Allspring Global Investments Holdings LLC, a major shareholder, has reduced its position in Hess Co., Morgan Stanley, and SRH Total Return Fund, Inc. during the second quarter [d4029f6f] [c5f35df1] [94872271]. The fund owned 41,588 shares of Hess Co.'s stock after selling 11,256 shares during the quarter. Allspring Global Investments Holdings LLC's holdings in Hess were worth $5,654,000 as of its most recent SEC filing [d4029f6f]. Additionally, Allspring Global Investments Holdings LLC reduced its holdings in Morgan Stanley by 29.8% during the second quarter [c5f35df1]. The fund owned 106,653 shares of Morgan Stanley's stock after selling 45,241 shares during the period. Allspring Global Investments Holdings LLC's holdings in Morgan Stanley were worth $9,108,000 at the end of the quarter [c5f35df1]. Furthermore, Allspring Global Investments Holdings LLC has sold 5,501 shares of SRH Total Return Fund, Inc. during the second quarter, reducing its stake to $7.91 million [94872271].

These reductions in positions highlight the changing investment strategy of Allspring Global Investments Holdings LLC and provide insights into the performance and market sentiment towards Hess Co., Morgan Stanley, and SRH Total Return Fund, Inc.

In a separate transaction, Murray Stahl's firm Horizon Kinetics reduced its stake in Associated Capital Group Inc by selling 37,852 shares at a price of $35.71 each on December 31, 2023 [f944c319]. The total holding now stands at 1,142,514 shares, representing 0.81% of the firm's portfolio and 43.30% of the company's outstanding shares. Murray Stahl is the CEO and Chairman of Horizon Kinetics, known for its independent, fundamental research and contrarian investment strategies. Associated Capital Group Inc is a diversified financial services entity specializing in alternative investment management and institutional research services. The stock price of Associated Capital Group has declined to $32.45 since the trade date, indicating a -9.13% change. Murray Stahl's firm holds a significant position in the company, reflecting a strong conviction in its potential within the asset management industry.

These recent transactions by Allspring Global Investments Holdings LLC and Murray Stahl's firm demonstrate the dynamic nature of investment strategies and the evolving market sentiment towards these companies [d4029f6f] [c5f35df1] [94872271] [f944c319].

