Investors at a Hong Kong central bank event expressed concerns about the US market, particularly the market for US government debt. The panelists discussed the potential inability of the US government to refinance its growing debt, given that a significant portion of demand for US government securities comes from foreign buyers and central banks. The panelists also highlighted the shift of financial activity from public to private markets in the US and the increasing presence of non-bank players in the market. The mood at the event was more positive compared to the previous year, with Chinese officials reassuring Hong Kong about its status as an international financial center.

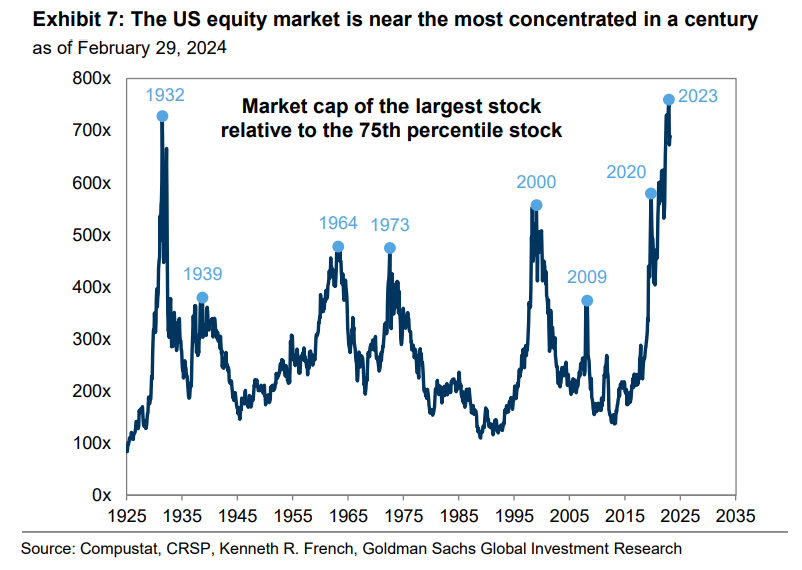

On the other hand, an article from A Wealth of Common Sense presents a different perspective. The author argues that they are not worried about stock market concentration and government debt. They believe that stock market concentration is not a bad thing, as the biggest and best companies are doing well. They also point out that stock markets around the globe are more concentrated than the US stock market. Regarding government debt, the author acknowledges that it is a concern, but believes that the US has built-in advantages such as the world's reserve currency and a dynamic economy. They also mention that debt is an asset for others and that the Fed and Treasury can take action in a crisis. The author concludes by stating that they prefer to worry about things they can control and advises letting the market and other investors worry about the rest. [9b0dba70] [0b68854c]