In July 1944, 730 delegates from 44 countries gathered at the Bretton Woods resort in New Hampshire to agree on new rules for the post-war international monetary system. This conference, facilitated by the US, resulted in the establishment of the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD). The Bretton Woods System created a fixed exchange rate system tied to the US dollar, which was pegged to gold at $35 per ounce. The US dollar quickly became the world's primary reserve currency, a status that has persisted despite significant challenges over the decades. [0e3cf6f3]

Challenges arose in the 1960s due to US spending on the Vietnam War and Great Society programs, leading to inflation and a growing trade deficit. These issues highlighted the system's vulnerabilities, particularly the Triffin Dilemma, which warned that the US needed to run trade deficits to maintain dollar liquidity. On August 15, 1971, President Richard Nixon announced the suspension of the dollar's convertibility to gold, effectively ending the Bretton Woods system. Despite its collapse, the US dollar retained its status as the primary reserve currency, influencing global finance and monetary policy. The legacy of the Bretton Woods System includes the rise of floating exchange rates and ongoing debates about international monetary reform. [0e3cf6f3]

In recent years, the BRICS coalition, originally founded in 2009, has expanded to include new members such as Egypt, Ethiopia, Iran, and the UAE, with invitations extended to Argentina and Saudi Arabia. This expansion reflects a growing desire among these nations to challenge Western-dominated institutions and advocate for de-dollarization and local currency trade. The New Development Bank, established by BRICS in 2014, has approved over $32 billion for various projects, further solidifying the group's influence in the global economic landscape. [6cc6241f]

The G-7 summit in June took unprecedented actions to hand over billions of dollars in profits earned on frozen Russian assets to Ukraine, which may undermine the legitimacy of the US-dominated international financial system. This could lead to a shift away from a US dollar-based global financial system and the emergence of alternative renminbi-based financial systems. The G-7 leaders indicated that new measures were being considered to restrict access to the international financial system for Chinese banks and entities, escalating tensions and posing risks to global financial stability. [64f65e7b]

The intensified weaponization of Western currencies may encourage China to establish an alternative renminbi-based financial trading system. The threat of financial mutual assured destruction between the West and China is significant, as both sides have substantial assets at risk of possible sanctions. The latest moves might spur Xi to further decouple China's economy and reduce vulnerabilities to sanctions. This could lead to a tipping point where many countries, even U.S. allies, begin moving their assets away from the dollar and euro. [64f65e7b]

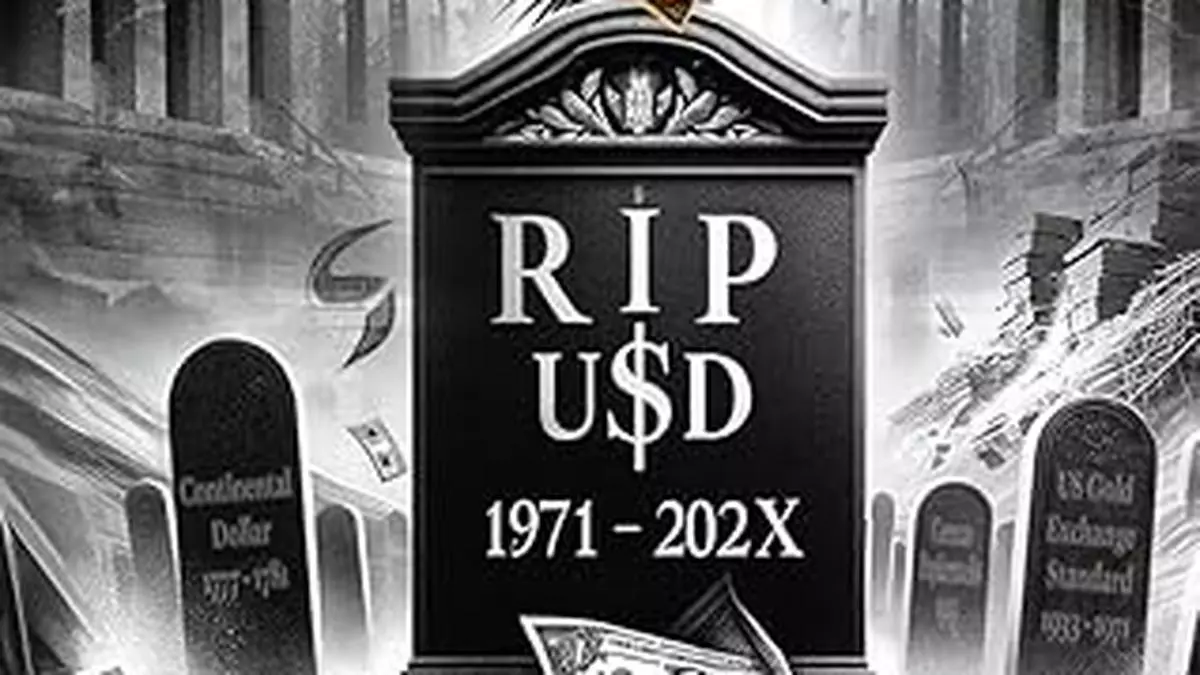

Additionally, a book titled 'RIP USD 1971-202X' offers a critical view of the fiat currency model that has dominated since 1971, suggesting a return to a gold-based currency system. The author argues that the paper-based monetary system is poised to inflict significant damage on the world economy, raising questions about the inherent value of gold and the potential for a new currency system to emerge. [a444b828]