term prospects and valuations. Baron Durable Advantage Fund's Q3 2023 Shareholder Letter focuses on the fund's performance and investment approach, emphasizing high-quality businesses with competitive advantages.

Validea, a service that offers stock analysis and model portfolios based on successful investment legends, provides an analysis of a large-cap value stock in the Auto & Truck Manufacturers industry. The analysis evaluates the stock's underlying fundamentals and valuation, providing insights into its strengths and weaknesses. Similarly, an article discusses a quantitative stock analysis of a large-cap growth stock in the Scientific & Technical Instr. industry, inspired by the investment strategies of Peter Lynch.

These various sources of information and analysis offer valuable insights and strategies for navigating the stock market. It is important to consider these perspectives and conduct thorough research before making investment decisions. Remember, the stock market is dynamic and unpredictable, and professional advice is always recommended.

Old Dominion Freight Line Inc (ODFL) is a leading less-than-truckload (LTL) carrier in the United States with a network of over 250 service centers and a fleet of more than 11,000 tractors. The company recently filed its annual report with the SEC, which includes a strategic SWOT analysis. The analysis highlights ODFL's operational strengths, potential weaknesses, market opportunities, and external threats [2bb1cb6b].

ODFL's financial performance is robust, driven by market share gains and a strong balance sheet. The company has been able to expand its market share and leverage technological advancements to improve its operations. However, ODFL is dependent on the U.S. domestic economy, which exposes it to economic fluctuations and regulatory changes. Additionally, the company faces competition and pricing pressure in the LTL industry. Despite these challenges, ODFL remains well-positioned for growth and has identified several opportunities for expansion [2bb1cb6b].

The SWOT analysis provides valuable insights for investors interested in ODFL. It highlights the company's strengths, such as its extensive network and strong financial performance. It also identifies potential weaknesses, such as its dependence on the U.S. domestic economy and the competitive nature of the LTL industry. Moreover, the analysis presents market opportunities, including market share expansion and technological advancements. Finally, it outlines external threats, such as economic fluctuations and regulatory changes [2bb1cb6b].

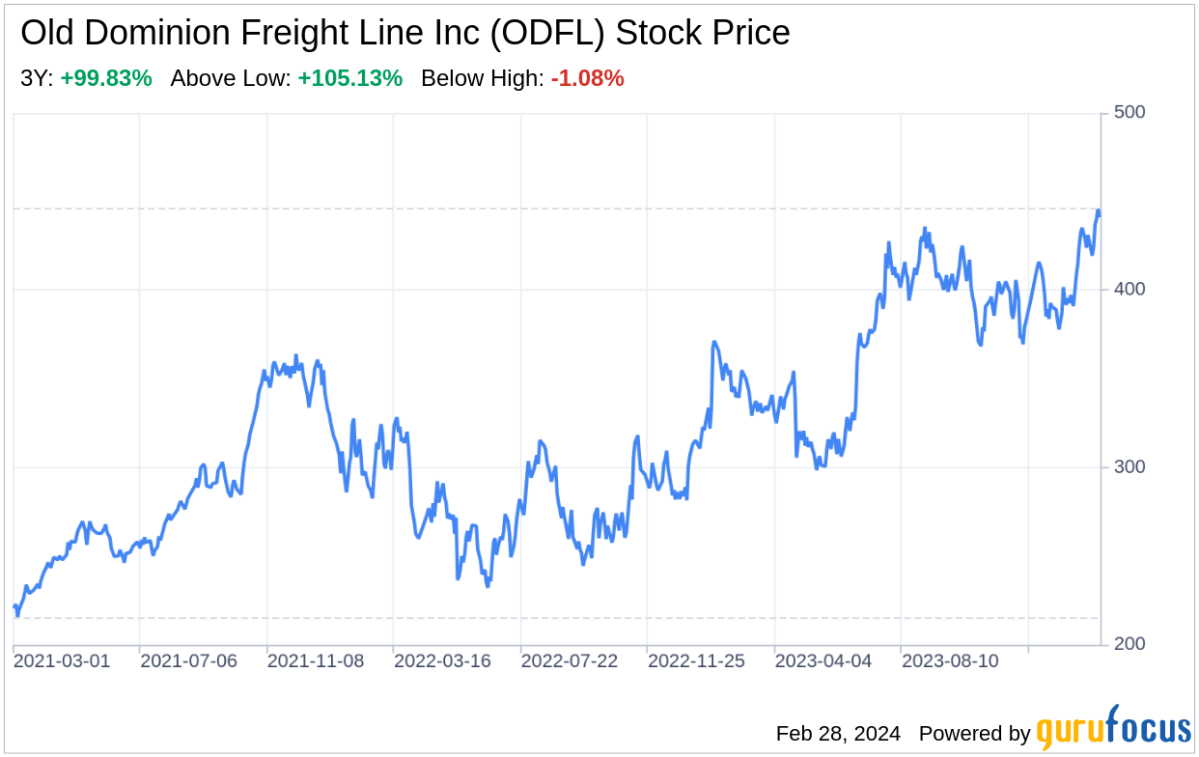

Old Dominion Freight Line (NASDAQ: ODFL) has seen its stock increase over 13,000% since 2003 on a split-adjusted basis. The company has split its shares five times since 2003, with the most recent split being 2-for-1 in March 2024. While stock splits don't meaningfully alter the fundamentals of a stock investment, Old Dominion's strong fundamentals make it an attractive investment. The company is comparatively undervalued when compared to its competitor Saia, Inc (NASDAQ: SAIA), with a lower price-to-earnings ratio and price-to-free cash flow per share. Old Dominion also has an enviable balance sheet, pays a dividend, and regularly repurchases shares. It is a strong choice for investors looking to capitalize on the move to shorten supply chains by manufacturing more goods in America. Despite the negative economic outlook, Old Dominion has held up well and can be viewed as a bet on continued strength in the American economy. The Motley Fool Stock Advisor analyst team did not include Old Dominion Freight Line in their list of top stocks to buy, but the company has a strong track record of performance.

Overall, the strategic SWOT analysis of ODFL offers a comprehensive understanding of the company's position in the trucking industry. Investors can use this analysis to make informed decisions about their investment strategies and assess the potential risks and rewards of investing in ODFL [2bb1cb6b].