Economics has often overlooked the significance of history in understanding economic performance. In 1939, a fundamental error in economics led to the assertion of decreasing returns instead of increasing returns, which goes against logic and evidence [0ee2ddcc]. Equilibrium models of competition were developed and rewarded, reinforcing this mistake. However, in the 1970s, equilibrium models were criticized, but the competitive view remained dominant. This error has resulted in a myopic culture in economics, leading to ethical and ecological losses [0ee2ddcc]. A revision of economics is necessary based on increasing returns and cooperation [0ee2ddcc].

Nick Crafts, a distinguished British economic historian, emphasized the importance of understanding historical context in economic performance [040637a9]. His work on the Industrial Revolution in Britain, economic geography, technological change, and economic policymaking reshaped the field of economic history [040637a9]. Crafts challenged previous beliefs and provided a radical reinterpretation of the Industrial Revolution, highlighting the significance of historical context [040637a9]. His contributions extended beyond academia and informed economic policy [040637a9]. Crafts' retirement in 2019 was marked by a gathering of former students, and he continued to teach and research until his passing in October 2023 [040637a9]. His legacy in economic history will be greatly missed [040637a9].

Emma Rothschild, director of the Center for History and Economics at Harvard University, discusses the disconnect between Adam Smith scholarship and public discourse about him. She explores Smith's view of the world outside his window and his observations on the economy and people's lives. Rothschild also highlights the recent reinvention and reinterpretation of Smith, both as a revered figure and as the epitome of the ills of modernity and the Enlightenment. She mentions the misinterpretation of Smith's writings on slavery and the blame placed on him for climate change. Rothschild emphasizes Smith's empirical approach and his focus on government policies rather than the market. She discusses the importance of understanding why companies seek government interventions and references Smith's critique of economic actors who use political methods to advance. Rothschild hopes that Smith will continue to be a subject of controversy and serious reading for another 300 years, and encourages more people to read and think about what Smith wrote. [a620002e]

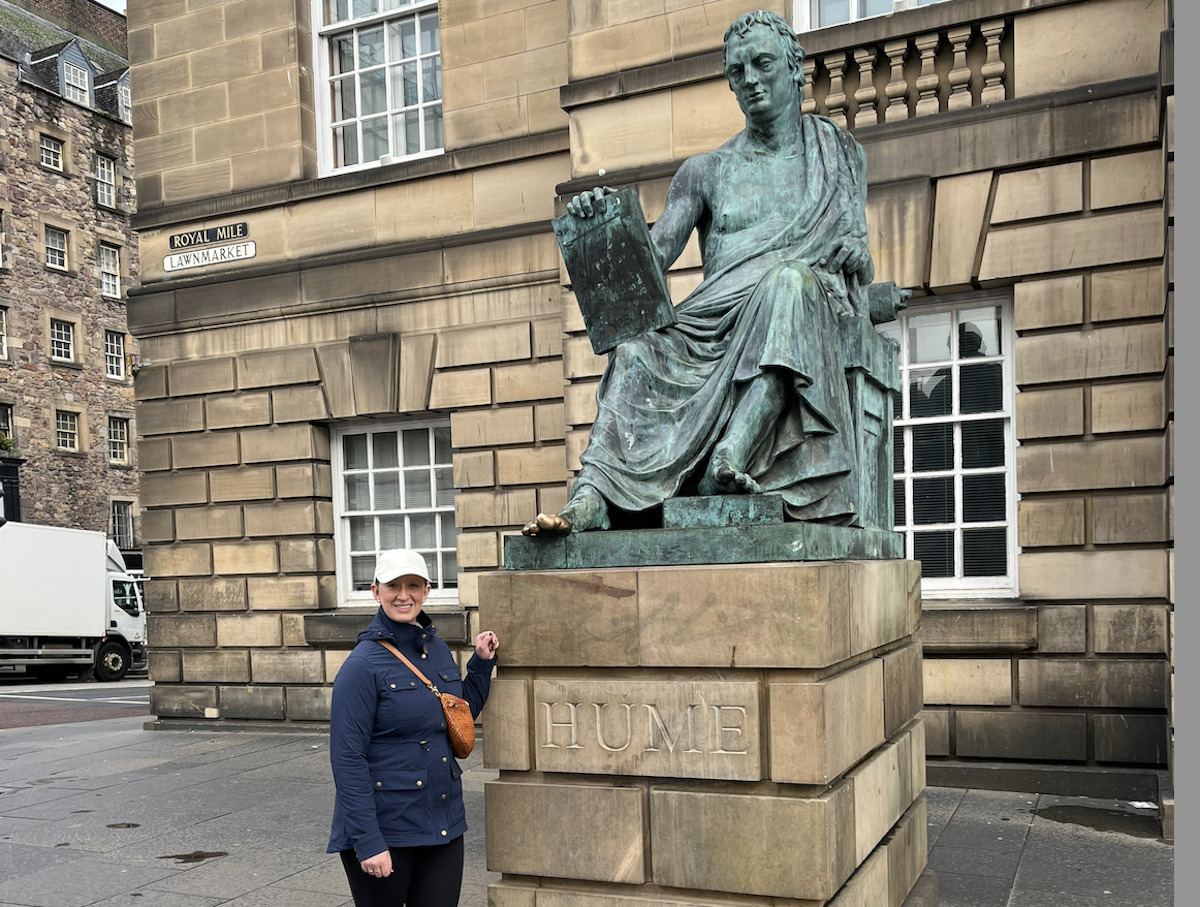

Adam Smith, an 18th-century philosopher, is credited as the father of modern economics. His theories offer valuable insights into our modern economy. Smith's ideas were complex and went beyond advancing economic prosperity; he also cared about improving the lives of less advantaged people. Smith's writings help us understand capitalism and our economy today by providing an outsider's perspective on our practices. He argued against mercantilism and emphasized the importance of free trade. Smith would be amazed by the prosperity achieved through the division of labor and trade but would be concerned about cronyism, limiting individual connections through economic exchange, and the use of government tools to insulate the rich and limit competition. Studying Smith's work helps us question and morally consider the development of labor in the 18th century. Researching Smith's archives in Scotland provided valuable insights into his perspective on political economy and the interaction of morality, politics, and economics. [d871d2b7]

In a recent episode of the Money Clinic podcast, Claer Barrett discusses the importance of understanding economics and its impact on personal finance [a9b8594b]. Joined by Sarah O’Connor, FT columnist and associate editor, and Susannah Streeter, head of money and markets at Hargreaves Lansdown, the panel explores various topics including the cost of living crisis, housing issues, the impact of interest rates on household finances, the future of work in the age of AI, and the benefits of financial education. They also answer questions from the audience, including how young people can start trading in the stock market and the implications of student debt. The panel emphasizes the need for financial literacy and the importance of long-term economic growth for a healthy economy [a9b8594b].