/tpg%2F715a0f71-0a4f-45d4-92e6-ea4595634ba3.jpeg)

On February 1, 2025, U.S. markets experienced a notable downturn as President Donald Trump confirmed the imposition of new tariffs against Canada, Mexico, and China. The tariffs include a 25% levy on imports from Canada and Mexico and a 10% tariff on goods from China, effective immediately. This announcement led to a sharp decline in major stock indexes, with the Dow Jones Industrial Average falling by 0.8% to close at 44,544.66, the S&P 500 decreasing by 0.5% to 6,040.53, and the Nasdaq dropping 0.3% to 19,627.44 [c26452f1].

The Canadian Dollar (CAD) and Mexican Peso (MXN) faced significant declines following the tariff announcement, raising concerns among market experts about potential cascading effects on global markets. Francesco Pesole noted that the dollar would likely be driven by the tariff narrative, reflecting the interconnectedness of global economies [674ca2b9].

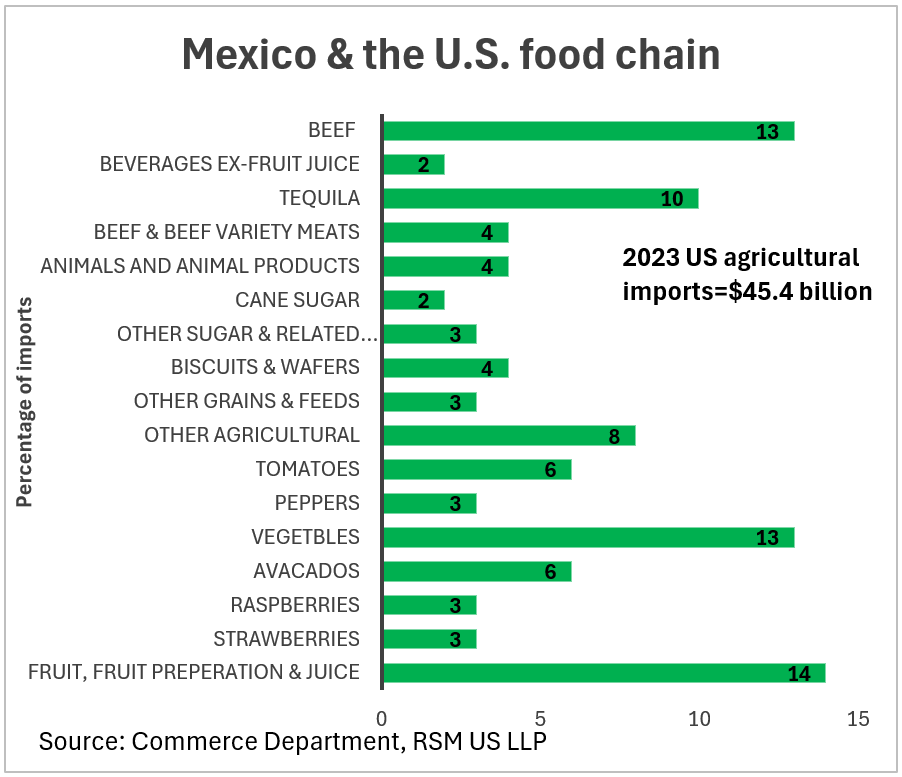

As the tariffs take effect on February 3, 2025, consumers are beginning to feel the impact on everyday goods, particularly food items. The U.S. imported $45.4 billion in agricultural products from Mexico in 2023, with avocados alone accounting for 6% of this total. The price of large organic avocados is expected to rise from $2.99 to $3.73, while a seven-ounce guacamole package may increase from $4.98 to $6.22. This price surge comes just in time for Super Bowl Sunday, testing consumers' tolerance for price increases during a time of high demand [b23a4de8].

Earlier in the week, the markets had already shown signs of volatility, with the Nasdaq experiencing a steep decline of approximately 600 points, largely due to the launch of Chinese AI company DeepSeek, which raised concerns about increased competition in the tech sector [8dce3510]. Despite some companies reporting stronger-than-expected earnings, the overall market sentiment remained negative. Notably, Apple shares fell by 0.7%, while Nvidia experienced a sharp decline of 3.7%, contributing to a total weekly drop of 15.8% [b037d6bf].

White House Press Secretary Karoline Leavitt stated, "These are promises made and promises kept by the president," emphasizing the administration's commitment to its trade policies. However, analysts like Patrick O'Hare from Briefing.com warned that the tariff announcement created uncertainty in the markets, prompting profit-taking among investors [c26452f1].

In the energy sector, Walgreens Boots Alliance faced a significant setback, with its stock plunging 10.3% after announcing the suspension of its dividend. Meanwhile, the U.S. Bureau of Economic Analysis reported steady consumer spending, with the Personal Consumption Expenditures price index rising by 0.3% month-over-month and 2.6% year-over-year. However, consumer confidence took a hit, with the Conference Board's index dropping 5.4 points, reflecting growing pessimism about the labor market [8dce3510].

The Federal Reserve's decision to maintain interest rates at 4.25% to 4.5% indicates a cautious approach in light of the potential economic impact of the tariffs. Economist Bernard Yaros warned that these tariffs could reduce the U.S. GDP by 1.2% in 2025. The U.S. economy grew by 2.3% in Q4 2024 and 2.5% for the entire year, surpassing earlier predictions, yet the looming tariffs have raised concerns about future growth [8dce3510][b037d6bf].

In response to the tariff fears, gold prices surged above $2,800 an ounce, reflecting a flight to safety among investors. European markets also reacted negatively, with France's CAC 40 down 0.6% as investors digested the implications of the tariffs. The European Central Bank has also signaled concerns regarding the trade conflict, further contributing to an overall cautious market sentiment [674ca2b9]. As the situation unfolds, analysts are closely monitoring how these developments will affect the broader economic landscape and market stability [c26452f1][b037d6bf].