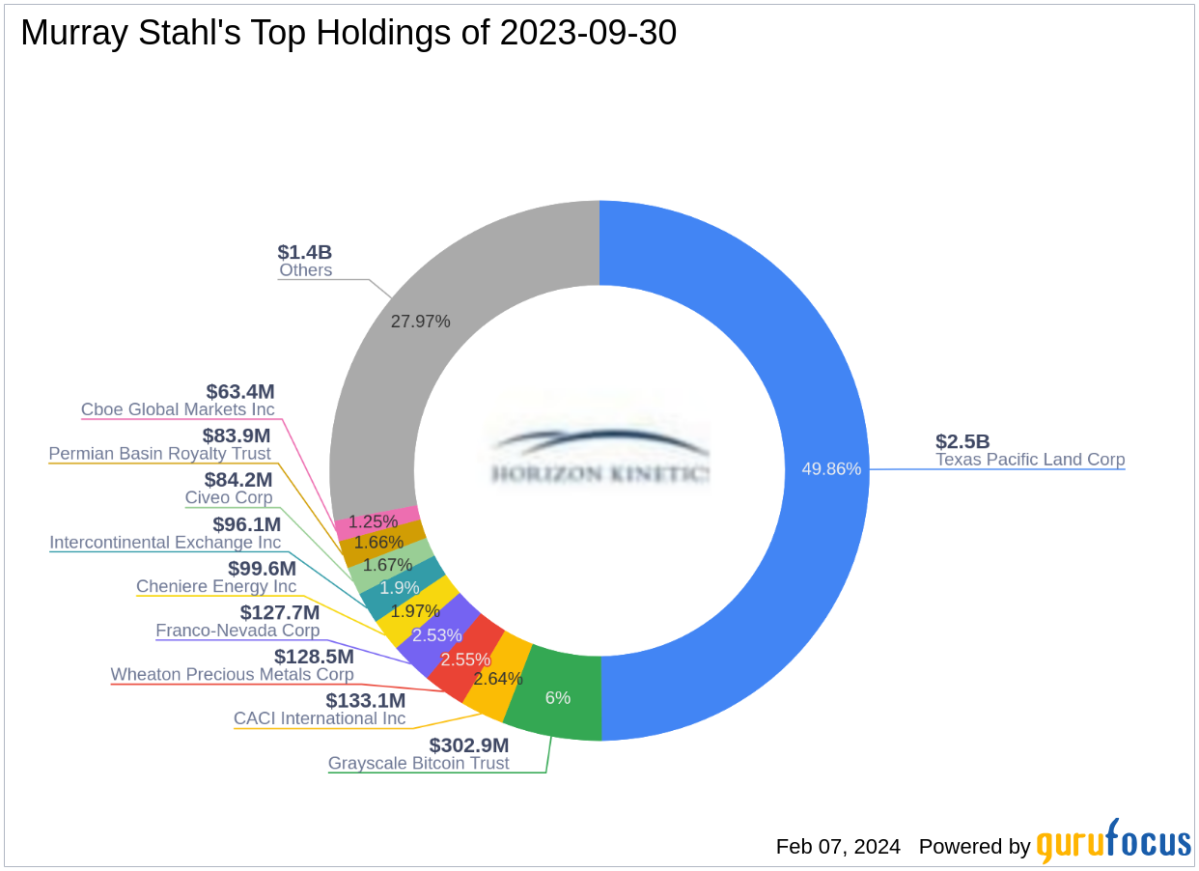

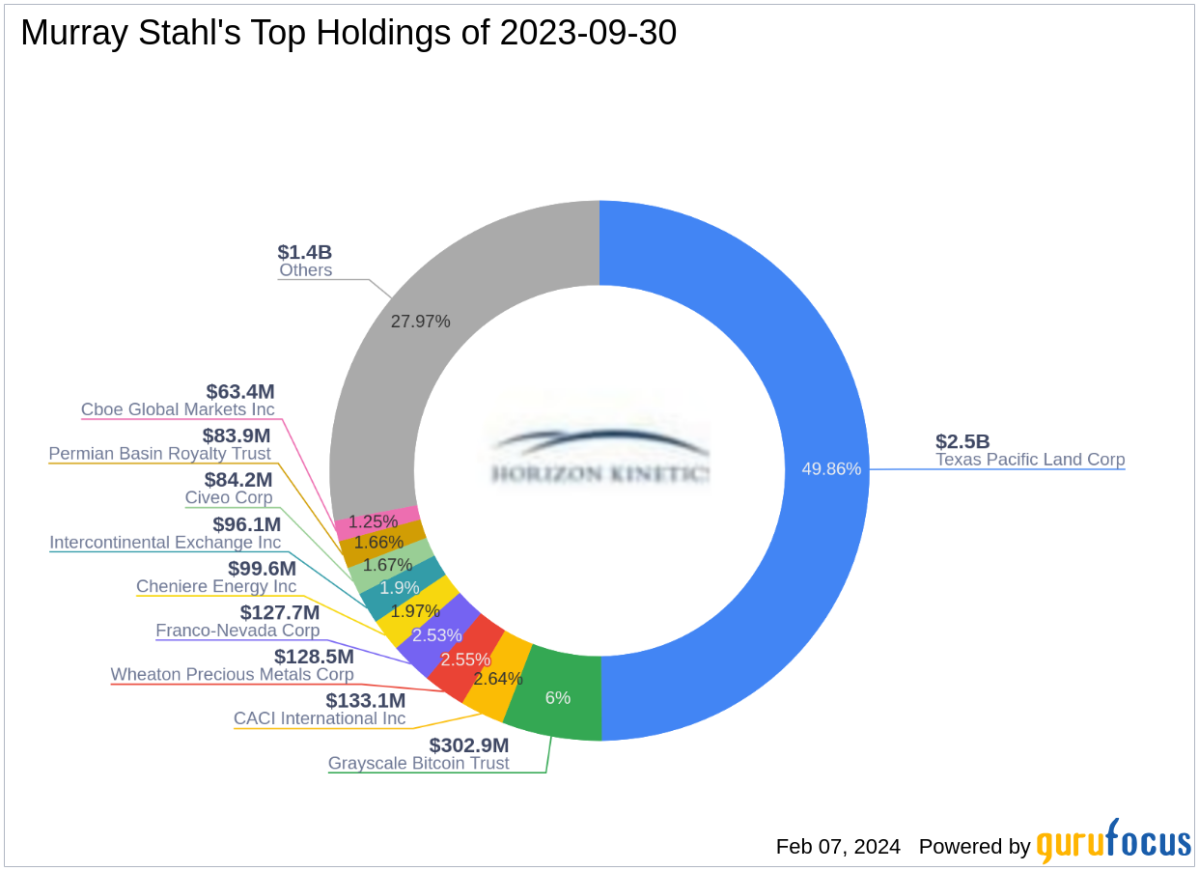

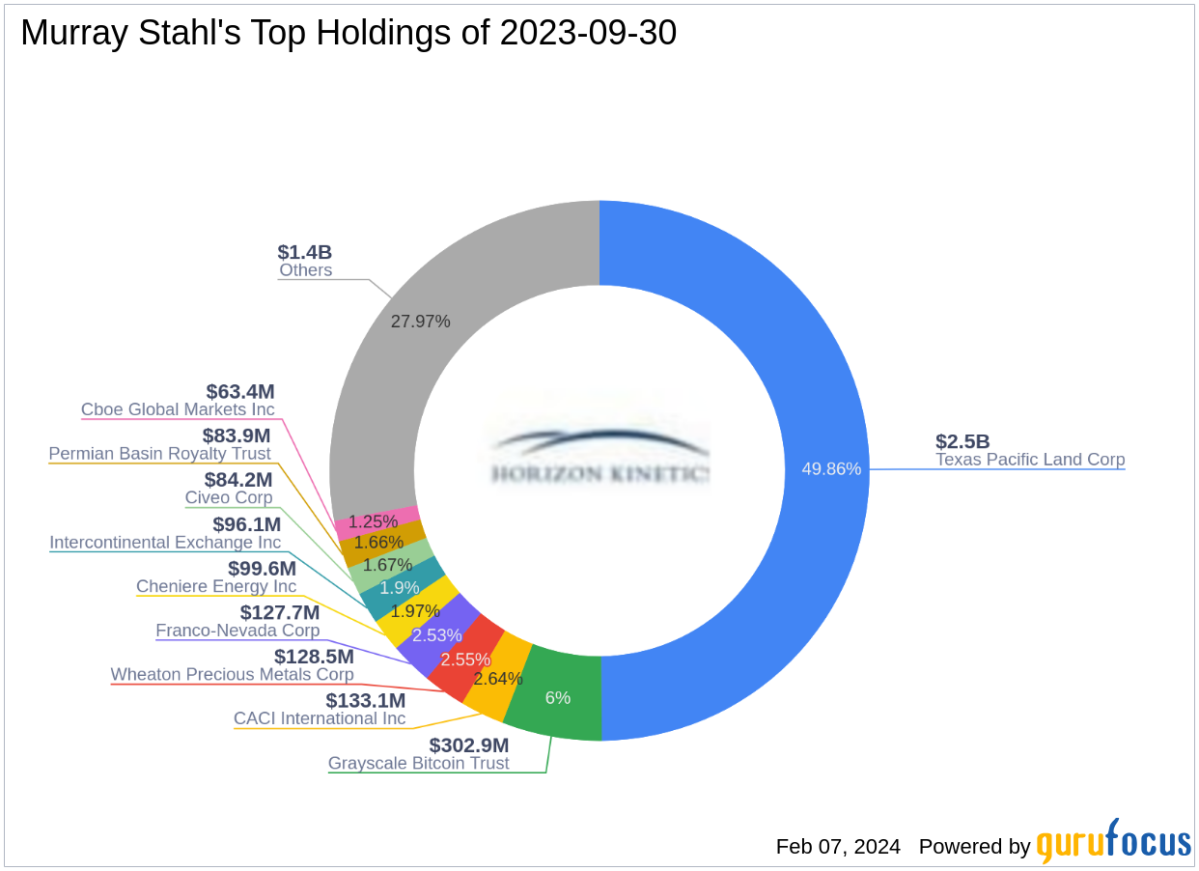

Murray Stahl's investment firm, Horizon Kinetics, has also reduced its stake in Mesabi Trust (NYSE:MSB) by selling 129,034 shares at a price of $20.47 per share [81298fae]. This trade resulted in a -4.23% change in the firm's holdings, with a post-transaction total of 2,920,318 shares in MSB. Mesabi Trust operates as a royalty trust focused on iron ore mining, and its stock price has seen a decline since the trade. Murray Stahl's Horizon Kinetics is known for its contrarian views and value investing strategy, with significant positions in companies like CACI International Inc (NYSE:CACI), Franco-Nevada Corp, and Texas Pacific Land Corp. Mesabi Trust is considered significantly overvalued according to GuruFocus metrics, with a GF Value of $10.58 and a price to GF Value ratio of 1.82. The market's reaction to the trade has been mixed, with cautious sentiment given the company's valuation and growth concerns [81298fae].

On December 31, 2023, Horizon Kinetics, under the leadership of Murray Stahl, reduced its position in Civeo Corp by selling 327,944 shares at a price of $22.85 each [2f439cad]. Following this transaction, the firm's total share count in Civeo Corp stood at 3,734,335, representing a 1.69% position in the firm's portfolio and a significant 25.30% ownership of the traded company. Murray Stahl, the CEO and Chairman of Horizon Kinetics, brings over three decades of investment experience and emphasizes a long-term investment horizon. Civeo Corp specializes in providing hospitality services to the natural resources industry and operates in the USA, Canada, and Australia. The recent sale by Murray Stahl has slightly decreased the firm's exposure to Civeo Corp, with the trade impact on the portfolio being a modest -0.15%. Civeo Corp's stock is currently trading at $22.1, slightly below the GF Value of $23.96. The company's financial health shows room for improvement, but it has shown a revenue growth of 9.50% over the past three years. Murray Stahl's investment strategy heavily features the energy and financial services sectors, and Civeo Corp aligns with Stahl's top sector focus. The sustained large position in Civeo Corp suggests a continued confidence in the company's value proposition.